☁️ Brex ditches SMBs

[Week 24, 2022] 📉 Cloud stocks fall 5.3%, 💸 Brex-it, and 📉 tech layoff tracker. Let's begin 👇

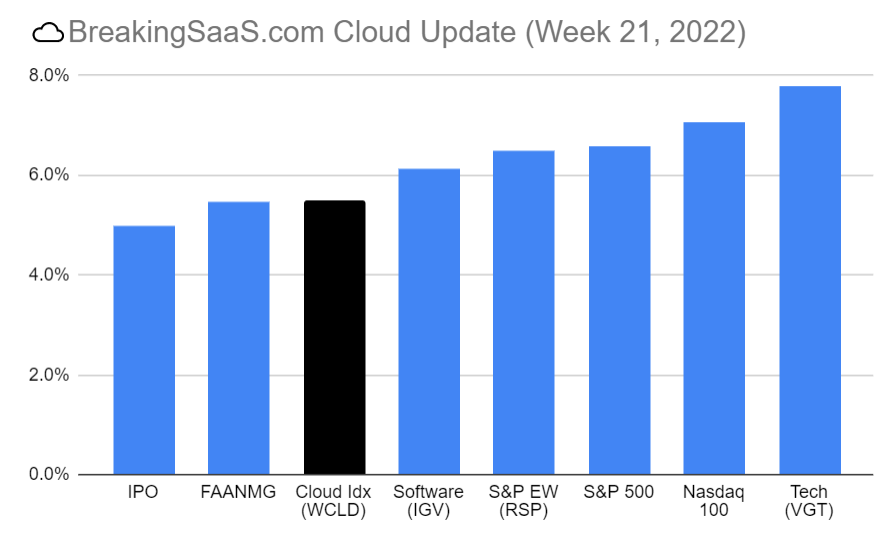

Cloud stocks continued their decline falling 5.3% for the week ending June 17, 2022 as investors weighed higher rates pushing the global economy into a recession.

- Oracle Hyper-Growth. $ORCL jumped over 11% on Monday as revenue and EPS beat consensus. "We believe that this revenue growth spike indicates that our infrastructure business has now entered a hyper-growth phase" - Oracle Chief Executive Officer Safra Catz

- 🥶 Crypto Winter. On Monday, crypto lending platform, Celsius, announced it would be pausing all withdrawals. Followed by Coinbase announcing it would lay off 18% of its workforce on Tuesday.

- 75bps. On Wednesday, the Fed raised benchmark rates by 75bps to a range of 1.5% to 1.75% and signaled more big hikes were coming. Risk assets caught a bid, with Cloud stocks increasing 4.3% on the day.

- Recession Fears. Rate increases are great for inflation but bad for consumers/GDP growth. Energy stocks fell 15% on the week and mortgage rates continued to rise.

👋 SMB is Hard

Brex, the banking start-up for start-ups, is getting pickier with its start-ups.

This past week, the company announced it would stop serving traditional SMEs and require 10,000s of customers to find a new banking home... in 2 months.

🧵 Yesterday we made the difficult decision to stop serving traditional small businesses at @brexHQ.

— Pedro Franceschi (@pedroh96) June 17, 2022

Brex remains deeply committed to serving startups, so let me explain how we got to this (painful) decision, and why it allows us to serve startups even better.

But, there's a catch. If you're a professionally funded (accelerator, angel, VC, web3 token, etc.) start-up, the company will continue to serve you.

Why? This all comes down to Brex trying to better target companies with a higher (i.e. explosive) growth profile. And honestly, that makes a lot of sense given the customer economics of SMBs on average.

Product roadmap conflict. Scaling with larger, more profitable customers also comes with different product roadmap requirements. Pedro Franceschi (Brex Co-CEO) wrote on Twitter larger customers were requesting the ability to rapidly hire new workers internationally.

Over time, we realized that our startup customers – the very customers we started with – were growing very fast, and needed Brex to scale with them. @scale_AI went from 5 people when we started serving them, to almost 1,000. Brex didn’t work as well for larger companies.

— Pedro Franceschi (@pedroh96) June 17, 2022

📰 Strategy from Top SaaS Leaders (in just 5 Minutes)

Join top VCs, founders, and SaaS executives. Actionable analysis straight to your inbox.

Long-tail SMBs

SMBs are a notoriously difficult segment with relatively high churn built-in from closures alone.

Combining this with low average ACV and cohort $ growth concentrated in a small percentage of customers means CAC must remain low for the overall economics to make sense.

Brex launched its original product with ~20 employees and was hoping breaking into the SMB space would require a similar effort.

Management underestimated the complexity and personalization needed to properly support and grow with the "long-tail" SMB.

The outcome? They were letting down both customer groups... and chose the more profitable segment.

Criteria for success:

— Gokul Rajaram (gokul.eth) (@gokulr) June 20, 2022

1. Ability to acquire customers at close to 0 CAC

2. Ability to withstand min 30% annual churn from business closures

3. Ability to cut through the (well-founded) skepticism and cynicism that long tail SMB proprietors harbor about vendors

4. PLG to the max

Software > Interchange Fees

This decision comes after Brex's $12.3B funding round in January and announcing its big push into software.

Guess what! Investors love recurring software revenue and the margins are notably higher than interchange fees.

In April, Brex announced Empower, a completely new spend management offering with DoorDash signing on as the first customer. The package is designed to enable "financial discipline at scale", reducing bureaucracy and increasing overall execution.

A week later, Brex purchased Pry, a 10-person start-up for $90M. Pry allows start-ups to quickly integrate with QuickBooks or Xero to give managers an overview of critical financial metrics and build a multi-scenario financial plan.

🤔 Cloud and Interest Rates

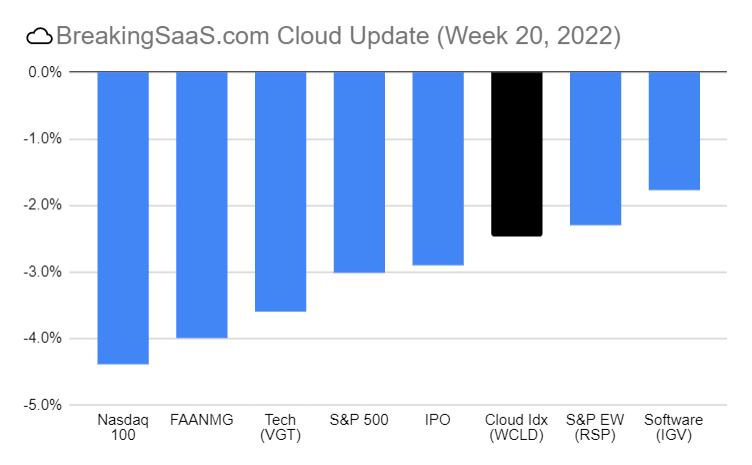

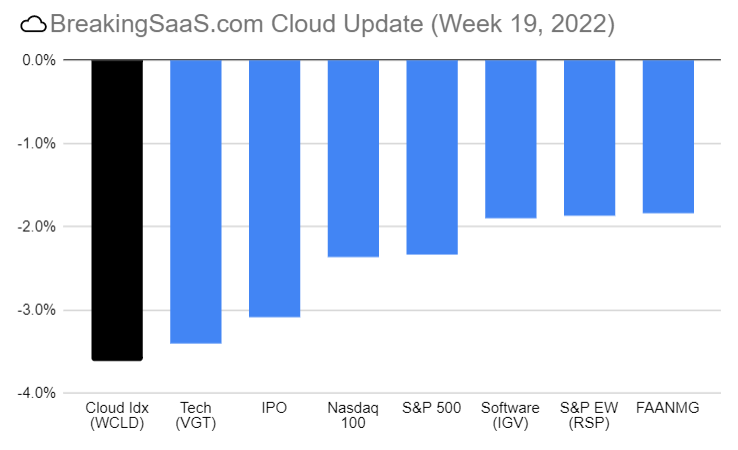

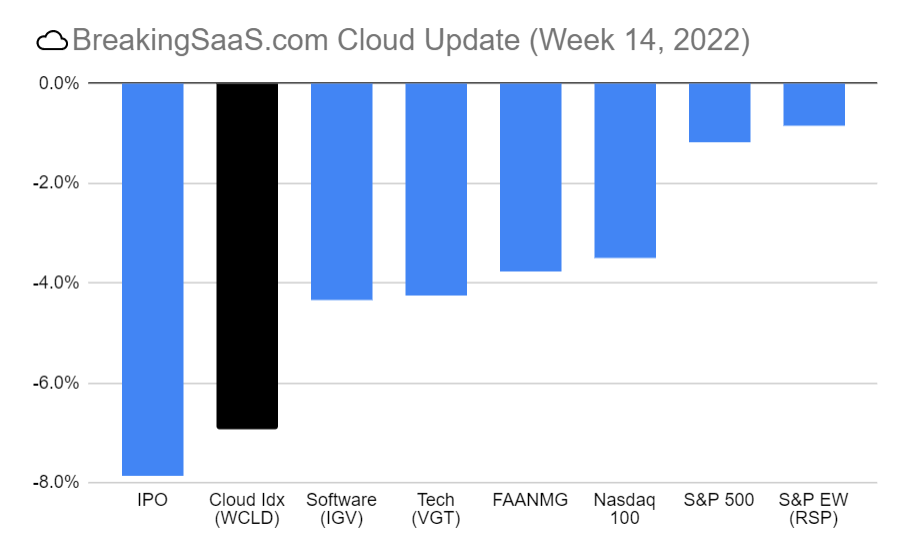

Feel like we're having a lot of down weeks? You're right. My math says 71% of weeks this year have been negative leaving Cloud stocks down nearly 50% YTD.

Why? Interest rates 👇

🎈 Popping the Bitcoin bubble

Bitcoin is experiencing an even more aggressive return to reality than FANG+ and Innovation (via ARKK).

Illuminating chart on the history of asset bubbles. $QQQ $BTC $ARKK pic.twitter.com/J2hOwUf5vu

— MT Capital (@MT_Capital1) June 19, 2022

Bitcoin looks like Chamath took it public via a SPAC

— Alex Cohen (@anothercohen) June 18, 2022

🪓 210 tech layoffs, 47,881 people impacted

TrueUp keeps an ongoing tracker of tech layoffs.

FWIW, Layoff.fyi found 818 startups impacting 13,6073 employees.

🔝 Picks from BreakingSaaS

- ☁️ Parker Conrad is Back

- ☁️ 2021 Cloud Review

- ☁️ 2022 Top SaaS Trends: Insights from 12 Cloud Leaders

- ☁️ Who is Barry McCarthy?

| 🤓 Share us with fellow SaaS nerds | |||||||

|

1

Referral

Hella good vibes |

|||||||

| Spread the SaaS | |||||||

| Powered by Viral Loops | |||||||

With blessings of strong NRR,

Thomas

Twitter | LinkedIn | Email

📰 Strategy from Top SaaS Leaders (in just 5 Minutes)

Join top VCs, founders, and SaaS executives. Actionable analysis straight to your inbox.