☁️ Chewing Gravel

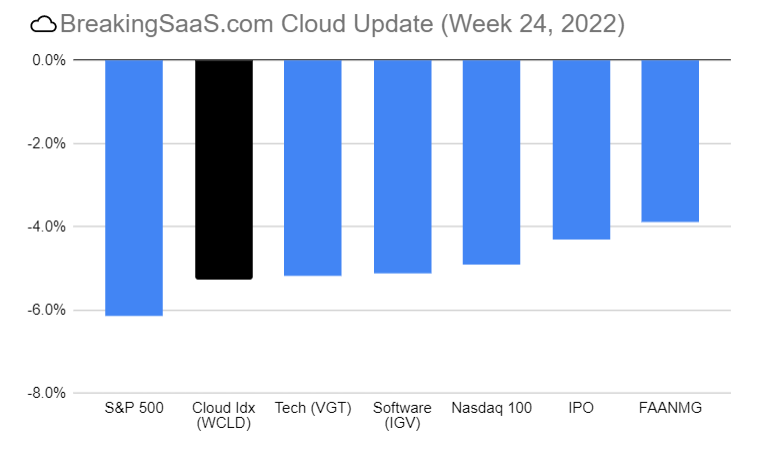

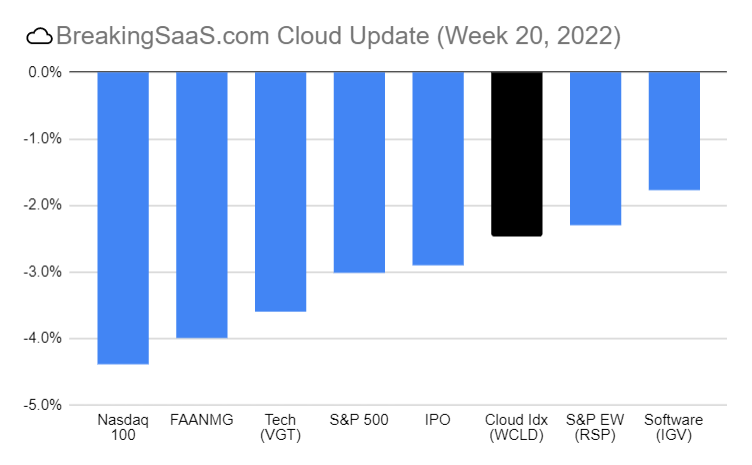

Cloud stocks fell 2.5% in the week ending May 20, 2022 as investor concerns pivoted from inflation > higher rates to higher rates > consumer spending concerns.

- WMT/TGT Inflation concerns. On Tuesday, Walmart warned of inflation pressures followed by Target citing inflation was pressuring profits and would not be easing anytime soon. Shares fell 25% on Wednesday and markets experienced some of their largest single-day losses in history.

- 📉 Existing home sales drop. Existing home sales fell 2.4% MoM to the lowest rate since June 2020. The National Association of Realtors (NAR) blamed home prices (122 consecutive months of YoY increases) and rising borrowing rates (Freddie Mac noted rates near 13 year highs).

- Subprime missing payments. "In a tightening cycle, as interest rates soar, the first causalities are usually consumers with the weakest balance sheets, such as ones in the subprime complex. Compound monetary tightening with the highest inflation in four decades, and it's not hard to see why consumers have been on a debt borrowing binge as they struggle to survive this bearish macro environment." - ZeroHedge

🚀 Don't just survive, prosper during a recession

Looking at my Twitter feeds and texts this week, and VC after VC has offered their version of gloom and doom advice. So rather than rehash the basics which amounts to make cash runway last to infinity, let me share a story of resiliency, a pivot, and a success story from the Dotcom crash and some lessons learned - Ed Sim

So many tweets about why it's a great time to start a co + it is, but let me share 1 of survival + success from the dot-com crash - how @Greenplum pivoted, sold to EMC + IPOed as Pivotal

— Ed Sim (@edsim) May 21, 2022

Hope is founders will come out more resilient, investors more patient + ecosystem healthier

🤔 Tom Tunguz: Will your business be impacted by a US recession?

I haven’t seen a broad shift in purchasing behavior in the market yet, which is encouraging, but keep a vigil. Markets reverse in a moment. - Tom Tunguz

Ask yourself 2 questions: 1) What is your Zero Cash Date? 2) Do I have product-market fit (via sales efficiency proxy). SMB segment should target 14-18 month payback, while enterprise should be between 18-28 months.

- Chewing Gravel: <12 Months cash and no PMF. Hardest place to be - time to start thinking about selling the business, raising an inside round, or all-out-sprint to save the business.

- Time to Strategize: With a long runway, it's time to focus on efficiency and focus solely on developing a product the market wants.

- Go Big or Go Profitable: Time to either take control of your destiny (push to profitability) or raise (albeit at a much lower terms) to continue prioritizing growth.

- The World is Your Oyster: Full speed ahead

👉 Cash flow pressures during a Recession

Meritech out with 2022 SaaS Crash which has a ton of great charts on valuations and 2 case studies on Salesforce and NetSuite through the GFC.

My favorite is a list of impacts to companies' funnels and demand during a recession. While none are detrimental on their own, together they could have a severe impact on cash flow.

Full list below via Meritech:

- Sales cycles lengthen by 10-15% as the urgency to buy software decreases.

- To close deals, companies have to discount 10% or more.

- The cost of a marketing qualified lead (MQL) or a sales qualified lead (SQL) increases by 10-15% as there are fewer buyers and they are more reluctant to purchase.

- Software budgets freeze or slow down as execs force companies to buy and consolidate their software stacks.

- Account executives (the sellers) will end up missing their quotas and quota participation rates (the % of reps hitting quota) will fall leading to lower attainment and more attrition.

- The overall cost to acquire a customer rises and the associated revenue could be lower.

- An increase in stock-based compensation, both for retention and motivation of existing employees who see less value in their equity and for hiring new employees, will result in lower profitability for public companies. For private companies, option pools will run out faster leading to higher dilution.

- Inflation requiring increases in salaries and furthering the need to increase pricing.

💡 This is not 2020

Some important points:

- The top 10 largest tech companies traded at a PE ratio 44% lower in 2020, than in 2000

- EPS for the basket have INCREASED 71% since peak valuation 21 months ago (vs. 73% decline in 2000)

- What killed tech in 2000? Multiple compression AND fundamental decline

- To repeat 2000 meltdown, EPS would now have to fall 73%

- Recurring revenue makes this nearly impossible. A “software contract is better than first lien debt.”

- Vs. 2000 tech company revenue was “capex” for their customers = easier to defer/turn off

1) This is nothing like 2000.

— Gavin Baker (@GavinSBaker) May 17, 2022

Valuations for tech peaked in 2020.

At the 2020 peak on a cap weighted basis, the 10 largest tech companies in the Nasdaq traded at a 44% discount to the largest tech companies at the 2000 peak using NTM EPS and 58% discount using LTM EPS. pic.twitter.com/QlfmjxFIwf

More SaaS Reports: