☁️ Who is Barry McCarthy?

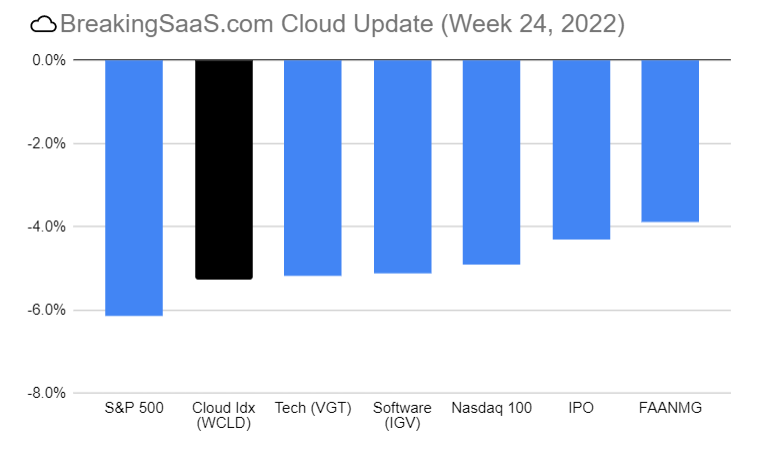

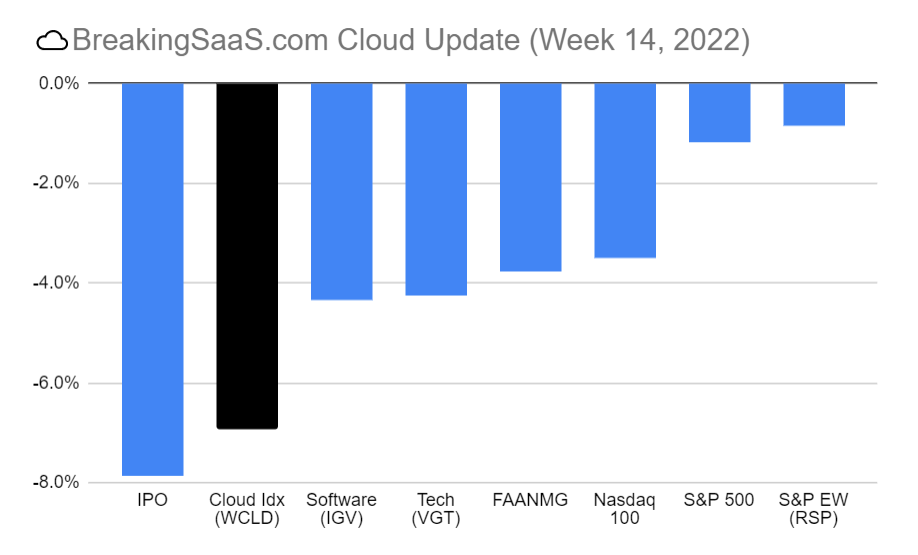

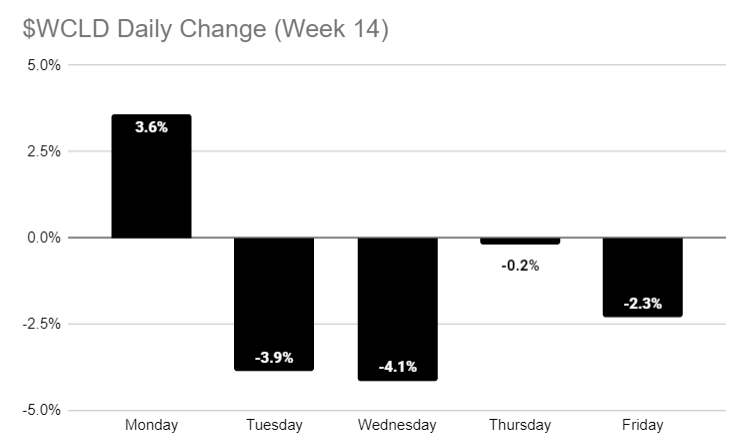

Cloud stocks declined 6.9% for the week ending April 9, 2022 as investors eyed yield curves, fed commentary, and global geopolitical risks.

- Yield Curves. Yield curves (2Y vs. 10Y) flipped negative on March 31st for the first time since 2019. Investors tend to use this spread as a future recession risk as it incentivizes banks to reduce lending. Yields remained inverted until Tuesday (live updates).

- Rapid Pace. On Tuesday, Fed Governor and Vice Chair nominee, Lael Brainard, noted in a speech that "It is of paramount importance to get inflation down" and "I expect the balance sheet to shrink considerably more rapidly than in the previous recovery" pushing interest rates higher. This also pushed mortgage rates above 5% for the first time since November 2018.

- Geopolitics. US and European allies continued to increase sanctions on Russia, while rhetoric between US and Chinese officials heated up over Taiwan.

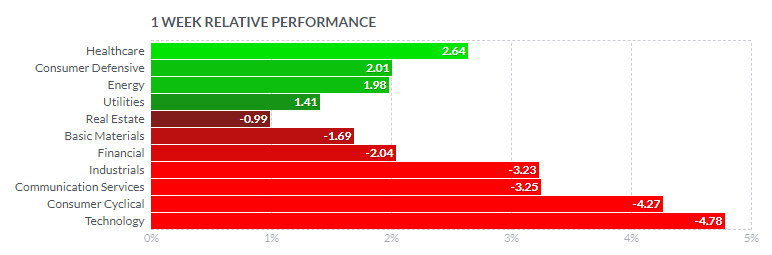

- Flight to safety. Tech-heavy Nasdaq (-3.5%) underperformed the S&P 500 (-1.2%) as investors moved to safer sectors (Healthcare, Consumer Defensive, Energy, Utilities outperformed on the week)

- The R Word. 2 banks (DB Tuesday, BofA Friday) warned the US could be heading towards a recession as raising inflation and the fed's intent to increase rates could cool economic growth.

🚲 Churning & Scaling With Barry McCarthy

Churn rates vary on subscriber maturity

Peloton would normally never pique my interest, but...

On January 8, Pelton announced Barry McCarthy had been appointed CEO. That same day, Pelton announced a cost-saving plan expected "to Deliver at Least $800 Million in Annual Run-Rate Cost Savings"

So who is this guy? At this point, I had no clue who Barry was and only vaguley knew $PTON as an expensive bike company which was getting whacked by the market post-Covid.

That quickly changed.

Barry's Brief Resume:

- Netflix CFO (April 1999 - Dec 2010)

- Spotify CFO (July 2015 - Jan 2020)

- Peloton CEO (Start Feb 2022)

Definitely someone to follow. Here's what I found digging in a bit more. 👇

1️⃣ A thread on Barry's customer economics insights

Barry was CFO of Netflix at the time and investors were still modeling subscription businesses as BOP Subs - Churn + Adds * Price.

However when fast growing subscription businesses report % churn for a given period, it masks a key dynamic of subscription economics: churn rates vary based on subscriber maturity.

When I was trying to learn about Netflix in 2003/2004, I was fortunate to spend a fair amount of time with the CFO at the time, Barry McCarthy.

— Mario Cibelli (@mario_cibelli) February 20, 2022

The 'a ha' moment for us was when he helped us see that as the % of mature subscribers became a larger portion of the overall sub base that the economics flipped to the positive - yes it seems obvious now but it wasn’t back then.

— Mario Cibelli (@mario_cibelli) February 20, 2022

2️⃣ His first email to staff laying out his management principles

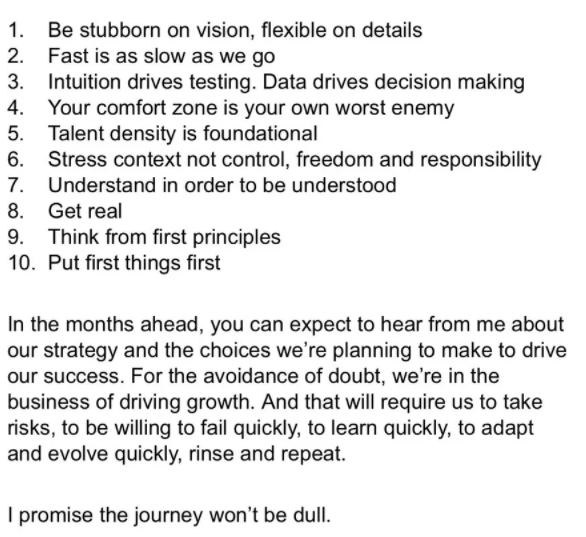

Shortly after joining Peloton, Barry's first email to staff leaked highlighting his management pricipals including: 1) moving quickly based on data-driven decisions, 2) focus and prioritize, and 3) think from first principles.

Overall, sounds like a badass who will drive results. Assuming many at the company won't like this style 🤷♂️

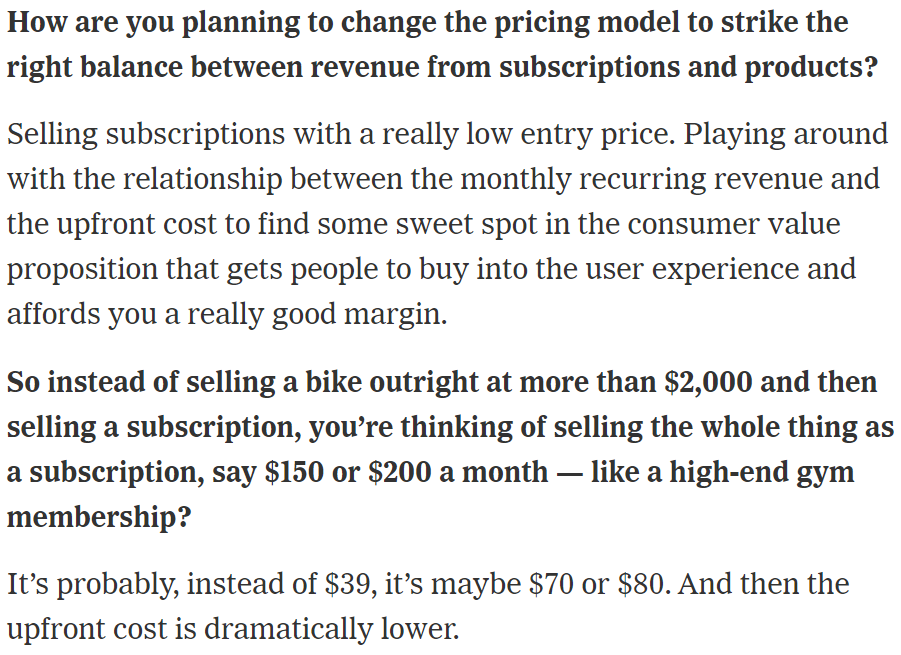

3️⃣ Interview with DealBook

In an honest and wide ranging interview, Barry talks about striking the right balance between customer value and margin, the opportunity to become a connected fitness platform, and importance of running the company like a team, not a family (similar to email above).

And when asked if he has "carte blanche" to run the ship as he wants, he was quick to note "The entire staff reports to me."

Like he announces to the team at our all hands — which didn’t get cut short by the way — that we’re a family. And I say you’ll never hear me say we’re a family. We’re a sports team, and we’re trying to win the Super Bowl. And so we’re going to put the best players on the field we can. And if you go down the field, and we throw you the ball, and you drop it a bunch, we’re going to cut you. Because everybody else who’s trying hard to win the game deserves to have the best players on the field. And if you’re a good player, you’re going to love being on this team. I love John’s strengths, but I’m running the company. - DealBook

Full Interview: DealBook