☁️ 2021 Cloud Review

Happy New Year! 🎉🥂 (And sorry, I'm a few days late). Let's Begin.

Top 5 ☁ Trends I'm thinking about:

1️⃣ First annual decline on record

2️⃣ Multiples driving relative performance

3️⃣ From Growth to Economics

4️⃣ PLG and Usage-Based Price FTW

5️⃣ Liquidity fueling a tech talent war

Read more below weekly update 👇

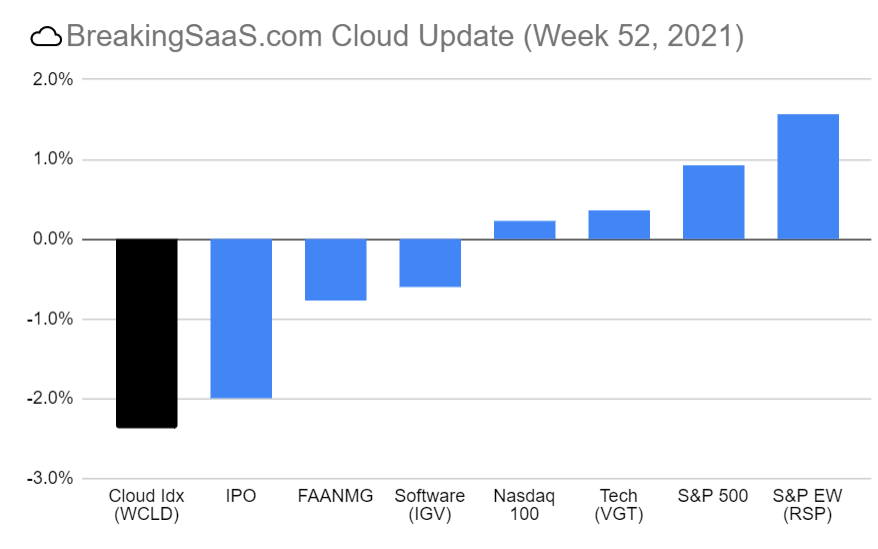

[Week 52, 2021] Cloud stocks (-2.4%) finished the final week of 2021 on a low note, underperforming the broader market (+0.9%) as investors showed a preference for relative safety (Consumer Defensive/Utilities) and industries levered to higher inflation (REITs). Nasdaq was a relative underperformer (+0.2%), while IPOs, FAANMG, and Software stocks all declined on the week.

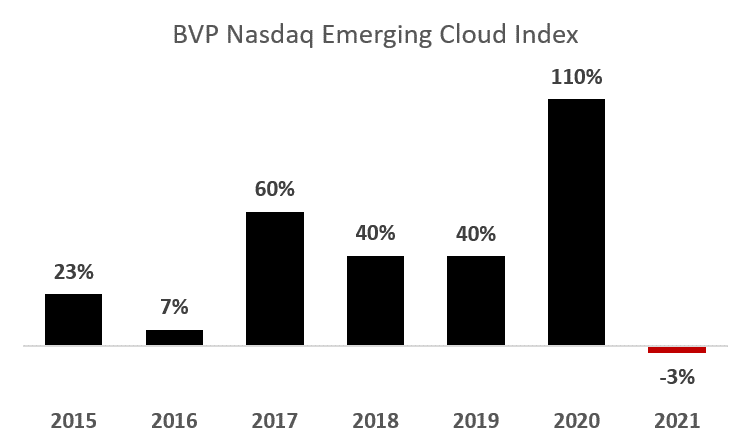

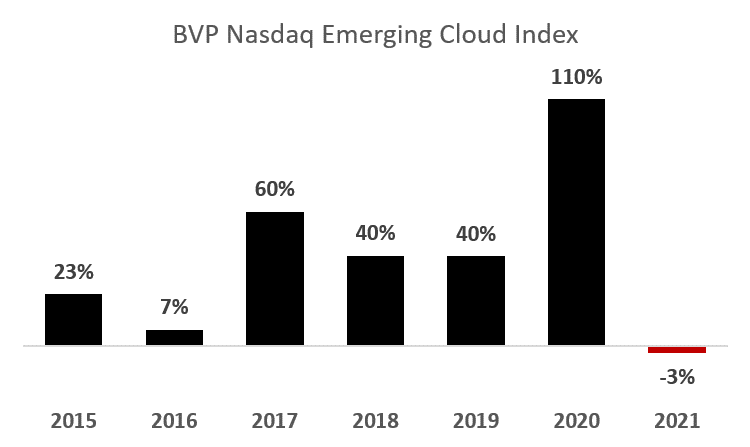

1️⃣ First annual decline on record

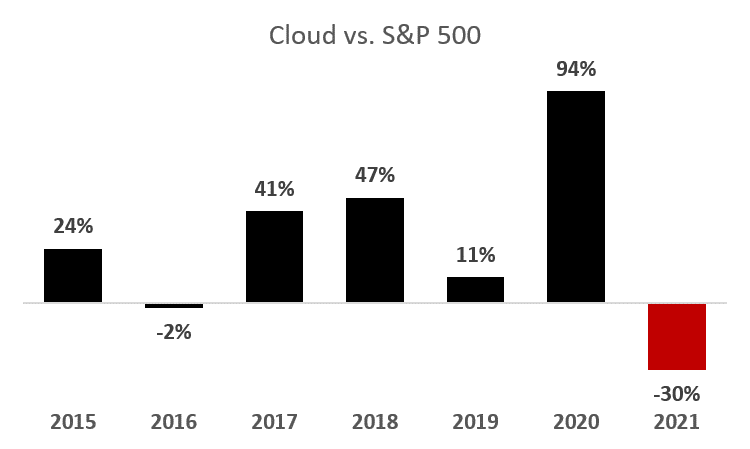

Cloud Underperformed S&P500 by 30ppts

After a blockbuster 2020 (+110% YoY), and nearly 6 years of uninterrupted outperformance vs. the S&P500 (except 2016), Cloud stocks declined 3% YoY in 2021. The relative underperformance can be attributed to a laundry list of well-discussed drivers: Covid concerns ceasing to be a driver of WFH stocks, concerns of rising rates on high-growth, money-losing companies, and a subtle shift from growth-at-all-costs to a deeper consideration of unit economics and long-term margins (SaaS Down YTD: What's Next?).

Either way, the average Cloud stock grew Revenue ~30% YoY (per BVP), so we're seeing multiple contraction across the industry.

Because FAANGM is the only thing working

So why does it feel like S&P/Nasdaq are making new highs, but your high-growth names are underperforming? Because FAANGM is the only thing performing. Masterly Inactive with a 🧵 of charts via Edward Yardeni looking at the massive outperformance of the largest tech names.

Likewise, Gavin Baker noted Nasdaq was up 21.2% YTD (as of 12/9), but only up 5.8% excluding it's top 5 contributors (AAPL, MSFT, GOOGL, TSLA & NVDA).

S&P 500 performance (since 2013) with and without FAANGM pic.twitter.com/j3Ur3MftW7

— Masterly Inactive (@masterly_in) December 26, 2021

1) Once and for all: here are the final numbers. I did them myself under the supervision of two math wizards.

— Gavin Baker (@GavinSBaker) December 9, 2021

The Nasdaq is up 21.17% YTD.

AAPL, MSFT, GOOGL, TSLA & NVDA are the top 5 return contributors YTD.

Excluding the top 5 contributors, the Nasdaq is up 5.79% this year. pic.twitter.com/QOGMOOSi1H

And now Cloud stocks are in 🐻 territory

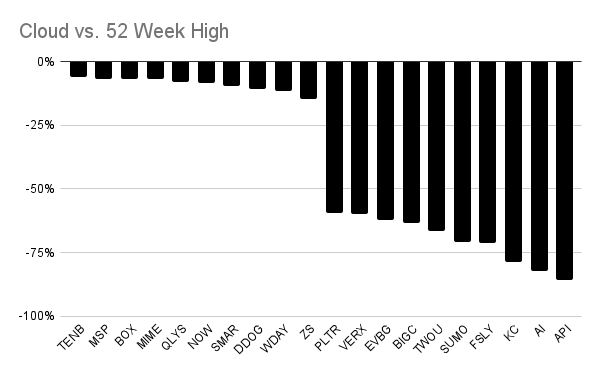

The Cloud index is down 20% from November highs, but that's hiding a lot of damage under the surface. The average stock is now down ~37% from its 52 week highs.

Note: All data as of 12/31/2021 close. As I write this, Cloud stocks are down another ~5% in the first 2 trading days of 2022. Buckle up 🙏

Going a layer deeper we can see the bottom 10 have declined by an average of 70%, while the best relative performers are down an average of 9%.

Relative performance is a key theme.

2️⃣ Multiples driving relative performance

2022 the year of SaaS stock picking?

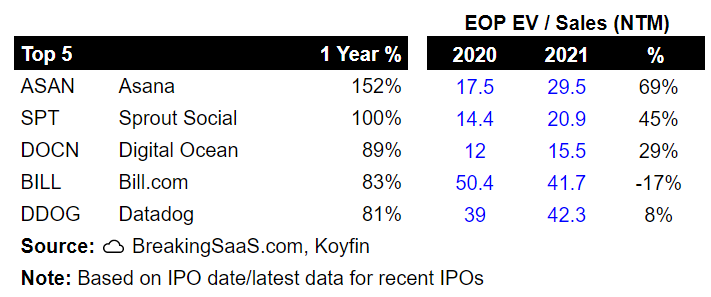

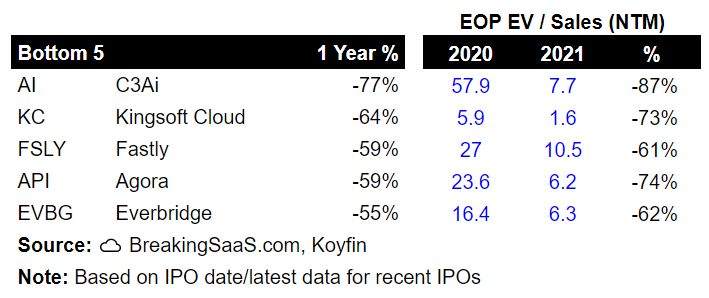

The top 5 SaaS stocks increased by an average of 101% in 2021, while the bottom 5 declined an average of 63%.

The biggest relative drivers? Multiples.

The top 5 performers saw their multiples increase by 27% on average, while the bottom saw their multiples decline by 71%.

The 🤯 part is both groups started the year at ~26-27x, while the top 5 finished at an average of 30x and the bottom finished at only 6x.

I would expect this trend to continue into 2022.

I discussed industry multiples in last week's update: SaaS Down YTD: What's Next?

3️⃣ From Growth to Economics

Growth still matters, but many investors were 🔥 last year

It's well known that SaaS valuations are highly correlated to forward revenue growth (~0.60 per Jamin Ball) and that is a double-edged sword. So when growth is slightly less hyper than expected, multiples can revert sharply and quickly.

With investors burned last year from high growth companies failing to live up to growth estimates (shown by the relative results above) many are starting to transition to taking a longer-term view.

The question investors must now answer becomes much more complex: What are a company's long-term margins? Tren Griffin (25iq fame) called out a report by Michael Mauboussin at Morgan Stanley discussing "unit economics."

Shocker: you have to do a DCF.

1/ When an investor talks about "unit economics," they are taking about a discounted cash flow (DCF) analysis.

— Tren Griffin (@trengriffin) May 26, 2021

CLV = "the present value of cash flows that a customer generates while they are engaged with the firm minus the cost to acquire the customer." https://t.co/nEpOStUMRU

A company's long-term margins are largely a function of its competitive position in its market and the cost to replace and grow it's revenue. If you have a good idea of the company's revenue churn and CAC ratio you can back into an idea of margin potential fairly quickly.

Want to play with my analysis? CRM LT Margins

While this is a quick and dirty framework, it is definitely something I'll be spending more time on in 2022.

If you have any thoughts/ideas please reach out.

first pass at building a framework to think about LT margin potential for $CRM (and any SaaS name)

— Thomas Robb ☁️ (@BreakingSaaS) December 28, 2021

Work in progress... currently a modified/more simplified version of MS SaaS X-Ray which is built on contribution margins

thoughts? Link attached to mess around with it https://t.co/4hyZ4bubAU

Margins as the sleeper risk in 2022?

I loved this tweet from @BucknSF. Analysts tend to model that all incremental revenue for SaaS companies come in at high contribution margins, but 2 things are different moving into 2022: 1) T&E (traveling) should rebound and 2) wage inflation (discussed more in 5️⃣ below).

Another prediction for next year is that margin expansion takes a breather for most of the space. A few factors:

— Buck (@BucknSF) December 27, 2021

1. T&E will likely come back post Omicron. That is 2-3% of revenue that has been a zero for two years.

2. Wage inflation. Becoming a real factor across all functions.

4️⃣ PLG and Usage-Based Price FTW

So which companies have the best customer economics? Companies pursuing Product-Led growth (heavy R&D, with less reliance on S&M) and often combined with Usage-Based pricing (pay as you use) tend to have faster growth, better customer economics, and stronger share performance.

Check out a few tweets below on PLG:

4) PLG remains untapped

— Thomas Robb ☁️ (@BreakingSaaS) November 27, 2021

Old: CRO hires more reps

PLG: treat products as the primary driver of customer acquisition and NRR

R&D > S&M

Investors are betting more efficient cost structures will generate larger long-term cash flows pic.twitter.com/mJLjhK12fk

How to Scale to $100M

— Thomas Robb ☁️ (@BreakingSaaS) December 3, 2021

A case for usage-based pricing@OpenViewVenture: "7 out of the 9 recent software IPOs with the best net dollar retention have a usage-based pricing model" $DDOG $AMZN $SHOP $SNOW $TWLO $HUBS $STRIPE

🎩 @poyark @SanjivKalevar

4 Step Playbook 🧵👇

Many have pointed out that these companies tend to go after SMBs which have shorter sales cycles on average, generally have lower competition (vs. enterprise markets) and customers have fewer resources to switch providers (potentially lower churn/greater pricing power). Bonus points if you can tack on a payments product.

In theory, SMB > Enterprise

— Jason ✨BeKind✨ Lemkin 2️⃣0️⃣2️⃣2️⃣ (@jasonlk) December 26, 2021

More customers, much faster sales cycles, faster PLG and viral cycles

But even 100% NRR is tough to hit with SMBs,

While 120%-140% common in Enterprise

Most SMB SaaS goes at least bit enterprise or at least into more “bigger deals” to balance it out

GS with a great report out this week on next gen software leaders: "Solving the next decade of hard problems." Great chart highlighting what we've been saying for some time: SMBTech is cool 😊 pic.twitter.com/oOu2y5yHJo

— Jeff Richards 🇺🇸 (@jrichlive) December 13, 2021

5️⃣ Liquidity fueling a tech talent war

Public market 📉, private markets 📈

VC and Growth Equity have a lot of money right now. How much? I was too lazy to Google it, but I'm sure you can find something.

The result: a long list of companies getting funding at >1000x 🤯

Here’s a list of startups that raised at unicorn status with single digit millions (or less) in annual recurring revenue https://t.co/70CQES0XSZ pic.twitter.com/HYv22iTttU

— Eric Newcomer (@EricNewcomer) November 22, 2021

fuck yeah 1,500x ARR multiples https://t.co/Gxfn7nEeLf

— alex (@alex) December 20, 2021

While great for founders and early investors, the liquidity is driving some unintended consequences.

Normally key executives will jump to hot start-ups with an expectation that valuation will increase significantly on their options. When you're valued at that high of a multiple so early its harder to make that decision (How many years of 100%+ growth do I need to see before this pays off? 🤔).

Second, there's only so much talent (primarily engineers, but also Account Executives). When everyone is raisings hundreds of millions it becomes an arms race to attract engineers and other top talent. Companies end up getting the same amount of engineering every year, but at double digit price increases.

Needless to say, founders are worried.

The Tech Talent War is very real

— Thomas Robb ☁️ (@BreakingSaaS) January 2, 2022

Your success as a start-up hinges on you winning the battle

5 thoughts from top tech insiders🧵👇

Thanks for reading! If you enjoyed/found this helpful/are someone who likes SaaS Metrics 🤓, please consider subscribing.

Cheers to a great 2022!

Did I miss anything? Reach out on Twitter @BreakingSaaS

With blessings of strong NRR,

Thomas

Twitter | LinkedIn

☁️ 2021 Cloud Review Mega Thread

— Thomas Robb ☁️ (@BreakingSaaS) January 6, 2022

In case we just met, my name is Thomas and I work in Corp Finance @Celonis

I ❤ SaaS metrics, strategy and public markets

Grab a ☕, stretch your 👍, this is a long one

5 trends I'm thinking about 🧵👇