☁️ 2022 Top SaaS Trends: Insights from 12 Cloud Leaders

I cold DM'd 50+ SaaS VCs, Founders and Executives – here are the top trends they're looking at in 2022.

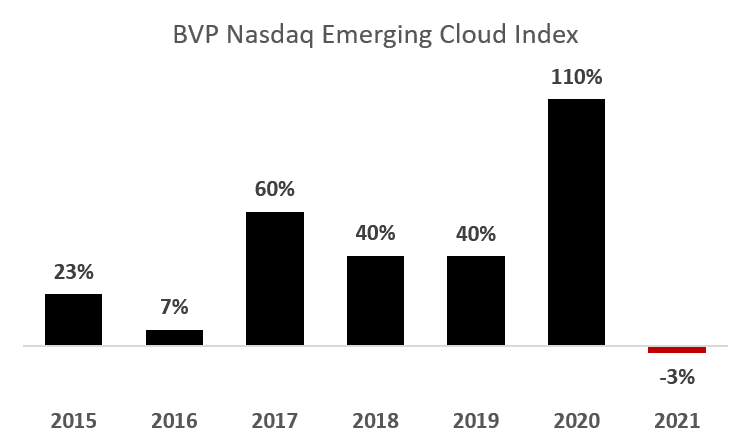

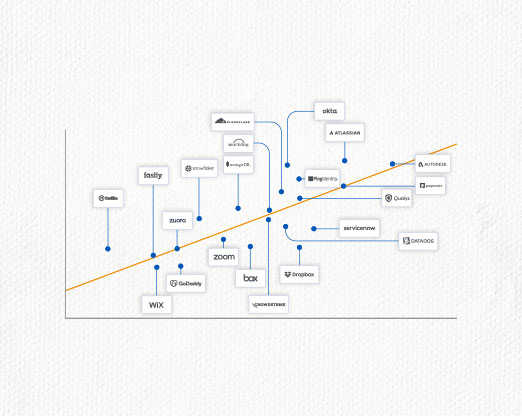

2022 will be another exciting year for Cloud. After 4 straight years of outperformance (with SaaS stocks more than doubling in 2020), the BVP Cloud index finally underperformed the broader market in 2021 (and actually declined). Multiples across the industry have pulled back as investors question the durability of SaaS hypergrowth and take into account rising interest rates on long-duration tech. The question on everyone's mind: What's next?

While public market investors contend with marked-down portfolios and conflate multiple compression with demand destruction, VCs and cloud executives remain bullish on long-term demand and are hunting for the next mega-trend.

I got great traction on my ☁️ 2021 Cloud Review, but I wanted to reach out to the professionals. I scanned my Twitter followers and recent likes and DM'd anyone who screened as a SaaS VC, Founder or Executive. I wanted to know what they were most-excited about in 2022. Many of the contributors mentioned the same trends I saw in my review: 1) PLG is supporting a greater focus on SMB markets, 2) there continues to be a greater focus on efficiency and economics, and 3) record VC liquidity is fueling a talent war and demand for smarter tools to manage employees.

I would like to thank the 12 contributors who took time out of their busy schedules to answer 🙏

Let's Begin 👇👇

2022 Top SaaS Themes:

- Big focus on SMBs. Targeting the SMB market has been a hot topic across the SaaS/VC space as large, horizontal platforms ($CRM, $NOW, $WDAY) have already dominated the enterprise markets and a number of notable start-ups have minted serious businesses off rather niche industries ($SHOP, $TOST, $PCOR). Sean Fanning (OpenView) is watching for the potential for newer software companies to finally shake customers off legacy products (CRM, payroll, finance, ops) with SMBs moving to single, vertical providers as a key driver. Muz is also bullish on the SMB market specifically across the CFO office, HR, and eCom enablement.

- The CFO suite is getting some attention. Across the industry, a16z is calling for new CFO tools and Scott Belsky is expecting enterprise tech to become a more multi-player experience. Muz Ashraf (TCV) sees a significant opportunity to digitize the CFO office. His team at TCV is investing in various companies which are aggregating multiple point solutions into a more unified stack. Likewise, Manav Shah (Scale Together) noted "more than 79% of organizations across the world have initiated a finance-led digital transformation activity in the last 12 months" and expects software to enable the next generation of strategic CFOs.

- PLG continues to evolve and drive efficiency. PLG is the trend of investing heavily in R&D (vs. S&M) to drive user acquisition and upsell through the customer lifecycle. Antoine Buteau (Replit) sees a trend towards PLG best-practices as companies rethink their product architecture and focus on unit economics (bonus: he's looking at rising hosting costs as well). Geoff Byron (Workday) expects PLG and no-code to unleash a new trend that helps empower employees to develop their own tools and increase collaboration. Alex Clayton (Meritech) noted that investors are already starting to value companies more on efficiency than on growth alone which may push more tech companies to explore this GTM strategy.

- Lots of greenfield in HR Tech. Tushar Makhija (TeamOhana) is working on a new concept of "Employee Success" to equip start-ups and managers with the tools and data they need to retain, incentivize, and attract top talent in an increasingly competitive landscape. Muz also called out core HR as an interesting vertical that may be disrupted in the SMB space and Sean noted we could see replacement cycles driven by the Deel's of the world.

- Increased M&A across the spectrum. Large corporations have always pursued M&A to rapidly accelerate business goals and bridge product gaps. We're now starting to see a trend of marketplaces (led by Microacquire) provide some much needed liquidity at the smaller-side of the spectrum. Nicholas Evans (Southport Ventures) acquires B2B SaaS companies and notes there are more options than ever for bootstrappers to stay independent and sellers are more aware of their options now. Sandeep Kella (Assembly) expects SaaS companies to be the next large purchasers of media companies as they try to build communities as a tool to lower CAC and increase their moats. Sean is also expecting a pickup in M&A in 2022.

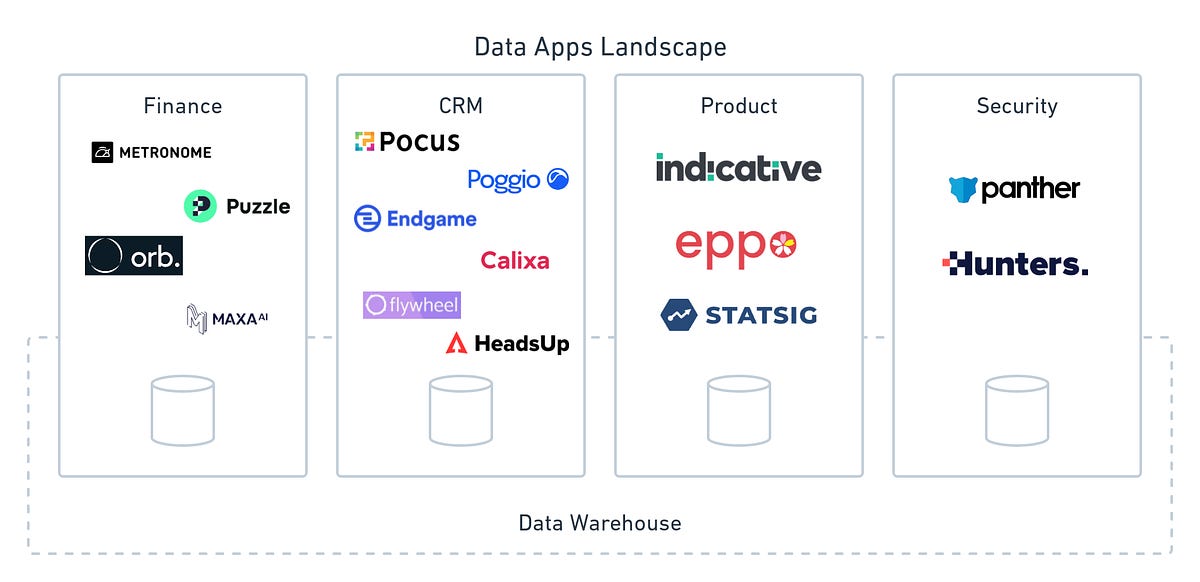

- Data gravity. Ram Parameswaran (Octahedron) argues data gravity will be an important battle ground as companies fight to be the repository and analytics hub of a corporation's data.

- A new era of web development. Jamstack is rapidly attracting the attention of developers and corporations as their technology offers faster performance, better security, and improved developer experience. Janelle Teng (Bessemer) is excited by the opportunity the technology has to enable headless commerce and headless CMS and is on the team which led Bessemer's investment in Netlify, "the evangelists of the Jamstack revolution".

- ESG at a tipping point. While previously considered more marketing than strategy, ESG has every indication of heating up in 2022. Amar Jani (Celonis) expects ESG to become a larger strategy in every company's arsenal and we're beginning to see start-ups and investments follow this trend (led by BlackRock).

2022 Top SaaS Trends by contributor:

- Janelle Teng (Bessemer). Jamstack will lead the next era of web development

- Sean Fanning (OpenView). New technologies may finally drive legacy replacement cycles

- Muz Ashraf (TCV). Opportunity to digitize the CFO office for SMBs

- Ram Parameswaran (Octahedron). Data gravity will be an important battle ground

- Geoff Byron (Workday). No-code and PLG are creating an environment of employee empowerment

- Nicholas Evans (Southport Ventures). Microacquire becoming a force in small SaaS M&A

- Antoine Buteau (Replit). A focus on efficiency is driving PLG best practices

- Amar Jani (Celonis). ESG ecosystem continues to evolve and grow

- Alex Clayton (Meritech). Efficiency becomes more important to investors

- Tushar Makhija (TeamOhana). Employee Success function emerges to manage attrition and hiring

- Sandeep Kella (Assembly). SaaS businesses leaning into Media M&A to build communities

- Manav Shah (Scale Together). Rise of the strategic CFO

Full analysis and deep dive by contributor below 👇👇

Janelle Teng, Bessemer

Jamstack will lead the next era of web development

I’m excited about the next era of web development fueled by the Jamstack revolution, including all the exciting new categories enabled by this approach such as headless commerce and headless CMS. - Janelle Teng, Bessemer

Janelle Teng is on the Bessemer Growth team which led the $105 million Series D in Netlify at a $2 billion valuation.

With Netlify, they have been able to take advantage of better developer productivity and satisfaction with improved collaboration, scalability, security, and end-customer experience.

Janelle describes the technology as:

Essentially the Jamstack allows for front end and back end architecture to be decoupled, enabling “headless” applications that can be linked in a flexible manner - Janelle Teng, Bessemer

Still curious about Jamstack? Janelle recommended Netlfiy CEO's, Matt Biilmann, original pitch of the technology in 2016.

Matt also published a 5 year update this past May:

Sean Fanning, OpenView

New technologies may finally drive legacy replacement cycles

I think there is a lot of obvious themes that we're going to hear even more about this year - more embedded payments, more usage based pricing, more PLG, and my favorite more M&A. One thing I'm thinking about more is replacement cycles, which will inevitably lead to more conversations about terminal value for software. - Sean Fanning, OpenView

Software economics largely hinge on switching costs keeping churn to a minimum, but we're starting to see signs of that theory cracking.

A few categories in which he noted replacement cycles could emerge:

- CRM. Moving from Salesforce to modern data platform

- Payroll. Moving from old payroll software to the Deel’s of the world

- Finance. Already hearing folks whisper about replacement cycles for Adaptive / Anaplan (which I don’t buy)

- Ops. i.e. Ripplings of world

In many cases, this is driven by the same trend of SMBs moving to single vertical providers, from multiple best-in-class solutions. Even if the software is not as good as the legacy providers, they’ll take the simplification and ease of use.

So what's the outcome? Potentially higher churn for legacy software providers (and higher "investment years" from the companies buying).

We're starting to see early indications this might come to fruition as JPM announced a $12B+ global tech spending program.

I think we are going to see “investment years” from many companies in 2022.

— Gavin Baker (@GavinSBaker) January 16, 2022

These plans were likely set at October/November board meetings - right before the economy weakened significantly in December.

Expense ramp plus revenue miss = big EPS misses.https://t.co/sCT1u0cHTb

Muz Ashraf, TCV

Opportunity to digitize the CFO office for SMBs

I've been quite interested in the increasing digitization in the broader SMB space. Many enterprise sectors have already been "won" but workflows in a lot of SMB segments still remain fairly manual. This includes areas ranging from core HR to the office of the CFO to e-commerce enablement. What's also quite interesting in serving SMBs is that they tend to buy broader suites vs. best-of-breed, thereby allowing the vendors in this market to land with a strategic wedge and then expand over time. - Muz Ashraf, TCV

A consistent theme is the potential in the SMB market: lower competition, more likely to buy a suite (churn from legacies), generally less digitized, and potential to bring more businesses online.

On verticals within SMB, the ones I have spent time in have been HR (lots of greenfield opportunity here) and the finance function. What I have also been seeing is that in some categories such as e-com enablement (think logistics, storefronts, etc.) have been solved for enterprises but the next leg growth is going to come from enabling the smaller businesses to come online. Then of course you have vertical software plays for SMBs such as fitness, hair salons, etc. where at least in Europe there's a lot happening. - Muz Ashraf, TCV

The TCV team wrote a specific piece on the CFO suite:

The CFO suite is on the radar of other top firms as well:

Likewise, Scott Belsky noted "every function of the enterprise will become a multi-player and fully immersive experience":

Disclosure: TCV is an investor in Celonis.

Ram Parameswaran, Octahedron

Data gravity is an important battle ground

Data gravity is an important battle ground. So who owns all the data. And which repository do you use for analytics / operations. - Ram Parameswaran

Ram is prolific on Twitter and covers topics across Adtech, gaming, fintech, eCom, and software. If you want to read more of Ram's thoughts, I would highly recommend his 4Q "A Few Things we Learned". He covers: 1) why he's still very bullish on cloud growth/spend 2) real-time data becoming more important (CFLT) and 3) continued investment in product/development velocity (HCP/GTLB).

Geoff Bryon was also recently posted on the important of data gravity:

Data is the center of gravity for enterprise SaaS

— Geoff Byron (@geoff_byron) January 14, 2022

And the more I read the more I realize how little I know about how data flows through the cloud ecosystem

This is a great chart by Joe Floyd and @wenzxing at @emergencecap that's helping me learn pic.twitter.com/ZOG2i704gR

And Wenz Xing's (Emergence Capital) full article:

Geoff Byron, Workday

No-code and PLG are creating an environment of employee empowerment

Geoff argues the next generation of SaaS categories will be built around collaboration and UI. In this environment, it's important to own the data, integrations, and provide multi-vendor analytics:

Power to the employee 💪

— Geoff Byron (@geoff_byron) January 13, 2022

A must understand trend in enterprise SaaS

It's the inflection point that unlocked both the product-led growth #plg and no-code #nocode movements

This is what I see happening and what it may mean for the future 📈 ↓

Jamie Cuffe also had a great thread on scaling a low-code:

I’ve learned so much seeing @retool scale from <100 to 1000s of customers over the last 2 years.

— Jamie Cuffe (@CuffeJamie) January 12, 2022

Given our recent Series C, I wanted to share share some of the lessons we discovered along the way 🧵

Nicholas Evans, Southport Ventures

Microacquire becoming a force in small SaaS M&A

I’d say one major trend is there’s a lot of activity on Microacquire. It’s only a couple years old and has become much more popular over the last year. I think it’s providing liquidity for very small businesses that just wasn’t there a few years ago. It’s also aggregating buyers, which can drive up prices. A trend I’ve noticed is there’s more awareness from sellers of their exit options. - Nicholas Evans, Southport Ventures

Southport Ventures focuses on acquiring B2B SaaS companies with up to $5M in revenue. These businesses now have many more additional options for being acquired or to fund growth while remaining independent.

The other rising trend is there’s way more funding options for both bootstrapped startups and for SaaS acquirers. There's a number of new revenue and acquisition financing offerings. Pipe is doing acquisition financing and non-dilutive growth financing, Boopos is a new fund doing it, and some other outfits are pushing in that direction too. For example, Stripe Capital keeps sending me emails that one of our portfolio businesses (SiteAlert.io) is eligible for growth financing. Bootstrapped companies with solid metrics have a lot more options now to stay independent and are weighing those options vs raising from VCs. There are now bootstrapper-focused funds like Calm Company Fund and accelerators like Tiny Seed that provide mentors and strong communities as well. - Nicholas Evans

Nick's thoughts on applying PLG to SaaS companies:

Not many of them know about PLG, have product managers to strategize how to pull that off, or have loads of funding to be able to give parts of their product away for free. The companies are small and they risk drowning under the support burden of free users. Maybe some do a free trial PLG approach but few make parts of their product free forever. - Nicholas Evans, Southport Ventures

Nicholas also recommended a recent indie SaaS report:

Antoine Buteau, Replit

A focus on efficiency is driving PLG best practices

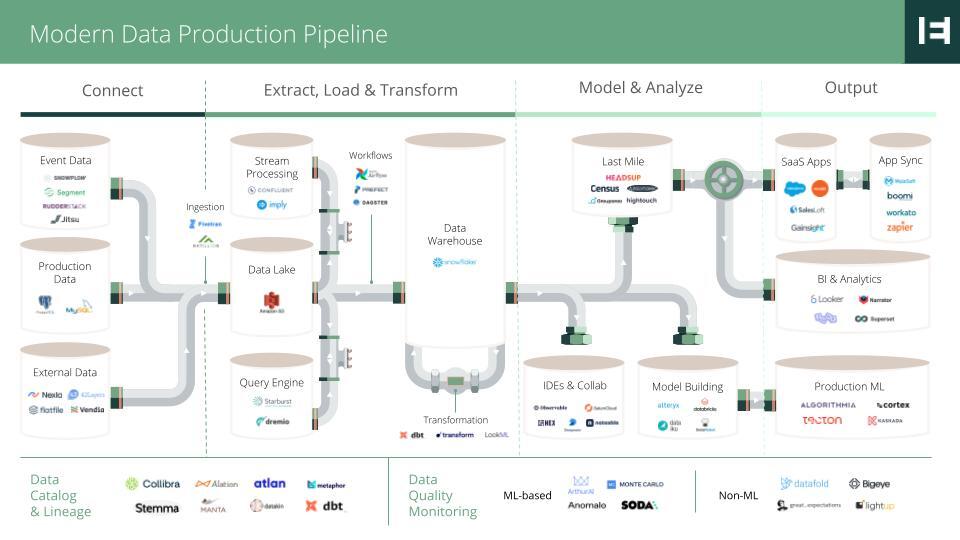

From what I'm seeing with my peers, the modern data landscape is all the rage. Largely driven by: 1) SaaS companies rethinking how they architecture their product and 2) Focus on decent unit economics and efficiency. We're starting to see some consensus and best practices on roles (data engineer vs. analyst vs. data scientist) and how to instrument your PLG GTM. The hardest part and what I'm seeing a lot of people talk about is a renewed focus on data governance (catalog, lineage & discovery) - Antoine Buteau, Replit

Antoine recommended an article by Patrick Chase (Redpoint) on the transition to companies building directly on top of the data warehouse:

Another big trend is the rapid increase in hosting costs and the influx of tools helping SaaS companies understand and optimize the expenses:

The second trend I'm seeing is people becoming way smarter about cloud finOps to understand their cost. Need a tight link between engineering, finance and ops. Seeing new generation of tools addressing cloud cost optimization challenge. - Antoine Buteau

I did a thread on the same article earlier this year. TLDR; a company may be able to save money, but the endeavor comes with risks and is not for everyone.

1/ .@a16z: Should SaaS companies 'repatriate' their cloud workloads?

— Thomas Robb ☁️ (@BreakingSaaS) May 31, 2021

1) Public SaaS spend: ~$8bn

2) Repatriating saves ~50%

3) SaaS companies trade @ 24-25x GP

= $100bn of trapped market cap

Lets dive in! 👇👇

Amar Jani, Celonis

ESG ecosystem continues to evolve and grow

The evolving ESG landscape will be a very important, interesting trend over the coming years. Corporations will need ways to track, monitor, institute, report, apply and communicate their goals, reports, and progress. - Amar Jani, Celonis

Investors are already taking notice as Berlin-based Plan A announced a $10M funding round to develop a SaaS tool to cover ESG reporting:

Long-term investors, frequently led by BlackRock, are embracing the positive ROI of ESG practices and investments. Larry Fink believes "companies risk being left behind" if they don’t embrace sustainable business practices:

Disclosure: Amar is Chief Planning and Analytics Officer at Celonis.

Alex Clayton, Meritech

Efficiency becomes more important to investors

I think a big trend in the public markets already is the move towards efficiency vs growth. Efficiency and growth together are becoming more correlated to valuation. Moreover... multiples are down significantly in the past 8 weeks. - Alex Clayton, Meritech

Alex publishes the annual SaaS IPO review at Meritech capital - a must-read in the industry:

A shift from Growth to unit economics is also a big trend I highlighted in my ☁️ 2021 Cloud Review.

Tushar Makhija, TeamOhana

Employee Success function emerges to manage attrition and hiring

I believe you will see a new class of job function emerge - something I call Employee Success. Similar to Customer Success - there will be dedicated tools, and teams to use data to manage attrition, retention and hiring across an org. Especially companies 200 employees and up. This is the extension of HR and Talent and looking past compliance functions. - Tushar Makhija, TeamOhana

The primary driver of this trend is the rapid increase of high-paying jobs, with a corresponding increase in managers with minimal experience. In a fast-paced tech environment, managers will need to act quickly to retain top talent.

Merit cycles which are run yearly will now be run every time the employee hits their yearly anniversary. You can’t wait for the annual merit cycle as it may be too late. If a team is hiring new folks at a premium and paying them more than those in-seat, the company would have to pay out of band adjustments. The market for HC is going to be fluid, so managers will need real time data, and employee success is that data system, where managers get insights and nudges - Tushar Makhija, TeamOhana

Want to stay updated on the teams progress? TeamOhana.

Record VC liquidity driving a tech talent war was a top trend in my ☁️ 2021 Cloud Review.

Sandeep Kella, Assembly

SaaS businesses leaning into Media M&A to build communities

While media mergers and acquisitions are no new feat, I am willing to bet that the next wave of media ownership and activity will be dominated by the SaaS category. Replicating the success of traditional media’s approach, software companies will prioritize creating or acquiring as much content and community as possible in order to connect with their audiences — whether through a Slack channel, podcast, blog or YouTube channel. - Sandeep Kella, Assembly via Forbes

Read the full article in Forbes:

/https%3A%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F605b4c12155bee51cff63f2f%2F0x0.jpg)

Manav Shah, Scale Together

Rise of the strategic CFO

Manav expects real-time visibility, cross-team collaboration, and a universal CFO platform to be key trends as the the CFO org leads digital transformation projects.

More than 79% of organizations across the world have initiated a finance-led digital transformation activity in the last 12 months.

— Manav (@manavbs) January 12, 2022

And over 88% claim that the tools the finance teams are equipped with contribute to the success or failure of the digital transformation.

🧵👇 pic.twitter.com/evr5lDSy4t