☁️ Superbubbles + other 2022 Predictions

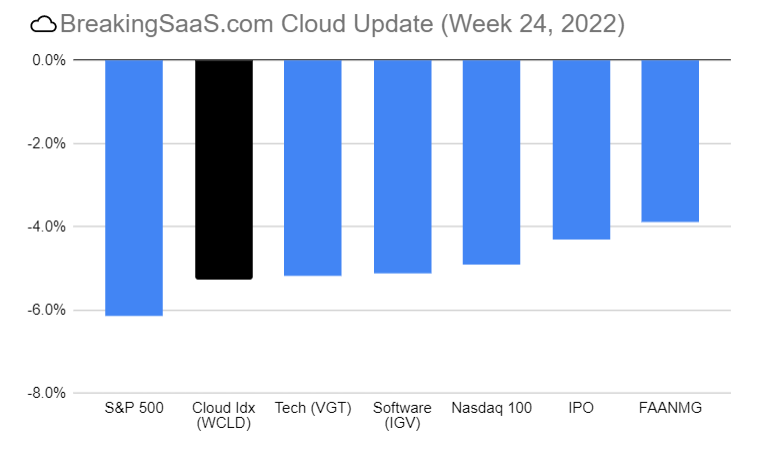

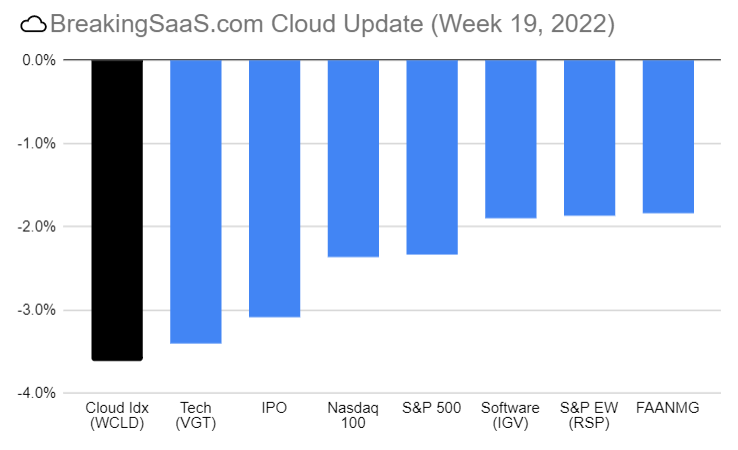

Cloud stocks fell 6.8% for the holiday-shortened week ending January 21st, 2022. The Nasdaq fell 7.5% putting the tech-heavy index in a correction territory. Why? rates blah blah blah 🤷♂️

Netflix fell over 20% as the company reported earnings January 20th, missing analyst expectations for subscriber adds and guiding below street estimates.

(I'm already a day late and $WCLD had a 10% intra-day bar today - this is going to be quick and tweet heavy)

🐻 Everyone was hella bearish last week

Jeremy Grantham: "Today in the U.S. we are in the fourth superbubble of the last hundred years."

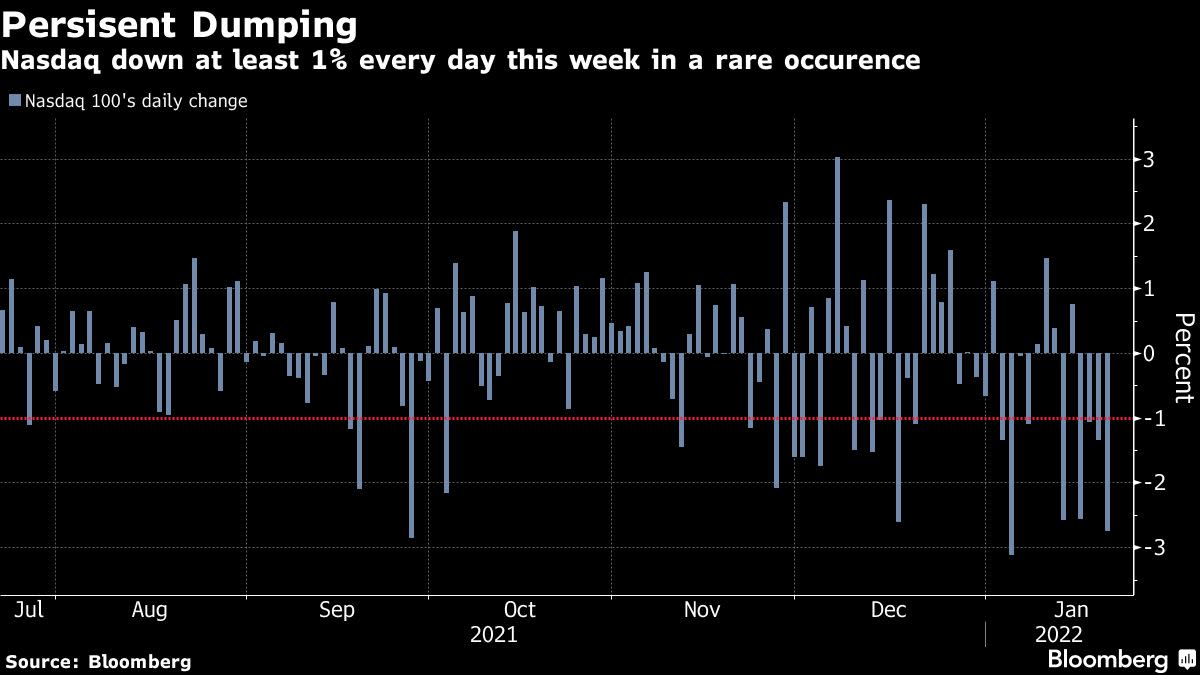

Apparently this only happens before the world ends:

A full week of big down days hasn’t happened since the dot-com bubble burst, first in April 2000 and then in September 2001. Back then, the Nasdaq went on to fall another 28% before the market bottomed roughly a year later.

Last time VC performance was this high was in the dot com era. Remember: Fundamentals > Multiples/Valuation. Keep Building.

Reminder to all VCs out there who didn't live through dot com era..

— Ed Sim (@edsim) January 20, 2022

We're good but not that good - last time returns for venture were this high was '98, 99 + they ended up at just 1.5x + 0.9x TVPI 20 yrs later. Just 10% realized now

Let's keep building!https://t.co/SZtzzdPU7R pic.twitter.com/29qbnXiY8Y

Chin up. At least you don't work in crypto.

🚀 Hunting for Mega-Trends

Here's where top investors remain bullish heading into 2022:

While public market investors contend with marked-down portfolios and conflate multiple compression with demand destruction, VCs and cloud executives remain bullish on long-term demand and are hunting for the next mega-trend. - Me

Kleiner Perkins remains bullish on analytics, AI, and security in 2022

‘22 is going to be an awesome year in infrastructure software. I see so many great companies out there that are ready to cross the chasm.

— Bucky Moore (@buckymoore) January 10, 2022

Some thoughts from me on what is top of mind: https://t.co/CAZKRrHF2p

OpenView: Talent war continues

Kellblog: 🐂 PLG, 🐻 Web3

Tom Tunguz: Data continues to go wild

Breaking SaaS list:

🤑 Damn it feels good to be a seed investor

As growth investors are more-levered to public valuations, seed investors remain more focused on products and building:

— Justin Kan ❄️ (@justinkan) January 21, 2022

Founder to-do list: poach talent

Given the amount of 💰 raised in the last year and on the sidelines, IMO early stage will continue to be strong as there is no better place to invest capital. For founders who are just building, this is the best time ever to poach talent, especially from the public companies where employees unfortunately have underwater stock. - Ed Sims

In prior periods of multiple contraction, little impact on Series A rounds:

🤔 Grow Fast or Die Slow

Good to revisit the classic “Grow Fast or Die Slow” aka why SaaS is a bastardized accel/decel game

— Bucco Capital (@buccocapital) January 20, 2022

“Supergrowers”, Co’s w/ growth greater than 60% when they reached $100M in revs, were 8x more likely to reach $1B in revs than those growing less than 20%https://t.co/2DyOWPt7gO pic.twitter.com/cD3PChsuJB

Full Report: