☁️ To BTFD, or not to BTFD

Stages of The Dip:

healthy little correction

ooo...don't mind if I do buy this little dip

oh wow a tasty dip, yes please

hmmm...everything just keeps going down

selling here I'll regret it

ok I'll sell a little

money isn't really key to happiness anyway

fuuuuckkkkk— Buck (@BucknSF) January 10, 2022

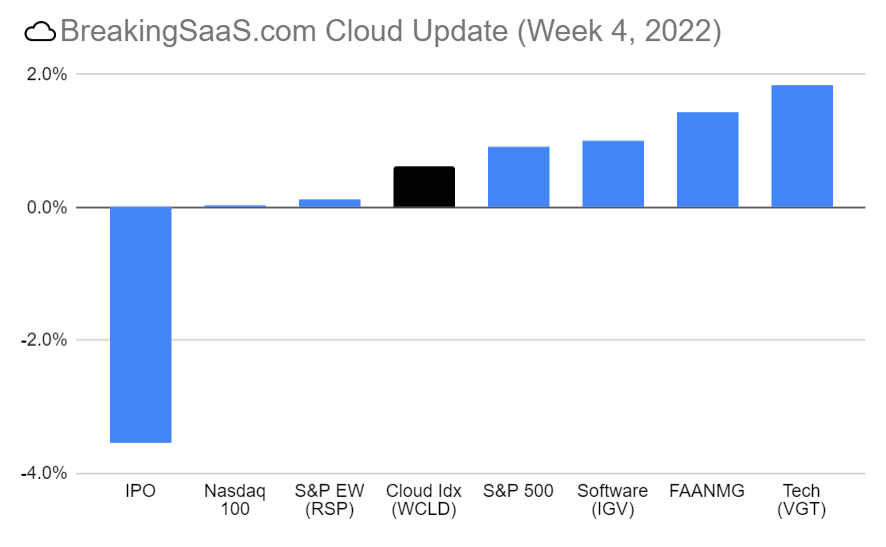

Cloud stocks broke a 4-week losing streak to finish the week up 0.6%.

Volatility. Gains were hard fought as large daily changes (+4% Monday, -5% Tuesday, +5% Friday) masked even wilder intra-day swings. $WCLD posted its 2nd biggest, same-day swing (10%) EVER on Monday.

De-risking/rotation. Strongest sectors remain interest-rate sensitive energy and financials. Recent IPOs (-3.5%) and biotech (-1.6%) underperformed.

Bears vs. Bulls. A hawkish fed meeting and rising tensions between Ukraine and Russia were offset by strong 4Q GDP growth and solid results from multiple software leaders (Microsoft, ServiceNow, Atlassian, and Qualtrics)

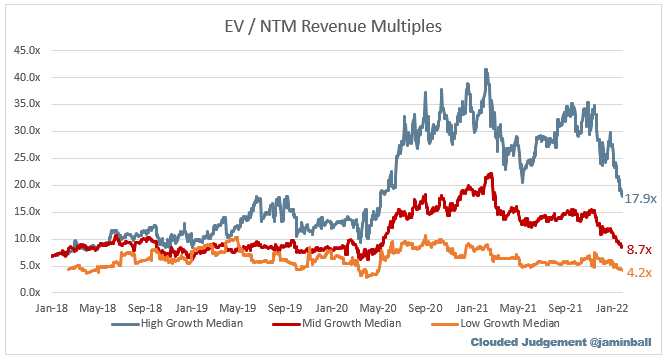

Multiples. "High growth software multiples are still elevated. Looking at high growth software median only - we are still 26% above pre-covid highs, 49% above where we were on Jan 1, 2020, and right in line with the previous peak in September 2019." - Jamin Ball (chart below)

📰 Software is eating the world. Make sure you're not the prey

Join top VCs, founders, and executives.

Subscribe Email sent

🐂/🐻 BTFD?

Place your bets

With Cloud stocks down ~35% from November highs and Nasdaq squarely in correction territory, investors favorite pastime has pivoted from calling hypergrowth to bottom picking.

Here's what I'm seeing:

1️⃣ 👍 Fundamentals remain strong

We've mentioned the demand environment remains strong for the last 2 weeks: 1) VCs remain focused on hunting for mega-trends and 2) 3 Bullish Signs on Cloud Spending.

The signs continue.

Jeff Richards noted systems integrator (SI) are seeing demand "off the charts":

I was with a top exec from one of the big SIs last week. He said demand for cloud tech / infra is “off the charts” and they can’t hire people fast enough. Probably nothing. 😊☁️🚀

— Jeff Richards (@jrichlive) January 25, 2022

Chris Conforti (Altimeter Capital) is pointing to strong bullish earnings and underlying demand as signs of support in software:

Feel like there’s enough evidence to call a bottom in software:

- early prints + guides unanimously bullish

- General consensus of strong fundamentals confirmed

- multiples have returned to 5 year average

- $TEAM, $NOW, $XM, $MSFT are holding gains post prints— Chris Conforti (@Chris_Conforti) January 28, 2022

2️⃣ 👍 Positioning light and technicals nearing historical lows

Lowest positioning for tech since December 2008:

These charts are pretty wild. Lowest tech positioning since 2008 and highest overweight *ever* for late cyclicals.

Being long energy and financials isn’t even vaguely contrarian.

Might be smart though - we will see! https://t.co/OBf8jvZdUe— Gavin Baker (@GavinSBaker) January 23, 2022

Only 17% of NASDAQ stocks above the 200-day moving average (the lowest since April 2020):

There are only 17.11% of NASDAQ stocks above their respective 200-day moving averages. The last time this many were failing below the average was April of 2020. pic.twitter.com/ec38RYqmj0

— 📈 Markets & Mayhem 📉 (@Mayhem4Markets) January 26, 2022

3️⃣ 🤙 Valuation normalized, but not necessarily bottomed

Jamin Ball noted "high growth software multiples are still elevated" (discussed more above).

Jared Sleeper noted "there's still ~24% downside to the average 'bottoming' multiple" and high-growth stocks are unlikely to outperform in a broader market downturn. That said, lower multiples should be supportive to M&A.

Summary of the seven notable downturns in the BVP Emerging Cloud Index (including this time around).

So far, this downturn is pressing the bounds of normal, but still normal.

Mini-🧵 on four things that are different this time and a thought on how it may end: pic.twitter.com/drR0KUTenO— Jared Sleeper (@JaredSleeper) January 23, 2022

4️⃣ 🤙 The "professionals" remain mixed

Banks remain focused on rates and HF capitulation to call the market bottom:

JPM: "We hadn’t seen consistent signs of capitulation by HFs" (ZeroHedge)

Stifel: 5 signs for correction to end: 1) Fed to turn dovish, 2) PMI bottoms, 3) M2 money supply has to bottom, 4) EPS beats vs. misses have to bottom, 5) Ukraine settled with minimal impact (ZeroHedge)

Goldman: “Any further significant weakness at the index level should be seen as a buying opportunity, in our view” (ZeroHedge)

Citi: “Rapid de-rating of growth stocks may slow as real yields stabilize,” adding that their bear market checklist - which screens for various fundamental and market factors - is suggesting to buy the dip.(ZeroHedge)

5️⃣ So where to put your money?

Jeff Richards suggests founder-led software companies with strong underlying growth, positive customer economics, and large TAM:

I personally like

- great founder / CEO

- expanding TAM

- growth >30%

- NRR > 120%

My largest positions are in a) cloud infra, b) low code / no code & c) digital $. Have owned most since IPO, adding to a few now.

SNOW GTLB HCP CRWD OKTA TWLO ZM MNDY ASAN SMAR DLO ADYEY SQ PYPL— Jeff Richards (@jrichlive) January 22, 2022

⚾ Inside Baseball

Great thread on the ins and outs of VC valuations as public multiples fall:

1/ there's lot of VC "inside baseball" on what's going on with startup valuations.

in short: VCs are SHITTING their pants over existing portfolio while same time SALIVATING over potential "more reasonable" (LOWER) valuations for new deals.

anyway here's my take on next 12 mo's: https://t.co/V7L2p5MbBf— Dave McClure (@davemcclure) January 27, 2022

Jeff Richards reminds new employees to fully understand option pricing when joining new firms in the face of falling multiples:

Pro tip for individuals thinking of joining a new company. Ask the late stage private tech company you are thinking of joining what the 409A valuation is on the options you will be granted. Important to do your homework and calibrate valuation in new market environment. 🤞

— Jeff Richards (@jrichlive) January 27, 2022

And Nick Mehta (CEO, Gainsight) had a great LinkedIn post (April 2021) on the potential downsides after a large fundraising round:

☁ So You’ve Raised a SaaS Mega Round:

Now What?— Thomas Robb ☁️ (@BreakingSaaS) January 26, 2022

🤔 Tweets I'm Thinking About

Great Thread from Manav Shah on Low Code/No Code Tech:

Get a cup of filter coffee.

In this thread, we are going to talk about Low Code/ No Code Tech.

(LC/NC for the cool kids)

A $15-20B+ category that is growing at over 23% YoY.

By some estimates, this is going to be $50B+ by 2024.

It's time we talk about this.

🧶

1/20 pic.twitter.com/LEXZxyV9Mr— Manav (@manavbs) January 26, 2022

Frank Slootman with his new book out. Heavy focus on execution and focus above all else:

No strategy is better than getting shit done. pic.twitter.com/5MW8efXryy

— Alex Song (@alexsongis) January 22, 2022

With blessings of strong NRR,

Thomas

Twitter | LinkedIn

🤓 P.S. You look like someone who likes SaaS Metrics. Make sure you never miss an update

Join top VCs, founders, and executives.

Subscribe Email sent