☁ ELi5: 409a

[Week 32, 2022] 📈 Cloud stocks jump 2.7%, 💵 digging into the 409a, and ☁ Cloud 100

Breaking SaaS dives into the strategy of top VCs, founders, and SaaS executives.

This is NOT TechCrunch -- it's analysis (and a bit of levity) delivered straight to your inbox every weekend.

We love making new friends -- join fellow SaaS nerds 🤓.

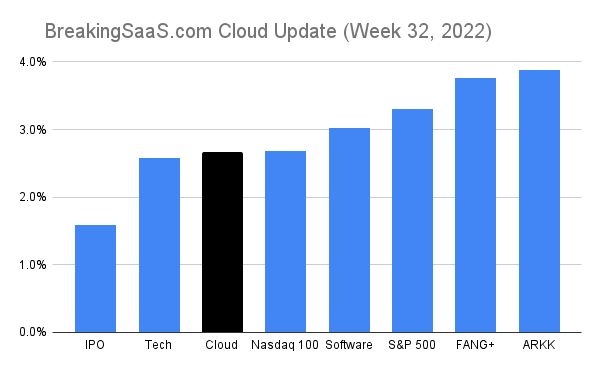

Cloud stocks jumped 2.7% for the week ending August 12, 2022 as CPI came in lower than feared. This week's performance followed an 11.8% increase last week, marking the first back-to-back weekly increase since early February. Cloud stocks are now down ~35% YTD vs. a low of ~48% in mid-June.

💻 Semis warning. On Monday, Nvidia (NVDA) noted a slump in gaming chip sales would impact quarterly revenue. On Tuesday, Micron (MU) warned about quarterly revenue blaming a “challenging market environment."

💸 CPI less than feared. On Wednesday, CPI reported July prices rose 8.5% on an annual basis vs. 9.1% in June. Cloud stocks ripped 5.8%.

🚲 PTON cuts more heads. Peloton announced ~780 employees would be impacted by layoffs as the company will close its NA warehouses and outsources its last-mile deliveries. In addition, Peloton will begin reducing its NA retail footprint beginning in 2023. For more Barry: Who is Barry McCarthy?

💵 WTF is a 409a

A lot can change in 10 months. With Cloud stocks down 35% YTD and ~50% from all-time highs, tech employees who previously took options and RSUs as free money, are learning these comp tools are anything but guaranteed.

What's under the headlines: Tech media loves to highlight "down rounds" and the sudden reduction in VC investment dollars. These stories naturally cause cause a lot of buzz and it's no surprise employees tend to anchor their payout expectations to these headline numbers. While the latest valuation of their employer is undoubtedly an important metric, a little-known (outside finance and accounting circles) term is starting to creep up more and more: the 409a.

So, what is a 409a?

A 409a is simply a third-party valuation of the company typically conducted once a year or around major liquidity events.

The primary impact on employees: the 409a valuation will be the strike price your option grants are issued at. A lower strike price implies there's a larger spread between what you must purchase your shares at vs. what you can ultimately (and theoretically) sell them at.

Fun fact: the term and requirement came into effect due to the shenanigans at Enron:

409A appraisals have become commonplace throughout the tech industry since the Enron scandal, which sparked their creation. In response to some of Enron executives’ misdeeds, Congress passed Section 409A of the IRS tax code to govern how companies issue stock options to their employees.

Public vs. private shares. While employees of public companies can see their wealth (or lack thereof) fluctuate in real time as prices move, employees at private companies generally only get intermediate updates when their companies raise new funds (or similar companies do), but generally need to wait for a liquidity event (IPO or buyout) before they can sell.

To meet accounting controls, CFOs generally have the valuations conducted once a year. But valuations are required if the company is planning a liquidity event, like a private capital raise or a public offering. Companies often add a secondary financing to a primary raise to make existing shares available for sale. Depending on how the secondary offering is structured, employees can use the sale as an opportunity to trade their shares for income.

📈📉Rising Valuations are so 2021

With public comps down, auditors conducting 409a valuations are starting to lower the internal valuations of many once high-flying growth companies. The bad? It sounds bad as a headline on WSJ. The good? Employees are issued shares at lower prices helping recruiting efforts.

In fact, many founders and industry experts see a company receiving a 409A valuation that’s lower than its investor-assigned valuation as a boon. That’s because a low 409A valuation allows companies to grant their employees stock options at a lower price. Companies can also use the new, lower 409A valuation as a recruiting tool, luring prospective employees with cheap options and the promise of cashing out at a higher price when the company eventually exits.

Instacart started the trend off in March with the WSJ reporting the company would cut its internal valuation by nearly 40%. At the time, DoorDash was trading down 22% and Shopify down 35% from the year prior (both returns shareholders would now kill for), impacting the company's valuation.

In June, Sendbird the company's auditors determined the company was worth around 50% less than it had been a year ago (The Information).

Finally, in July, the granddaddy of all startups, Stripe, cut its internal valuation by 28% (WSJ). Rising interest rates took a tool and Fidelity had cut its internal estimate by 9%.

Inside Baseball: John Kim, the Sendbird CEO and co-founder of Sendbird, noted that all the start-up CEOs he's spoken to have received 409A valuations down 25% to 80% (via The Information)

Also as a side note, Palantir made waves in 2019 when it cuts its own valuation.

While public tech stocks have plunged this year amid rising interest rates and slowing growth expectations, the 409A providers said they haven’t seen a broad decline in valuations yet. In fact, in May, the median 409A valuation Carta, which offers 409A valuations and other stock plan services, gave among companies that last received an assessment 12 months prior rose 6%, according to data Carta shared with The Information.

🤷♂️More Boring 409a Stuff

☁ Cloud 100

Forbes out with their annual list of the top 100 private cloud companies.

🎉 Celonis up to #11

Forbes’ definitive ranking of the best, brightest and most valuable private companies in the cloud.

https://www.forbes.com/lists/cloud100

🔝 Picks from BreakingSaaS

With Blessings of strong NRR,

Thomas

📰 Strategy from Top SaaS Leaders (in just 5 Minutes)

Join top VCs, founders, and SaaS executives. Actionable analysis straight to your inbox.