☁ The next 5 years of vSaaS Investing w/ Bowery Capital

Plan Ahead to Eat your Cake + Decade Founders

Welcome to Hard Mode! Top founders, VCs, and investors subscribe for insights and analysis to successfully compete and invest in the Enterprise SaaS market. If you haven’t subscribed yet, we love to make new friends 👇

Thank you to all those who came out to our inaugural SaaS 101 Live workshop! We had a great time and amazing engagement (120+ people stopped by)! Register for the full replay below. We’ll send you the presentation and worksheet there.

🍺 Want to be BFFs IRL? Thinking of hosting a NYC SaaS beers. Respond to this email or DM on twitter if interested!

I had the pleasure of meeting Mike Brown of Bowery Capital after he responded to a prior BreakingSaaS post.

As leaders in vertical SaaS investing, I thought Mike and the team would have great insights on how vertical software companies would be uniquely impacted by the end of low-interest rates and lengthening of investment timelines.

🔮 No doubt their crystal ball did not disappoint!

Would like to thank Pat for all the help brainstorming, writing, and editing 🙏

Hope you Enjoy! 👇

Intro to Bowery Capital

Bowery Capital: Bowery Capital is an early-stage venture capital fund focused exclusively on business software.

Michael Brown: After starting his career in equity research, Michael learned the venture business as an early-stage investor at Virgin Group and at AOL Ventures before going on to found Bowery Capital.

Pat McGovern: Pat started his career as a diligence consultant before getting an MBA and working as an independent advisor to early-stage B2B businesses. Pat initially interned at Bowery during graduate school and has since joined the firm full-time as a senior associate.

Bowery’s Focus: The firm was founded as a specialist in business software. We primarily spend time at the application and infrastructure layer leading pre-seed and seed rounds of funding. Most of the major software “buying” buckets are covered here at the firm - software sold to the offices of the CTO, CMO, CIO, CFO, and beyond. Recently we have expanded our remit to include some of the trends occurring around software verticalization in various industry cloud segments. In addition, we have been spending a lot of time in business eCommerce or what has been referred to as B2B Marketplaces.

Past Vertical SaaS Investments: Alchemy (vSaaS for the specialty chemicals industry); Fero Labs (vSaaS for process manufacturing), Oncue (vSaaS for the moving industry); Castiron (vSaaS for culinary creators); Klir (vSaaS for water management) and others.

How to get in touch: If you are building or want to trade ideas feel free to reach out to Mike (mike.brown@bowerycap.com) or Pat (patrick.mcgovern@bowerycap.com).

Bowery Capital’s Investment Philosophy: “At Bowery Capital, we are firm believers in the power of vertical SaaS and have seen firsthand how its adoption has spread across a wide range of industries. Vertical SaaS is a broad term but we tend to define it as being a SaaS business where >80% of the revenues come from buyers in a particular NAICS code. As we evaluate opportunities to invest in vertical SaaS businesses, we have a few key tailwinds we look for.” 💯

1) Industry REALLY Matters

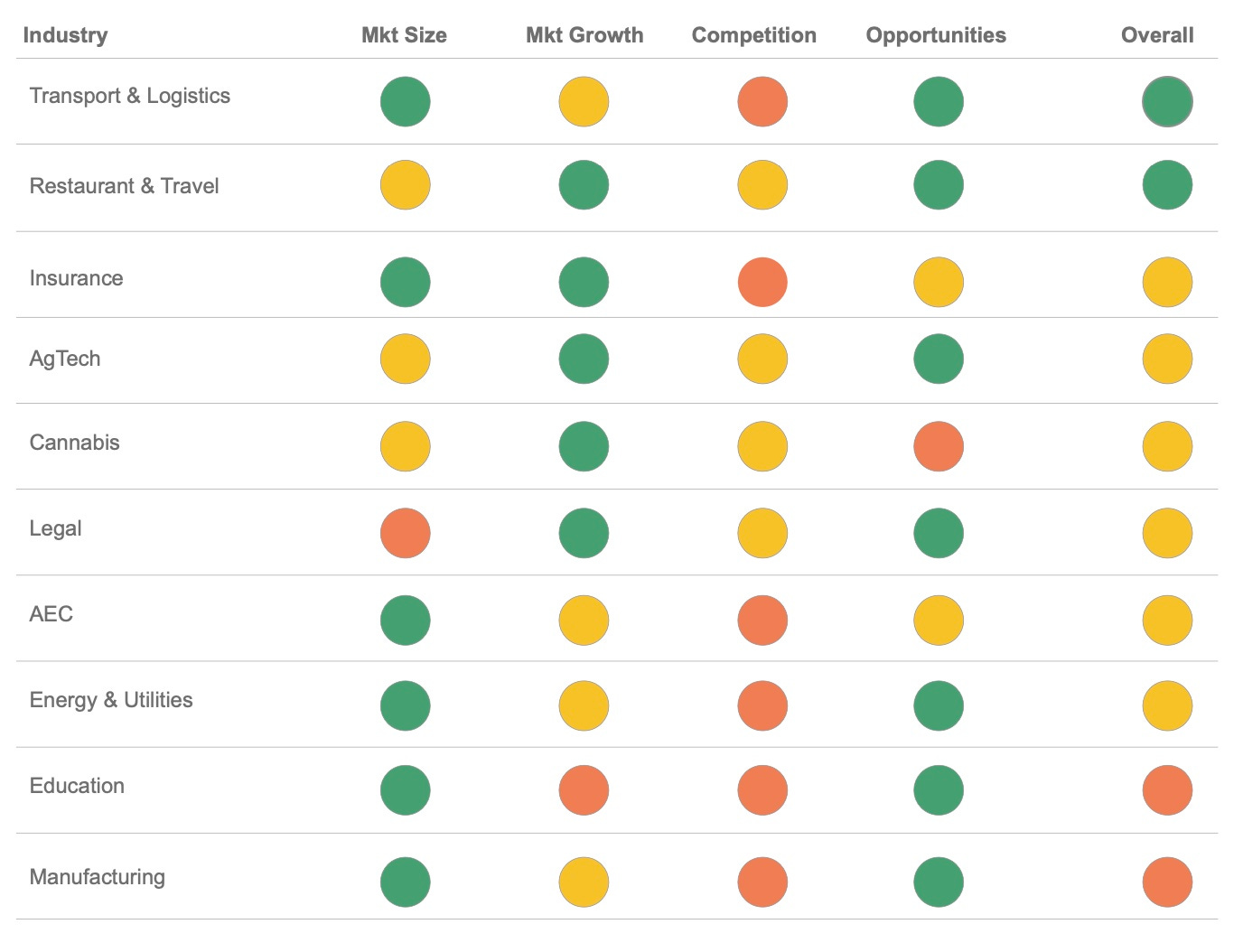

Bowery is widely recognized as a leader in vertical SaaS investing.

Every year they publish a vertical SaaS report diving into market size, sector growth, competition, and the catalysts for adoption.

Their goal? Game out which verticals are most promising at a given point in time.

Check out the full report here:

What dynamics should you watch out for?

Offline is the new Online. Bowery is excited about investing in software companies targeting ‘offline’ industries that are going ‘online’. Think mom and pop industries where the potential of switching to mobile unlocks significant value (i.e., in-field service professionals going from phones to mobile apps). We often see this shift being sparked by outside factors like generational ownership changes or supply chain issues (e.g., SMBs experimenting with new marketplaces to source supplies during COVID).

Inflection points in legacy industries. Industry-level cloud migration is a common inflection point driving a shift to vertical software. This might shock you – many industries still operate using on-prem point solutions which are 10-20 years old. It gives us heartburn too.

Which verticals is Bowery focused on?

Transport & Logistics. Increased concern among companies with regards to securing their supply chain and dealing with logistics bottlenecks have led businesses to look more deeply at software to solve these challenges. We think the potential for vertical SaaS to help revamp supply chains to make them more resilient and more cost-efficient is a long-term opportunity. Examples: Kargo, Flexport, Starship.

Travel & Hospitality. Gen 1.0 on-prem solutions are now facing increased pressure from cloud-native challengers in the travel sector. The adoption of POS/CRM technology allows companies to better understand their customers and enable automation and efficiency in light of growing labor costs and worker shortages. Examples: CloudBeds, Revinate, and ResQ.

2) Plan Ahead to Eat Your Cake

With a narrow industry focus, it’s important to always be planning the next act.

System of record. Your goal is to become a system of record for the business you sell to. Vertical SaaS companies often start out as glorified point solutions which solve for a few key functions. Over time they add additional features until they become an OS for a business.

Once you provide enough value to an industry, your product becomes the ‘default option’ for that particular sector (and therefore irreplaceable).

This expansion strategy is commonly referred to as a “layer cake” approach - this is a term coined by Bessemer and is a helpful heuristic for thinking about feature expansion.

The two most-famous examples:

Toast - Expanded features (POS > reservations -> payroll -> restaurant financing) but stayed locked in on restaurants as their category.

ServiceTitan - Expanded features while also expanding categories by growing from HVAC professionals into pest management, lawn care, electrician, plumbing, etc.

Example: So you Want to Layercake your Vertical Software Company?

Landscapr, a (hypothetical) software company selling into the landscaping market wants to expand.

Goal: The CEO wants to increase ASP. How would they do it?

CRM. The company starts off as a CRM to help landscapers track track and contact leads and customers.

Payments. Given its roots are as a customer engagement suite, the company expands into helping operators with invoicing and processing customer payments.

Scheduling. From the FinOps side, Landscapr could then expand into operations by offering scheduling, productivity, and communications (think a white-labled app).

Payroll. Now that Landscapr is handling scheduling, it has all the data and process to expand into offering payroll (they could also offer payroll advances to the workers supported by its payroll offering).

Asset Tracking + Marketplace. Along with helping management track and manage human capital, it can quickly expand into tracking maintenance and repairs on physical machinery (they may even roll out a marketplace to source new equipment and sell used machinery).

Financing. Landscapr could begin to offer financing to landscaping companies - it could also partner with an insurtech company to sell them business and workers’ comp insurance.

Pricing/BI Tools. Offer anonymized benchmarks to help users understand how to optimize pricing for their product.

Feature Laying vs. Category expansion. Companies can also expand by offering the same feature set into adjacent categories. In our Landscapr example, they could expand into snow removal or pest control. The key is to look for sectors with similar fragmentation, seller types, and end customers.

Bowery Note: “Founder-market fit is so important given how deeply a successful vertical SaaS platform needs to integrate with its users’ businesses - we tend to gravitate towards founders who have direct experience in the sectors they are building for as they can understand which features to prioritize and how to build them optimally for their industry use cases.”

3) Looking for Decade Founders

Value accrues slower in Vertical SaaS. A hot data or cybersecurity company can reach a $1B valuation much faster than a traditional vertical SaaS company ever will.

Why? While many B2B SaaS companies only need to successfully launch one product or platform, a vertical SaaS company needs to engineer and develop an entire tech stack across a company.

>10 Years. The time to exit for vertical SaaS companies that make it to an IPO is often >10 years. Founders and investors should understand that they are signing up for a long journey if they are chasing the largest possible outcome (i.e., a multi-billion dollar public company)

How long exactly? The VERY BEST still take 9 years from inception to IPO.

Long-term founder vision will start to play a bigger role. Will this timeline lead vertical SaaS founders to go a more capital efficient path and eventually exit to PE?

10 years + questionable economics = rise of the PE exit. The possibility of 10 years is hard to stomach even for the most ardent founder.

Founder game theory:

Can I become an OS? Every vertical SaaS founder initially envisions that they will become a platform for their particular industry. Achieving this ‘default’ status (like Toast in restaurants, Procore in construction, etc.) is typically necessary to reach an IPO scale outcome.

Should I exit? In today’s funding environment, companies won’t be raising money without tier 1 customer economics. With an IPO-scale exit out of the question, founders need to optimize for the second best option which is frequently a smaller strategic or PE exit. Often PE firms will allow founders to roll over some equity and acquisitions usually include an equity component to continue to drive upside for founders.

Can I continue solo? If you realize mid-way that it’s not going to happen, it's important to reduce spend and reach for profitability. This offers the alternative of being taken out by private equity or rolled up into the leading platform, but might mean slower growth/smaller scale.

Bowery Note: “We expect speed to exit will increase as i) the vertical software playbook is more well understood and ii) ‘offline’ industries are more receptive to and reliant on vertical solutions. Nevertheless, the often lengthy hold periods observed among the recent vertical SaaS success stories is something that many seed funds who invest in this space are weighing as they evaluate the next crop of vertical SaaS businesses going out to fundraise.”

4) $100M May Be the New NYSE Bell

Free put option is no longer available. The pathway to IPO has always been littered with ambitious founders who never quite made it. Over the past 5 years, low interest rates basically gave founders a free put option impacting a variety of behaviors:

Gave founders the appearance that downside was limited

Potential pathway to IPO was much more clear

License to hire aggressively and address competition with headcount

Reduced need to consider long-term profitability

Now that the free-money exuberance is over, we would expect to see many Vertical SaaS companies be built for profitability and mid-sized scale in mind, rather than burning heaps of cash to try to attain (and sustain) industry dominance.

While we all want to believe EVERY SaaS company will win, the market reality remains that the majority of value accrues to a few and what looks like a dominant market position today may be competed away by another company. Not to mention a platform could eventually just give your primary product away for free.

What does this mean for founders?

Historically: IPO vs. Constellation (multi-million exit). Vertical SaaS companies often ended up with two types of exits - either an IPO-scale outcome, or a sub-$10MM sale to Constellation or other aggregators of specialty software.

Now: PE Exit. As founders realize growth funding for non-market leaders is unavailable, alternatives to the growth at all costs philosophy will arise (think $100-$500MM exits vs. $1B-$5B exits). In fact, TechCrunch was talking about the PE Exit trend back in 2018.

Key traits PE would be looking for?

Vertical SaaS company with sticky recurring cash flows (able to be levered).

Moderately efficient (need to be able to squeeze cost efficiencies).

Mid-sized (not many PEs have appetite for whale SaaS acquisitions yet).

Industry where cloud adoption is increasing (want an industry tailwind).

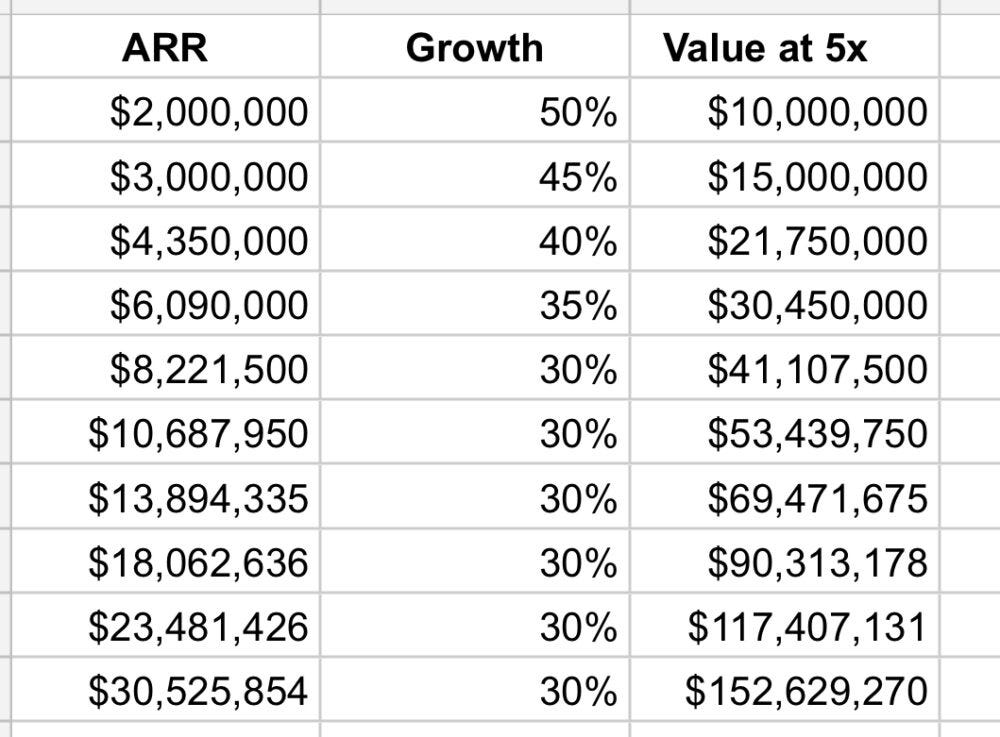

Jason Lemkin at SaaStr was discussing the future rise of the $100M exit last month:

$20m ARR with 100%+ NRR and even just so-so growth gets a lot of folks interested in an acquisition as long as you are doing something reasonably important in SaaS.

Now it’s not always a huge multiple. A $20m ARR startup growing 40% getting acquired for $100m ARR isn’t an amazing outcome for VCs.

And showed a pathway to a great exit even at a reasonable ARR and multiple:

5) Investor Reckoning

Putting all these dynamics together, investors will also have to adapt to the new realities and expected outcomes.

Returns over the last few years were heavily influenced by expanding multiples and mark to market valuations as new capital flooded the market.

As market funding dynamics return to normal, the importance of company (founder team) and industry selection will return as the key return drivers.

Seed investors will be relatively insulated. For seed investors, exits to private equity in the $250MM-$750MM range are still quite successful in terms of MOIC. However, this same size outcome may be viewed as a bad investment by a growth investor.

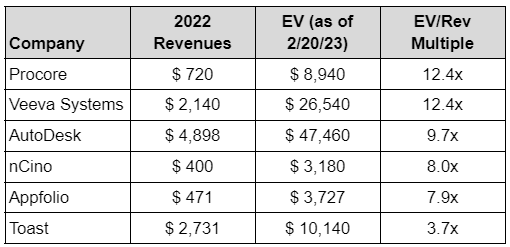

Investors need to have reasonable public valuation expectations. Vertical SaaS multiples today are in the high single digits on average - in our sample below the average EV/Rev sits at about 9x. Only a few vertical SaaS companies have achieved public scale so this multiple is probably artificially high compared to the wider universe of mid and late-stage private companies that employ a vSaaS business model.

How will this impact appetite for growth capital overall? If more vertical SaaS companies end up selling to PE in the growth stage instead of chasing an IPO, this could impact the growth appetite for this business model which could lead to a feedback loop where founders have fewer options in terms of VCs investing in their company beyond Series A.

Net / Net - Final Advice for Founders

Start with an industry tailwind. Understand you will be competing in a given industry for 10+ years so you want to make sure you choose an industry with catalysts (e.g., ownership changes and mom-and-pops moving to the cloud).

Plan your long-term product roadmap. Every Vertical SaaS company aims to become the Operating System of a given industry. This usually starts with more modest ambitions and expands across the enterprise overtime.

Be prepared to be committed. The very best Vertical SaaS companies took at least 9 years to IPO. Is this really what you want to do? Plan accordingly.

Know your exit opportunities. Ringing the Opening Bell is every founder's dream, but keep your eyes open for the $100M Exit.

Understand the new realities for investors. Realize that investors will want to understand your expected timeline and how your preferred exit impacts spending and fundraising strategy.

With Blessings of Strong NRR,

Thomas