☁ Unbundling, Rebundling, and Distribution

Microsoft just works (and it's cheaper)

Welcome to Hard Mode! Top founders, VCs, and investors subscribe for insights and analysis to successfully compete and invest in the Enterprise SaaS market. We love to make new friends 👇

Wrapped up in SaaS

High level, here’s where we stand on the Macro environment:

There’s a war in Europe creating an energy crisis with multiple SaaS companies noting deal cycle times blowing out.

Higher interest rates and spicy inflation are destroying consumer demand stateside (and was just confirmed by FedEx withdrawing guidance).

Layoffs.fyi estimates ~80k tech employees have been laid off in 2022 (Just this week, Twilio announced they would be laying off 11% of its workforce).

With this backdrop, expect more and more CFO orgs to place tighter controls on unnecessary spending and investments:

One area that constantly gets scrutinized is non-payroll and lately, there has been more and more talk about trying to find these cuts within Software spend.

So what’s sparking the sudden focus?

In reality, the average number of SaaS apps per organization has skyrocketed since ~2017. BetterCloud found we were above 100 in 2021.

This trend was accelerated when Covid hit, as companies were willing to test out any solution available to get their companies back up and running.

Multiple guests noted that they are “wrapped up in SaaS,” which has proliferated since the beginning of the pandemic, when many vendors provided free licenses, or otherwise attracted remote workers to adopt their solutions. In the face of potential budget cuts, our guests say that they will turn to these pandemic-era tools to reduce license counts and spend. - ETR

How did we get here? Unbundling.

There are only two ways to make money in business: One is to bundle; the other is to unbundle. - Jim Barksdale

Tren Griffin of 25iq had a whole piece on the topic and gives a little history on the quote:

I dug into bundling and single-point solutions in my piece on Parker Conrad and Rippling:

Building a best-of-breed SaaS has been modus operandi for SaaS companies and VCs for the past 10+ years. The playbook follows finding a single vertical niche to solve, allowing a company to focus VC capital on building one great product that solves a narrow issue better than any other competitor. 10 years ago, this worked great. Find a single use case and there's a good chance you could grow into a large enterprise. Now? All the obvious, low-hanging fruit is picked over.

Single-point solutions are great, but...

The problem is all these best-in-class start-ups can't work well together. Companies are left trying to hire consultants to make custom solutions or cobbling together providers via APIs which sometimes work... but barely.

From unbundling and back

For the last 15 years, there has been a trend of unbundling large, legacy software providers (Oracle, SAP, etc.). This trend persisted for so long because the legacies were generally not known for having great products and were late moving to the cloud. With the vacuum now filled with so many SaaS solutions, Parker is expecting a great re-bundling and all-in-one packages to dominate moving forward.

The result of unbundling? Higher spending and bloated internal IT overhead.

For fast-growing startups, this overhead requires sacrificing precious time and elevating burn rates. For non-tech companies, maintaining a web of HR, IT, and compliance obligations is a constant burden, prohibiting them from investing in growth, building a strong culture, and solving big problems. - John Luttig

Time for consolidation

Annicodately more and more people are starting to talk about reducing (or at least slowing) software spending by eliminating point solutions and consolidating to broader platforms.

Do you need Dropbox and Google storage? Do you need Teams and Slack? Do you need Zoom and 3 other conferencing programs? What about Office and Workspace?

ETR did a great study asking: what is your organization’s plans to achieve a YoY decrease in IT spending? (Note: this was only asked of companies indicating a YoY DECREASE, but would assume it applies directionally to companies looking to slow growth as well)

38% of respondents said they would aim to reduce their IT budgets by consolidating redundant vendors.

It’s also interesting to note that 14% of respondents said “Reduce excess Cloud resource” and 11% will opt to “reduce workflows in consumption-based services and tools”.

While this might sound negative for SaaS, in reality, it reflects customers becoming more mature and requiring every dollar spent is efficient and not redundant.

The decline in cloud spending does not necessarily indicate lower priority. Instead, vendor and product rationalizing, and the undertaking of projects around things like security posture management and cloud cost controls, indicates that their organizations have reached a certain level of maturity in the cloud. Spending will continue, but it will be smarter, more efficient, and less redundant. Plus, this awareness of their organizational environment makes it easier for IT decision makers to make a determination, “if I have to hit the button and start cutting.” - ETR

Bundling as a Competitive Advantage

As unbundling reaches its natural limit (fewer markets to penetrate and corporate IT sprawl), one-stop shops become much more enticing.

Operationally, it helps software companies optimize spend:

This is one of the few true accumulating advantages in software – amortizing S&M across several products means you can charge less while making more. - John Luttig

On the customer side, buyers are looking to lean more towards simplification and better integration and away from single-point solutions:

I think everyone recognizes that there's a huge market space out there, and a lot of folks want to opt for simplification and integration versus dealing with standalone, best-of-breed solutions. Now that Salesforce is offering all of these different features and functionality, I can start to look to them as a possible solution instead of looking in other avenues for things that I typically wouldn't have considered them for before. - VP of Technology Services, Large Software Enterprise via ETR

It also helps your standard SaaS metrics look better to investors:

Bundling is Rippling’s accumulating advantage that offsets classical diseconomies of scale. This means that, unlike most growth-stage companies, Rippling’s core metrics improve over time. CAC paybacks decrease. Growth accelerates. Retention improves. Cross-sell rates increase. - John Luttig

And what wins in rebundling? Distribution

Microsoft’s product is just bad enough to tolerate and just good enough to not switch to Slack and start paying for the tool. Preetam Nath

The most popular example of distribution winning over product is the race of Teams vs. Slack. Teams overtook Slack only 3 years after launch using Microsoft’s superior distribution even though Teams was an inferior product.

Slack famously penned a letter to Microsoft in November 2016 after the announcement of their Teams product, Dear Microsoft. Was Slack bold or naive? We’ll never know. Either way, the acquisition by Salesforce will help their distribution.

But don’t let that fool you: there is a real bundling effect in software. See Parker Conrad’s Compound Startup thesis, playing out in real-time via Rippling. Office 365 has its weaknesses but is a truly compound product – Microsoft Teams, for example, outpaced Silicon Valley darling Slack just 3 years after launch. - John Luttig

Fortune 1000 Distribution

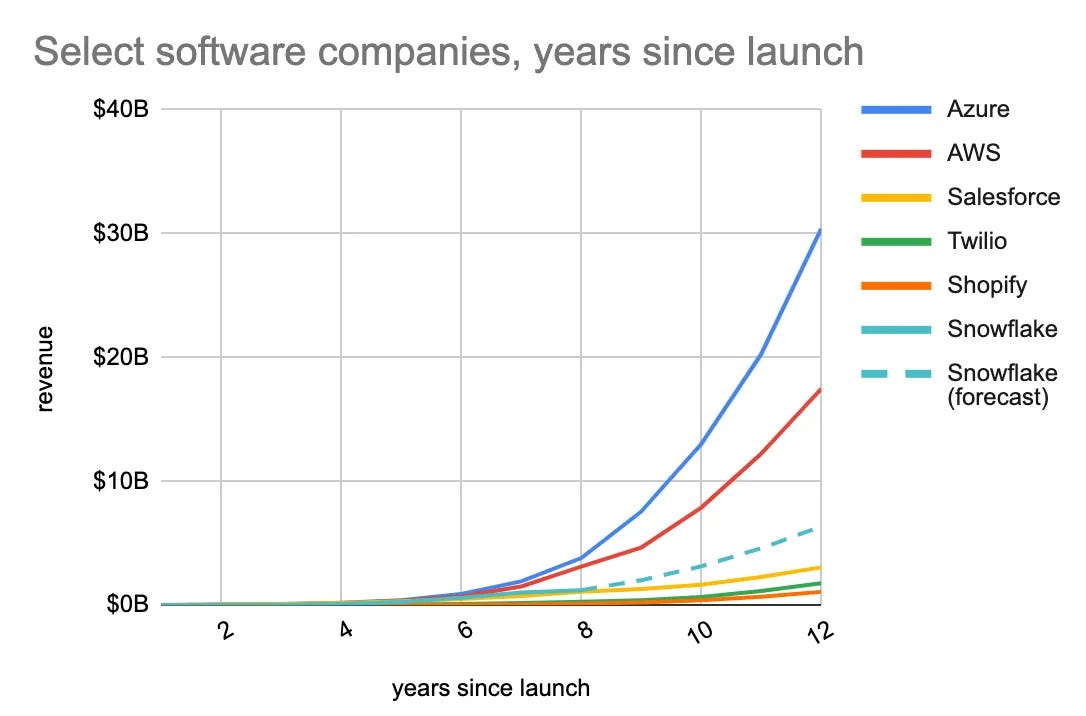

Microsoft used the same playbook to win with Azure in infrastructure.

Microsoft already has distribution into every Fortune 1000 IT department. This makes it much easier to sell new products than from a cold start. A myriad product line suggests a lack of focus, yet Microsoft is more profitable than all of FAANG – that is the power of cross-sell. - John Luttig

Microsoft is also not afraid to compete aggressively to win market share:

Nailing the technicals

Microsoft is an expert at designing products and contracts that incentivize customers to stay within the ecosystem and increase spending with Microsoft when new needs arise:

Because Microsoft—which owns arguably the most successful suite of data tools in the world—represents the opposite point of view. Microsoft’s languages and tools are, though not strictly proprietary or closed off, largely segregated from the rest of the market. Microsoft tightly integrates its products, aggressively packages them together, and generates as much as 95 percent of its commercial revenue through its enormous partnership ecosystem. This creates an insular dynamic where, if you use Microsoft infrastructure, you’re strongly incentivized to put Microsoft tooling on top. - Benn Stancil

Customers are coming around to the power of consolidating on Microsoft and Google as it gives the buyer access to more product features for the same price.

The downside? Microsoft could then decide to increase their prices by 20%

Everybody’s looking at the Microsofts, Googles, Oracles, and SAPs of the world. If I have an enterprise agreement with one of these vendors, I can leverage a lot more technology and a lot more solutions without necessarily going to other sources for fine point solutions. There’s a huge benefit in leveraging a Microsoft agreement, and all the things that come with it, and not having to go to 15 different vendors for the same solutions. We are going down the path of looking at how to make sure that we are leveraging and taking advantage of the capabilities there, yet not putting ourselves in a bind should Microsoft go and raise prices by 20%. - VP of Technology Services, Large Software Enterprise via ETR

A final fun fact: Microsoft’s prior Executive VP of Human Resources, Lisa Brummel, owns a WNBA team, the Seattle Storm (🎩 Benn Stancil)