Thoughts on SentinelOne

ARR Metrics, Revenue Forecasting, and the Price of Confidence

SentinelOne reported earnings Thursday night (6/1), with multiple negative announcements causing the stock to drop 35% on Friday and erase >$1.5B of market cap.

This provides an AMAZING case study applicable to CFO orgs across the SaaS industry:

The dangers and downsides of publicly reporting ARR (or any non-GAAP operating metric)

The importance of properly setting up your CRM

Having a proper forecasting methodology (and ongoing revenue reconciliation process)

Building conservatism into your guidance methodology

The multiple impact of going from an inflecting growth asset to a “show me” story

A few notes before we begin: 1) I haven’t talked to the company, nor sell-side analysts so all details are based on the public conference call transcript and my personal experience/assumptions, 2) none of this is a reflection of my own personal outlook on the company/technology/financials.

📢🚨 Cybersecurity x SaaS Bootcamp

Francis and I are hosting a 2-week bootcamp starting June 13th (less than 2 weeks away!) covering the cybersecurity industry and SaaS modeling

Simplify the complex world of cybersecurity. Francis will be providing a framework and overview of the many technologies across the cybersecurity industry. Including the products from Microsoft security, Palo Alto Networks, Datadog, Crowdstrike, SentinelOne and more!

Learn to analyze and model SaaS companies. Dive into how to build a SaaS financial model using live modeling case studies. We will cover how to understand the difference between bookings vs. billings, FCF, and more.

Hosted with FinTwit legend, Francis Odum. A cybersecurity guru with amazing pieces on Palo Alto’s Path to $100bn (quoted by Nikesh Arora, CEO of Palo Alto Networks), SASE technology deepdive, and Microsoft Security reaching $20bn.

30% off code: BreakingSaaS30

ARR Changes & Errors

The company made a $27M, one-time adjustment to their reported ARR metric driven by 2 changes:

Changing the ARR methodology to only included contracted ARR on consumption based contracts. This removes the volatility associated with these contracts (especially in unfavorable macro environment) and better matches ARR to revenue. While kind of shady to change when a tailwind turns to headwind, this is probably the correct methodology to use.

Fixing a subset of renewal+upsell contracts where the company included the renewal portion as incremental ARR, inflating reported ARR (contributed to majority of revenue miss in the quarter)

These by themselves are pretty shocking, but it’s when you double click, these changes appear to reflect an internal controls issue vs. concerns of a simple guidance miss:

Revenue forecasts appear to be based on ARR forecast (forecasted ARR/12?), not a deferred revenue schedule + new ACV + renewal bookings + consumption assumption (less clarity on this, but other reported GAAP metrics did not need restating)

ARR forecasts were based on consumption remaining flat/continuing to increase

The ARR double counting came from a CRM implementation issue, but also seems to imply the ARR roll was not cross checked with a final contracted ARR number (again less clarity on this)

Problems were only found AFTER quarter-end during a rev rec exercise (of all 10.7k customers)

Public guidance was all predicated on the faulty data/forecasting methodology and did not seem to include a healthy amount of conservatism for known industry/macro factors

Thanks for reading Hard Mode by Breaking SaaS! Subscribe for free to receive new posts and support my work.

Wall Street Whipsawed

The company had been signaling a strong quarter to investors through the period, leaving the street whipsawed and destroying confidence in management execution.

Wolfe Research noted the company appeared bullish to investors during the quarter:

So a lot of the feedback that I'm getting from investors is just that it seems like you guys came across pretty bullish during the quarter. And clearly, the tone is changing here on this call. So I apologize if I missed this, but I'm just trying to understand when exactly did you notice the slowdown in the business really pick up? And maybe even like when did you guys notice the issues with the historical ARR disclosure?

With the CEO responding they were surprised by the suddenness and magnitude of the consumption change at the end of the quarter:

I think generally, when we look at it, we see kind of the end of the quarter is the point where we started noticing more and more pronounced consumption changing. To us, that was a point where couple that with a couple of deals slips and suddenly, you're looking at a very different outcome for the quarter. So I think, generally, if you just look at our new and upsell target for the quarter, it was pretty much in line with what we expected. But when you couple that with that downsizing of consumption, then you just arrive at a very, very different result. And to us, I mean, once again, win rates sustained, revenue still growing about 70%. I think if you take out that consumption element, I mean, things would have looked very, very different. So that, I think, is kind of the reason where parts of the business here are really humming. And suddenly, we saw this, which, frankly, we were surprised by and we were surprised by the magnitude, and that's where we are today.

Leading Deutsche Bank to publicly ask for the CEO’s “End game” with all the volatility:

The ARR statement is very unfortunate. The environment is very tough. I think you guys have said it yourselves, and you're being asked a lot of tough questions. So I mean, as long as we're in this forum, I'm going to add to those, which I guess, for you, Tomer, most appropriately, what is your strategic end game? You're facing an increasingly hostile macro and competitive end market. You're still burning a good amount of cash. I mean, it just seems like, in a recession, you're in a bit of a tough spot. And you, yourself, I think, said in many different ways that conditions are worsening. So when you think about what you envision for the business years ago, coming to the public market versus where you are today and what you can see a few years out on the horizon, how do you think about the different alternatives out there?

Analyst notes after the call were equally concerned by the methodology changes and control issues and expect this to turn into a “show me” story for the next few quarters.

Morgan Stanley see’s SentinelOne “Stuck in the Penalty” Box:

Coming into the FQ1 print, investor sentiment in SentinelOne had been meaningfully improving. Now, we think that investor confidence will be hard and take a while to regain… Restating and revising down prior-year ARR by 5%, putting more scrutiny on the quality of disclosure and internal controls

JP Morgan expects the investors will require a couple quarters to regain confidence:

The company discovered historical upsell and renewal recording inaccuracies relating to ARR and certain subscription and consumption contracts. There were no changes to GAAP reported numbers, but the company made a one-time F4Q23 ARR reduction of $27mm, or approximately 5% of ARR. The inaccuracies have now been corrected, but we think it will take a couple of quarters of solid execution to regain investor confidence.

$1.5B of Confidence

Confidence is fickle and expensive on wall street.

Zooming out:

SentinelOne was a SaaS darling at it’s IPO in 2021 per CNBC: SentinelOne closes up 21% in NYSE debut as highest-valued cybersecurity IPO ever.

And if anyone needs reminding of the SaaS IPO market in 2021 you can have a lookback at the Meritech 2021 SaaS IPO Review.

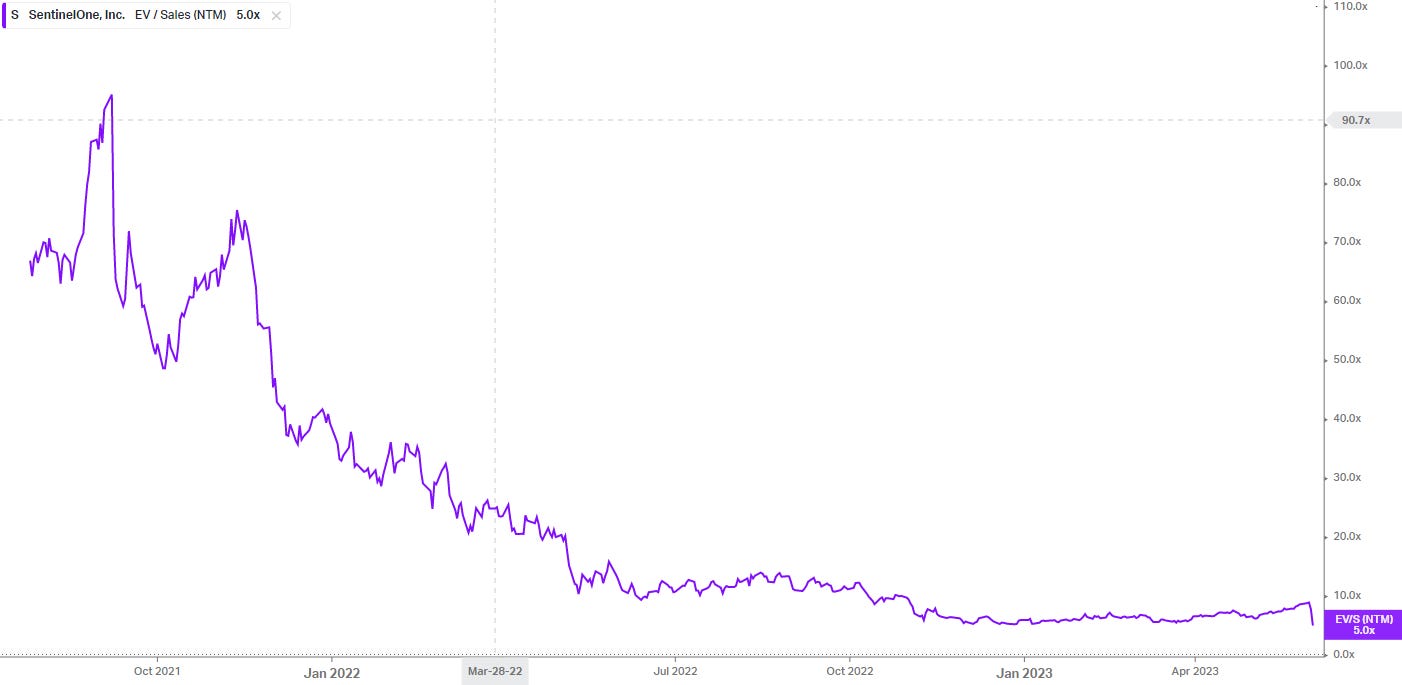

Based on data from Koyfin, S 0.00%↑ NTM EV/Sales peaked at 95x in September 2021.

How the turntables.

Zooming In:

S 0.00%↑ multiples troughed at ~5x in January, coinciding with the broader SaaS industry

Multiples re-expanded to nearly 9x before earnings, consistent with high-growth peers as tracked by Jamin Ball

Following the disappointing results, guidance reduction (2nd time for ARR), and metric issues, multiples have come full circle back to ~5x (below the current SaaS median)

Now a “show me” story. Investors are waiting to see if there are any other control/reporting/metric issues and digesting the sudden change in consumption trends. Investors will want more clarity before stepping in again

📢🚨 Cybersecurity x SaaS Bootcamp

Simplify the complex world of cybersecurity.

Better understand Microsoft security, Palo Alto Networks, Datadog, Crowdstrike, SentinelOne and more!

Learn to analyze and model SaaS companies.

Dive into how to build a SaaS financial model using live modeling case studies.

30% off code: BreakingSaaS30

More Quotes on ARR Changes from Conference Call:

On consumption impact:

First, some context. In the past few years, we had seen steadily increasing usage and consumption patterns by our large customers, which we accounted for real-time in quarterly ARR. However, as the first quarter progressed, we experienced a notable decline in usage, which continued in May. In light of the current macro environment, we expect these lower usage and consumption trends to persist. Due to this new dynamic, we elected to tighten the methodology for calculating ARR for consumption and usage-based agreements to reflect committed contract values. This provides a cleaner view of growth for fiscal '24 and beyond. By making this change now, we expect ARR and revenue to be more closely aligned. It should also reduce volatility in ARR compared to the prior methodology, where usage and consumption changes could have a magnified impact on ARR.

But what we had been seeing historically was we were seeing customers that were signing up for contracts, using the data in excess of what they were committed to, renewing early, and we were reflecting that in the ARR balance. As something that we've seen going into late Q4 and early Q1 and then throughout Q1, even into May and likely into June, we're seeing a decrease in that and customers rightsizing their spend to get back to committed total. So we were seeing an outsized swing to the opposite end that we had seen prior. So what had happened was we're -- by doing this, we're trying to tighten the definition of ARR to eliminate these swings to our favor or to our detriment and basically lock it to the committed contract. So we believe that this is -- this, going forward, it's going to reduce the quarterly ARR fluctuations. It's going to more correlate ARR and revenue.

But basically, the ARR adjustment that we've done was realizing that both we've had consumption is kind of an ad hoc element to our ARR, which basically drives up ARR as consumption goes up, but it drives down ARR significantly when consumption is not continuing to grow. In the past couple of years, consumption for us was always on the up and up, and it created that overstatement of ARR, so to speak, which created an expectation for revenue for us internally as well. So when the quarter ended, the dust settled, when he started kind of figuring out, hey, why aren't we seeing that revenue, a big part of it was the ARR was reflecting consumption that was now going down. And that impacted what we should have seen in revenue. And couple that with, again, some CRM inaccuracies that Dave mentioned as well, and that was mainly the reason for the revenue miss

On calculation error:

As we reviewed the methodology, we also discovered historical upsell and renewal recording inaccuracies relating to ARR on certain subscription and consumption contracts, which are now corrected. After considering these factors, this adjustment resulted in a onetime ARR reduction of $27 million or approximately 5% of ARR, resulting in Q4 fiscal '23 ending ARR of $522 million.

The reason it doesn't change any historical bookings, in terms of the other side of this, which was historical upsell and renewal inaccuracies, what we were seeing was we had upsell motions that included a renewal, and we were adding that to the historical ARR versus adding just the upsell component of it.

This was an error in our CRM. We have fixed this and should not have that error going forward. That's why it didn't affect revenue, didn't affect overall total bookings, didn't affect cash flows, didn't affect the income statement. But what it did do is it set external expectations for what revenue should be going forward, both externally and internally, that's why we made this adjustment now.

And in terms of evaluating the ARR, I guess, rebasing restatement. When we really were diving into that, it was because I was investigating why revenue was coming up as a shortfall. So it started out, and we did a deep dive into revenue. And obviously, you would assume that about 1/4 of ARR goes into revenue absent some churn, absent some slower deployments, things like that, that are typical. But I still, obviously, based on our Q1 results, had a shortfall. So to understand that, we did a deeper dive by scrubbing everything in ARR, all 10,700 customers, to evaluate why that was. And that's where we noticed that we essentially had an uplift that we expected because of renewals that had not been essentially moved out of the system because they were treated as upsell. So I was essentially stacking an upsell on top of an existing renewal without removing the previous renewal. And this was an error in our CRM. We fixed it, but that's where that came up, and that was obviously later on in the quarter and actually post quarter end when we really had fully identified it and been able to scrub all the customers.

Great stuff man. Wonder if you are able to write about revenue forecasting. Thanks

This is fascinating. Thanks for the deep dive.