☁️ Software is Eating Your 401k

Software is eating your 401k

— GromitCap (@GromitCap) May 11, 2022

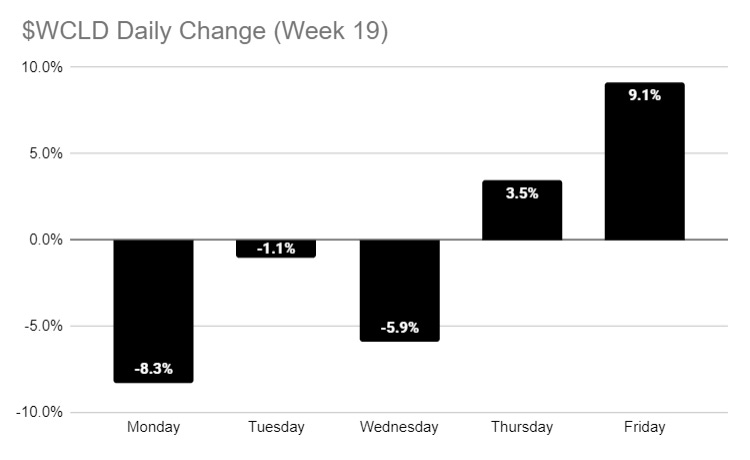

Cloud stocks fell 3.6% in a roller coaster week ending May 13, 2022 as investors digested SaaS (and other momentum darlings) earnings, a crypto implosion, and continued questions about the macroeconomic environment.

Everyone hates Mondays. Cloud stocks fell 8.3% to start the week as investors remained concerned that Fed actions to stem rising inflation would push the country closer to a recession. Markets fell to the lowest levels since November 2020 with Tech being the hardest hit.

Inflation remains 🔥. On Wednesday, April CPI increased 8.3% YoY, above 8.1% expectations pushing Cloud names down 5.9%. Shelter, food, airline fares, and new vehicles remain the spiciest. "The food at home index rose 10.8% YoY, marking the largest 12-month increase since November 1980." - Stocktwits

Crypto Rout. BTC fell nearly 30% during the week. Why? Who knows, but it's certainly risk-off. $LUNA (previously offering a "guaranteed" 17% yield) was completely wiped out as their algo-driven, wildly unstable "stablecoin" lost its peg to the USD. Ryanair was kind (i.e. savage) enough to welcome crypto bros back to its services (below).

🐻 rally? Cloud stocks rallied 9.1% to end the week as buys stepped in as broader indices neared bear market territory. Beginning of the end? Or just a bear market rally? 🤷♂️

Crypto bros yesterday vs. Crypto bros today #welcomeaboard pic.twitter.com/w7gSUE1DJI

— Ryanair (@Ryanair) May 13, 2022

📰 Software is eating the world. Make sure you're not the prey

Join top VCs, founders, and executives.

Subscribe Email sent

💰 Comeback Kid

Former Zenefits CEO, Parker Conrad, back with new HR Start-Up

Rippling raised $250M Series D at $11.25B valuation

Quite impressive given:

The overall smacking tech (especially cloud) stocks have faced in recent months

Rippling just fetched a $6.5 billion valuation in October (less than 7 months ago)

Conrad's prior start-up, Zenefits, unraveled as the company's growth stalled and ran into compliance problems

Rippling is running at $100M+ ARR, apparently has an NRR over 200%, and is clearly running a heavy PLG playbook:

Over the next 12 months, Conrad says, Rippling plans to launch seven new products, an aggressive expansion plan. All told, the company spends 50% of revenue on R&D, compared with 20% or 25% for a more typical SaaS company of its size, he says. - Forbes

The investment was led by Kleiner Perkins and Bedrock Capital.

Some news: We just raised a $250M Series D at an $11.25B valuation, co-led by Bedrock and Kleiner Perkins. We’re very thankful for the trust of our investors, partners, and customers, and the hard work of our team. Read our announcement here: https://t.co/npll2etQro

— Rippling (@Rippling) May 11, 2022

🤔 a16z: A Framework for Navigating Down Markets

A framework for founders: 1) reevaluate your valuation, 2) understand your burn multiples, and 3) build scenario plans.

Reevaluate your valuation

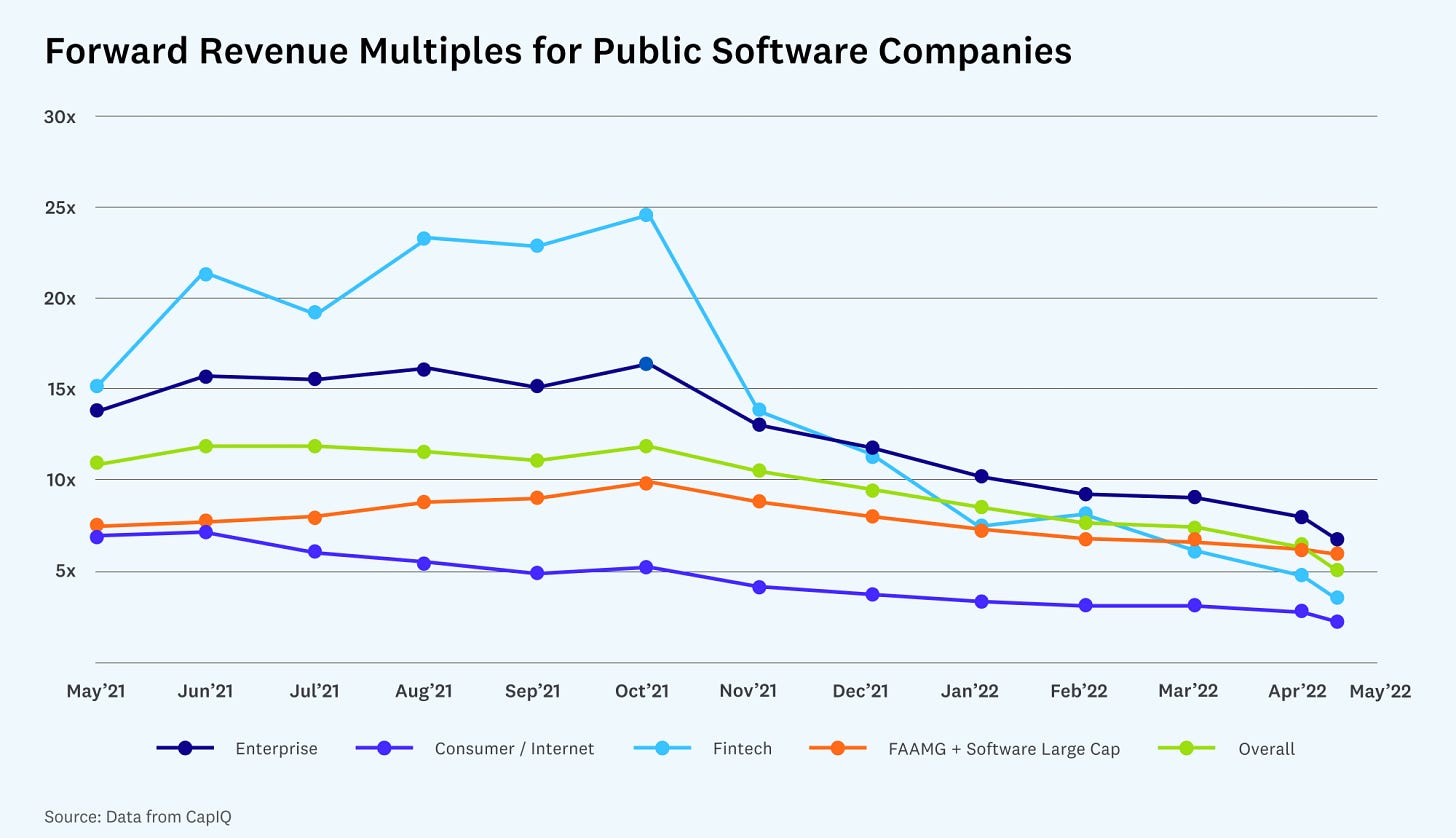

First, some real talk. Your multiple ain't what it used to be:

For instance, in the current market (as the graph below shows), median public company software valuations have dropped from 12x forward revenue to 5x or less since highs in October 2021, representing an almost 60% decline. The same goes for fintech and consumer internet companies, which are also down over 70-80%. - Future

Now you have to figure out what ARR you need to reach to have a FLAT round:

A helpful exercise is to figure out what ARR you need to reach to get back to your last round’s valuation and plan accordingly. To do this, use the estimated change in valuation multiples from leading public companies in your space and add a growth- and efficiency-adjusted premium for your faster growth. Then use this number to calculate the ARR you need to get to. - Future

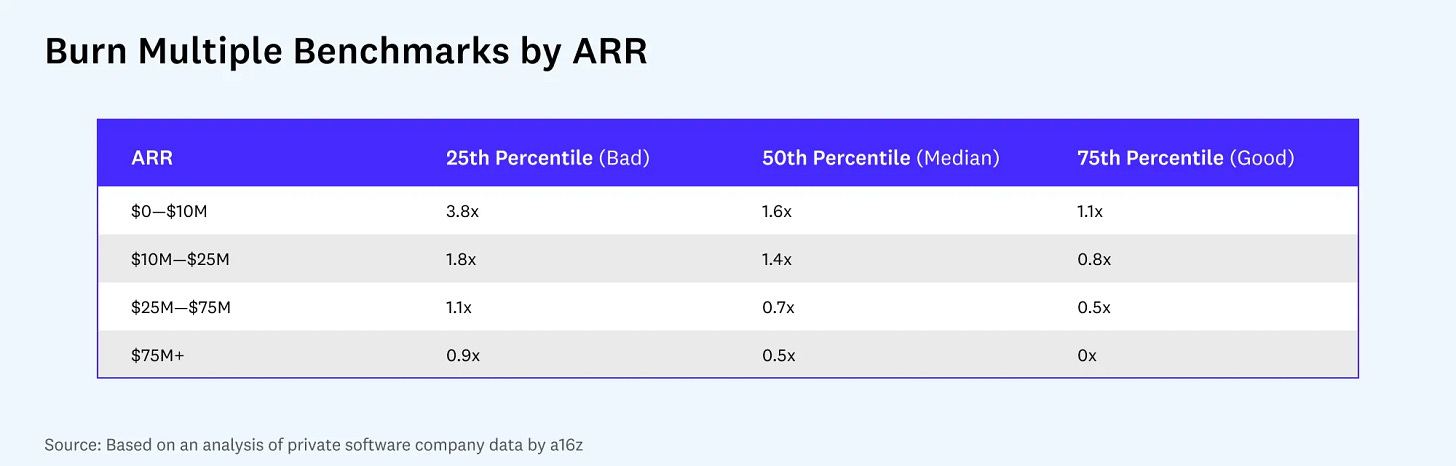

Understand your burn multiples

a16z prefers burn multiples over efficiency metrics as this looks at all aspects of your business (not just S&M).

Burn Multiples = Cash burned / Net ARR added

As a company scales, this metric should improve and approach zero as the company becomes cash flow positive.

If your burn multiple isn’t where you need it to be, there are many ways to improve your burn multiple to grow more efficiently, including right-sizing different functions, improving margins, or lowering CAC. - Future

Build scenario plans

a16z suggests planning for the following 3 scenarios and adjusting hiring and spending based on performance and market conditions:

Base case: Assumes ~80% confidence plan interval. Likely slowing down or holding CAC/Opex growth flat. Assumes slower revenue growth will be met with greater efficiency.

Best case: "ARR growth and burn rate is likely at or better than your operating plan from six months ago." Growth is highly efficient with no runway concerns.

Worst case: The goal is to lengthen your runway. ARR will likely be below plan as you cut CAC investments and you may need to reduce opex for survival

A Framework for Navigating Down Markets

With blessings of strong NRR,

Thomas

Twitter | LinkedIn

🤓 P.S. You look like someone who likes SaaS Metrics. Make sure you never miss an update

Join top VCs, founders, and executives.

Subscribe Email sent