☁️ SaaS Down YTD: What's Next? ($WCLD)

5-Minutes Daily. Built for VCs, founders, and SaaS executives.

[Week 51, 2021] Cloud stocks (+3.1%) outperformed the broader market (+2.3%) for the shortened Holiday week ending December 23, 2021. The strong performance marks a positive tilt to a period of volatile SaaS performance as investors digest and debate the importance of Omicron on WFH stocks, rising rates on high-growth, money-losing companies, and a subtle shift from growth-at-all-costs to a deeper consideration of unit economics and long-term margins.

With 5 trading days left in the year, SaaS stocks are DOWN 0.9% YTD. Place your bets.

🐻 $WCLD flirting with bear market territory (again)

Friendly reminder: 2021 is NOT 2020

It doesn't feel like a bear market, but we have bad news. With a week left of trading in the year, the Cloud index is down ~19% from November highs, recovering only modestly from multiple ~25% declines earlier in December.

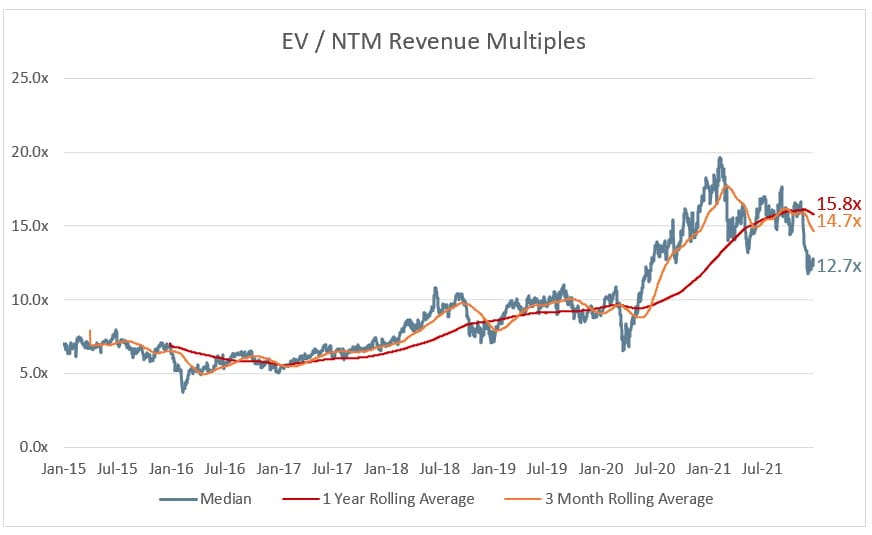

The volatility of the past 2 months continues to highlight what many growth investors are already painfully aware of: the multiple-expansion-fueled rally of 2020 is giving way to a much more nuanced market.

🎢 In fact, all of 2021 has been a rollercoaster. Valuations peaked in early February before beginning their "reversion" through May. The nearly 30% rout was the first significant decline in the index since the Covid-fueled sell-off beginning in February 2020.

Shocker: Valuation Matters

So what changed? Multiples for the industry peaked at nearly 20x in February, up from pre-Covid levels below 10x. High-growth names were trading even higher (30-40x), while top individual names were frequently at 50x+.

Simply put: A LOT needs to go right for a stock to trade at those levels, let alone an entire industry. Now investors are balancing the impact of rising rates when many high-growth names have a significant portion of their intrinsic value in future periods. And while current growth is great (and relatively easy to measure/value), determining the long-term FCF margins for an individual company in a rapidly evolving, highly-competitive market is a much more difficult exercise.

Cloud stocks now haven't outperformed the S&P since mid-February and are sitting down 0.9% YTD vs. +25.9% for the broader market.

Source: Clouded Judgement

$CRWD Co-Founder & Former CTO, Dmitri Alperovitch, is worried about Russia

In the last few weeks, I have become increasingly convinced that Kremlin has unfortunately made a decision to invade Ukraine later this winter. While it is still possible for Putin to deescalate, I believe the likelihood is now quite low. Allow me to explain why 🧵— Dmitri Alperovitch (@DAlperovitch) December 21, 2021

💑 Automation Anywhere acquires FortressIQ

Continues recent string of RPA companies expanding into process mining

Together, Automation Anywhere and FortressIQ will reshape the future of automation, changing the way our customers automate, adapt, and accelerate as they pursue digital transformation initiatives - Automation Anywhere CEO and co-founder Mihir Shukla via TechCrunch

As two cloud-first companies, we … have common customers who we can help scale their digital transformation efforts and who will benefit from our best-of-breed automation technologies. We believe our acquisition of FortressIQ makes complete business sense. We are combining the pioneer in intelligent automation with the pioneer in process discovery — a perfect match. - Automation Anywhere COO Mike Micucci via VentureBeat

Phil Fersht, CEO and Chief Analyst, HFS Research much less excited (all views Phil's):

Why did Automation Anywhere acquire FortressIQ? We view this is a less-than-exciting combination. It seems too little too late for AA to jump into the process mining/intelligence world, and a quick cash-out for FortressIQ Founder,…https://t.co/ESepF9mbFl https://t.co/Fnz7xyrlkP— Phil Fersht (@pfersht) December 23, 2021

🧵 @BessemerVP: 6 Strategies companies can deploy to expand TAM and drive innovation

100% of BVP's Top 10 Cloud Index offers a marketplace

☁ The infamous second act@BessemerVP with the playbook on how to expand TAM and drive innovation

🎩@nextbigteng @thevaluesvc$SHOP $PCOR $TOST @canva @ServiceTitan @Yotpo

6 Strategies 🧵👇— Thomas Robb ☁️ (@BreakingSaaS) December 23, 2021

With blessings of strong NRR,ThomasTwitter | LinkedIn

P.S. You look like someone who likes SaaS Metrics 🤓 Subscribe to make sure you never miss an update