☁ SaaS Revenue 101

Internal vs. External Forecasting

Live view of analysts attempting to forecast revenue.

Revenue forecasting seems complex (and many times is), but can be broken more simply into 3 main pieces:

New revenue

Renewal Revenue

Contracted revenue

Usage-based

How analysts forecast these different pieces is largely based on whether they are internal (Corporate FP&A) or external (sell-side/buy-side analyst).

Internal teams. Have the benefit of knowing complete information of #3, partial knowledge of #2 (know the timing of renewals and trends), and at least pipeline/sales calls of #1.

External teams. Must battle with limited knowledge of all 3 while using historically reported external metrics to fill in the gaps (especially for contracted and renewal). Hedge funds will use their usual “how’s the quarter going?” call at conferences to get management’s relative guidance on #1.

☁ SaaS Modeling Bootcamp

Dive into SaaS ARR & revenue metrics

Learn to model SaaS expenses

Understand long-term FCF margins

Bookings, billings, and collections

Join students from Goldman Sachs, Microsoft, Bank of America, Palo Alto Networks, Cowen, SVB, Scotiabank, VCs, and ETF Managers

🚨 Workshop starts in 3 weeks! (reply to this email with any questions)

Internal Forecasting

The building block of any internal revenue forecast is your contracted revenue schedule. This tells you how much revenue will be recognized if nothing else happens.

Next, you will want to tease out contracts up for renewals by period. This will allow you to apply a churn assumption to those contracts and properly forecast the revenue.

Finally is new ACV. Every company has a full-year forecast (typically by month/quarter), but usually includes some sort of execution risk / “go-get” assumptions. Further, timing (even internally) plays a huge factor in revenue recognition as deals may slip from month to month.

As a bonus complexity, many SaaS companies now include a usage-based component to their pricing strategy which must be included separately.

Step 1: Contracted Revenue

When you close a SaaS contract, a revenue schedule should be built to document how revenue will be recognized over the life of a contract. Most SaaS contracts are straightforward and recognized ratably over the life of the contract, but some may be more complex if they are designed to ramp or have variable performance obligations over the life of the contract. Either way, your accounting team typically builds the official schedule.

As a side note, this is slightly different than your deferred revenue schedule. The deferred revenue schedule only includes contracts that have been billed so would miss non-standard billing terms and known rebills (multi-year contracts with annual billings terms).

Step 2: Renewals

The beauty of SaaS is the recurring revenue nature of the contracts and business. Once you sign, a contract you know the exact revenue you’ll recognize over time, and assuming your customer finds value, your company should have a high probability of renewing the contract (and hopefully upselling). This is where the term GRR (gross retention rate) comes into play.

ServiceNow ran into this complexity 2 quarters ago as lower early renewal+upsell contracts was lower than in prior periods pushing new bookings below analyst estimates.

Step 3: New ACV

Once you have the value of your current book of business (contracted + forecasted renewals), it’s time to layer on new contracts.

The mechanics of new contracts are fairly straightforward, but face the greatest risks and uncertainty in regards to sales execution, timing, and macro factors (companies are less likely to buy new software in a recession).

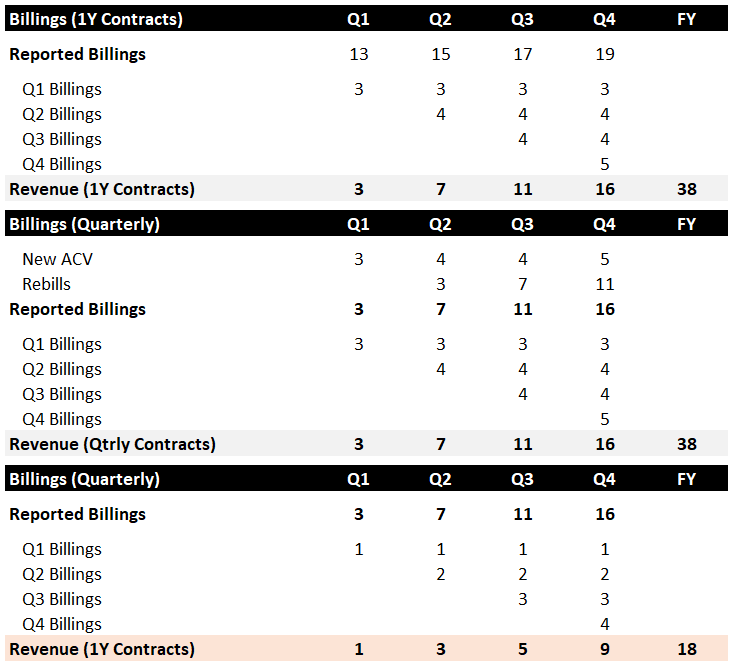

We can see these 3 steps in action below. This assumes all contracts are signed at the first day of the month so ARR / 4 can accurately calculate revenue.

Bonus: Usage Based

Many SaaS companies have embraced Usage-based pricing as a way to more closely align pricing with the value delivered to customers. This allows customers to only be charged for what they use but also allows customers to expand organically and with less friction as use expands. While this dynamic tends to create a net benefit for the company overtime, it also adds a layer of complexity to the forecasting as companies are able to ramp and cut usage as needed.

SentinalOne missed guidance last quarter as the company assumed usage-based trends would continue at current levels even though the company was entering a seasonally lower period and enterprise spending was well-known to be decelerating.

External Forecasting

Godspeed and good luck 🤷♂️

External forecasting comes down to piecing together the few pieces of information companies provide in their financial statements with guidance (if the company provides it).

The important part to remember is that all external metrics are linked together to one core contract so it’s the job of the analyst to understand how everything is pieced together and how the business dynamics of each company impacts each metric provided.

Every contract goes through a similar life cycle:

Revenue = Bookings = Billings = Collections

Everything else is just timing.

There are 3 main metrics to be aware of each with benefits, downsides, and caveats:

ARR

Bookings/RPO

Billings/Deferred Revenue

ARR

ARR indicates the current annual run rate revenue of signed contracts.

Many companies don’t actually report ARR but can be a powerful metric for forecasting if available.

All else equal, Average ARR / 12 should give you a close approximation of monthly revenue. This value can swing based on timing of new business, delays in renewals, FX rates (many ARR numbers are reported in constant currency), inclusion of future start contracts, and many other one-offs. These variances will be even higher when working to convert ARR to quarterly revenue.

You can see this methodology in the charts above.

Bookings/RPO

Bookings and RPO represent the value of all signed contracts that have not been recognized as revenue yet.

The derivative Current RPO (cRPO) represents only the revenue that will be recognized within the next 12 months.

Analysts also use calculated bookings as an indicator of business closed within the period.

The important thing to remember about bookings is if a company sells multiyear contracts this bookings number may not be helpful for forecasting revenue. And the complexity multiplies if the percentage of multi-year bookings fluctuates.

You can see below how consistent terms can be used to adjust the forecast, but if you mismatch between bookings and revenue recognition you can get too high or too low of an estimate.

For 1Y contracts you can take bookings / 4, and for 3Y contracts you can take bookings / 12.

Billings/Deferred Revenue

SaaS contracts are typically billed annually upfront giving analysts another methodology to estimate future revenue.

Billings face similar challenges to bookings as not all contracts have consistent billings terms and some companies bill usage in arrears instead of in advance.

Again if these trends are consistent you can still use the information but many times they fluctuate. Similar to bookings if a company bills quarterly, but you model it annually, you’ll underestimate revenue.

With Blessings of Strong NRR,

Thomas

Any questions? Respond to this email or drop them in the comments 👇

☁ Looking to learn more about SaaS Revenue forecasting?

Learn to analyze and model SaaS companies

Live Q&A + interactive models/worksheets

Slack networking group

Amazing guest speakers (including the CISO of Datadog)

🚨 Workshop starts September 12th (reply to this email with any questions)