☁ Platform or Bust

And Risks to your 2nd Act

Welcome to Hard Mode! Top founders, VCs, and investors subscribe for insights and analysis to successfully compete and invest in the Enterprise SaaS market. We love to make new friends 👇

Too Many Silos

The explosion of SaaS products (especially since the beginning of Covid) seems to be reaching its breaking point. Investors and operators are beginning to question the benefit and necessity, and more importantly the downside (financially and operationally), to having hundreds of points solutions.

With macroeconomic headwinds (from the war in Europe to spicy interest rates) pressuring budgets, “pet favorite” software requests and companies being inundated with free licenses are giving way to a desire to move back towards platforms.

The benefits? Reduced spending (hopefully) and tighter integration (usually).

Battery came out with their 2022 Cloud Software Spending Survey, polling 100 CXOs controlling ~$29B in annual technology spend. The survey is geared towards enterprise software start-ups with 85% of respondents spending “$100 million or more annually on cloud infrastructure, application software, data platforms and machine-learning tooling.”

Layoffs continue to attract headlines (Layoffs.fyi estimates 93k in 2022), but that is far from the preferred method to get budgets in line with new economic realities. “The more immediate reaction is for CXOs to consolidate vendors as a way to simplify software spending and the resources needed to support tools and technology.”

Check out our prior pieces on Platforms and Rebundling:

Platforms are Taking Share

At Goldman Sach’s Communiopia Conference, Google cloud CEO noted that on average a company uses 13 different products from Google Cloud.

On average, a company uses 13 different products from Google cloud, showing the deep product relationships we have with these customers. In the first half of this year alone, we delivered 1,300 new products and features, a 22% increase from a year ago. On the partner side, as I said, 92,000 partners do business with us. It's a 3x -- along with -- we committed 3 years ago or 4 years ago that we would expand our sales organization by more than 3x, and we have done that through disciplined focused expansion of our sales and go-to-market organization. Are we winning only in the largest customers? No, even in the new emerging companies, 70% of the top 100 unicorns run on Google Cloud - Google Cloud CEO Thomas Kurian (Goldman Sachs Communicopia via The Transcript)

At the same conference, Microsoft noted it provides the best (self-described) of a wide cross-section of tech companies (AWS, Google, CRM, Zoom, Octave, CrowdStrike) with the added benefit of not needing a third-party integrator.

...we're the best-of-suite cloud if you think about it. If you look at what's in the Microsoft Cloud, you'd need the best of AWS, the best of Google, the best of Salesforce, the best of Zoom, the best Octave, the best of CrowdStrike, and you'd have to hope like hell, that some integrator will have that together for you perfectly to get what you can get from the Microsoft Cloud. So, we're going to do all of these things and we're going to lower customer spend and increase our share at the same time. - Microsoft EVP & COO Judson Althoff (Goldman Sachs Communicopia via The Transcript)

And while cheeky, it seems like Microsoft’s (MSFT 0.00%↑) platform comments are justified. In Morgan Stanley’s recent CIO survey, they noted 58% of CIOs today are standardized on Teams and 70% are expected to be standardized within the next 3 years. This is up from 40% in 3Q19 and 54% from last year. And while the chart is hard to interpret, it looks like Google Hangouts, Zoom (ZM 0.00%↑) , and Webex are going to be share donors over the coming years.

You Need Multi-Product to Scale

With Platforms continuing to take share, Morgan Stanley expects vendors to further build out their product suite.

75% of finance buyers, on average, prefer an integrated platform of financial applications vs. best-of-breed solutions, we believe that we will continue to see vendors rapidly expanding into adjacent capabilities - Morgan Stanley BILL 0.00%↑ Upgrade

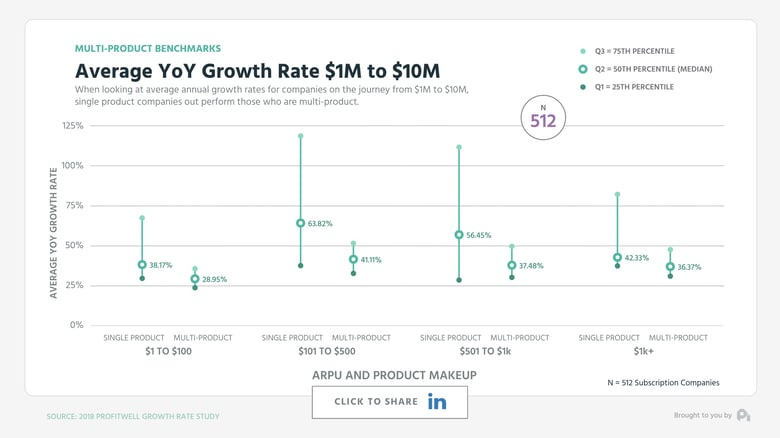

Single product work under $10M…

When a company is <$10M of revenue single-product companies have higher growth across the ARPU ranges. This is likely due to a start-up’s ability to focus on best-in-class point solutions that are differentiated in the market and solve customers’ pain points. The revenue range also conincides with companies’ growth being weighted towards new customers vs. expansion revenue.

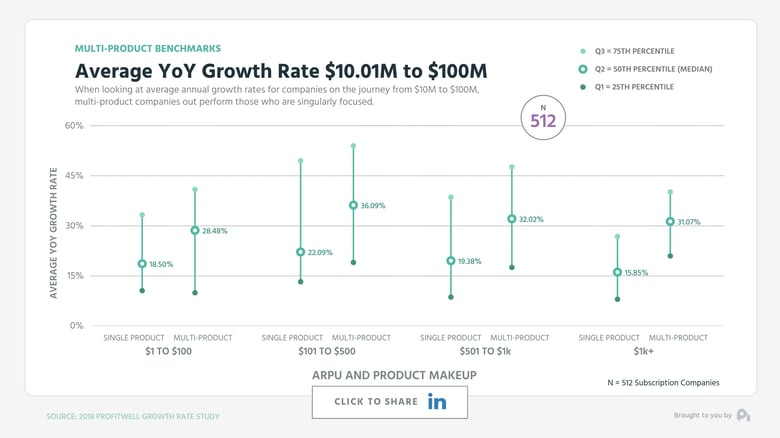

… But only multi-product continues to scale

This flips as companies grow from $10M to $100M when multi-product companies begin to grow faster. And as companies get larger they naturally shift towards expansion ARR vs. new logo ARR. While some products can support continued seat-based expansion, in reality, you’ll probably have to increase ARPU via layering in additional products.

There are 2 great reports to checkout on the topic:

ProfitWell polled over 1,200 companies to determine the “impact on growth of companies having either a singular product focus or a multi-product offering”

ICONIQ published it’s Topline Growth and Operational Efficiency report using a “proprietary dataset of financial and operating metrics from ICONIQ Growth’s SaaS partnerships and select public companies to explore how leaders balance topline growth with operational efficiency as they scale from <$10M ARR to IPO and beyond”

Risks to Your Second Act

Alright, so you NEED a second act. Your growth will be faster and the largest companies are all growing from expansion (this can’t come from one product forever).

Your choices: build vs. buy.

While most teams will lean towards one or the other, in reality, there are significant risks to both strategies.

@BuccoCapital had a great thread on the risks of pursuing an “Act 2” and how “everyone immediately pumps valuations for TAM expansion when it should probably be an immediate discount”.

Here are the 10 risks he highlighted:

Going multi-product too early. Developing a new product and building a platform costs significant R&D resources which will likely be a drain on FCF and productivity. Doing this too soon could put the entire operation at risk.

Disjointed Pricing Strategy. As you add products (and complexity) to your platform, the likelihood of requiring multiple pricing strategies (seat-based vs. usage-based, etc.) increases exponentially.

Different Unit Economics. “You can end up running 2 different businesses”

Different End User. Happens when one product is bottoms-up and another is top-down (Example: Twilio).

Different Markets. Different markets can bring different regulations, sales cycles, complexity, maturity, etc.

Inflexible Management. Management will try to operate the new product as they would a larger company by minimizing expenses instead of investing for success.

Ignore Partner Channel. Channel partners should be a “force multiplier” but can become a liability if not included in plans.

Degraded Service From Larger Product Footprint. Customer service is hard. This becomes exponentially harder with platform complexity.

Bad Incentives for Product Team. Keeping product teams siloed is a point solution mentality when customers buy into a platform for better integrations.

Different cultures. This is especially true with M&A

Highly recommend the full thread:

With Blessings of Strong NRR,

Thomas

Check out our prior pieces on Platforms and Rebundling: