☁️ Market Conditions

5-Minutes Daily. Built for VCs, founders, and SaaS executives.

Welcome to the SaaS Weekly: A weekly update on SaaS strategy, ☁ multiples, customer economics, and what's moving Top SaaS stocks. Subscribe Now

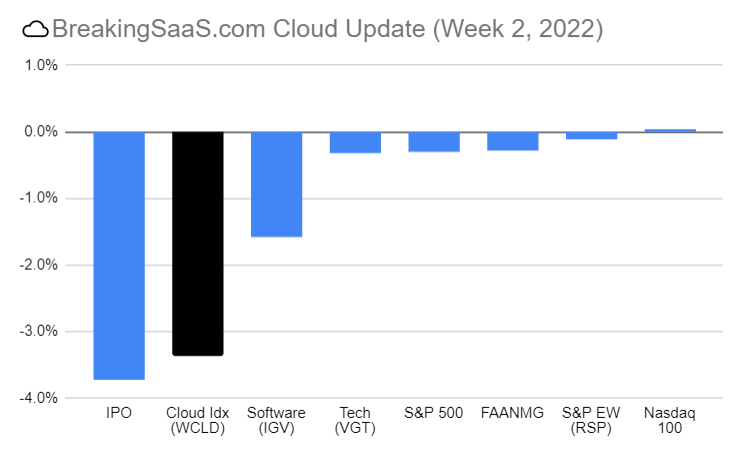

Cloud stocks fell another 3.4% for the week ending January 14th, 2022. Inflation remains the top concerns for tech investors as the US CPI increased 7% YoY in December, an acceleration from 6.8% in November and the largest increase since 1982. Recent IPOs (-3.7%) and broader Software (-1.6%) were also relative underperformers as "long-duration" tech continues to face pressure on potential rate increases. Energy continued to outperform as colder weather pushed up oil and gas prices.

ELI5: High inflation signals > possible rate increase > high-growth, unprofitable terminal value decreases > multiple compression

Still don't get the concept of Inflation? Check your Netflix bill.

The longest-duration, hyper-growth and non-profitable tech companies crashed further this week, now down a shocking 49% from its record highs in Feb 2021 (down 7 of the last 9 weeks) - ZeroHedge

Via ZeroHedge

We've now seen a version of this chart cut 100 different ways... prior corrections in software stocks saw a ~27% decline on average. We're at 22% (again averages mean nothing).

The last 13 corrections/bear market in software stocks (since 2000) pic.twitter.com/kSrfDCKJbx— Masterly Inactive (@masterly_in) January 14, 2022

Elad Gil, Silicon Valley’s Biggest Solo Venture Capitalist, notes still plenty of room for SaaS stocks to fall (again, based on long-term valuation averages).

Usually private markets are 2-3 quarters behind publics. So next few months will be telling - Elad Gil

Falling public market valuations don't necessarily tie to company fundamentals or signal a change in industry demand (although they certainly can). But public multiples may impact private companies in a few indirect ways: 1) could lead to a dreaded down round (only if you need capital), 2) your IPO may be pushed out (see Justworks below), or 3) if they're too high, negatively impact exec recruiting (Liquidity fueling a tech talent war)

Wondering if this holds up or not

Based on historical comps public SaaS could still drop another 20-50% pretty easily

Usually private markets at 2-3 quarters behind publics. So next few months will be telling— Elad Gil (@eladgil) January 15, 2022

📰 Software is eating the world. Make sure you're not the prey.

Justworks Delays IPO on "Market Conditions"

Capital markets playing hard to get after record 2021

IPO market has slammed on the breaks in the last ~6-8 weeks after a fairly easy 2021. More than 60% of 2021 IPOs are currently trading below their IPO price (per Refinitiv) as threats of raising rates compress high-growth multiples.

In a fairly normal move during market turbulence, Justworks is delaying its IPO due to "market conditions," but leavings its S-1 on file with the SEC.

Databricks CEO, Ali Ghodsi, went on CNBC confirming this is just a fire drill. Demand remains robust and growth will offset any multiple compression (although investors are already shifting focus From Growth to Economics).

As long as you have growth rates that are growing as fast as we are growing, then actually that growth rate will break through the multiple compression that’s happening in the market, sooner or later - Ali Ghodsi

3 Bullish Signs on Cloud Spending

Morgan Stanley CIO Survey Points to "early innings" of cloud

Some takeaways from Morgan Stanley's Q4 CIO survey

- Software has the highest growth expectations in IT

- Strong demand in software persisting (not simply pull forward in 2021)

- Cloud computing remains CIO's top priorities

- Security software most defensible

More graphs below— Jamin Ball (@jaminball) January 12, 2022

Kleiner Perkins remains bullish on analytics, AI, and security in 2022

‘22 is going to be an awesome year in infrastructure software. I see so many great companies out there that are ready to cross the chasm.

Some thoughts from me on what is top of mind: https://t.co/CAZKRrHF2p— Bucky Moore (@buckymoore) January 10, 2022

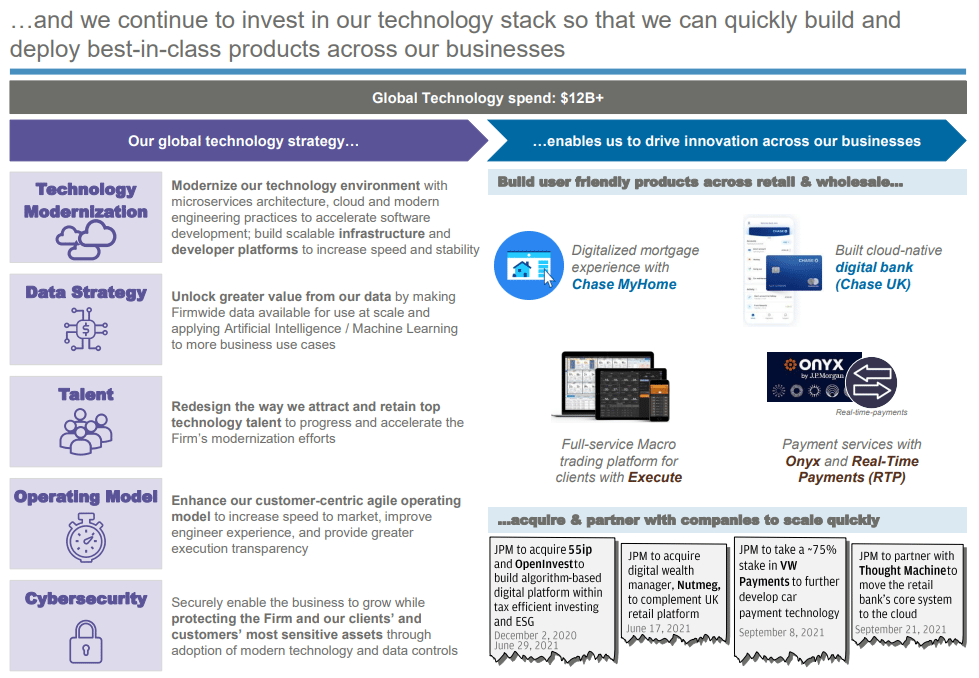

JPM investing $12B+ in global tech spend

And this year, roughly 30%, 40%, 50% of all our apps and all data will be moving to cloud-related type of stuff. This stuff is absolutely totally valuable... if you sat in this room and look at the power of the cloud and big data on risk, fraud, marketing, capabilities, offers, customer satisfaction, dealing with errors and complaints, prospecting, it's extraordinary. - Jamie Dimon

🎩Ed Sim with a full write-up in his newsletter:

🔥 Hot off the press: “What's 🔥 in Enterprise IT/VC - Issue #272" Silver lining - enterprise IT spend to continue 📈 https://t.co/2NI9qt4Mw3— Ed Sim (@edsim) January 15, 2022

💭Tweets I'm Thinking About

1) Lessons on Scaling a Low-Code

I’ve learned so much seeing @retool scale from <100 to 1000s of customers over the last 2 years.

Given our recent Series C, I wanted to share share some of the lessons we discovered along the way 🧵— Jamie Cuffe (@CuffeJamie) January 12, 2022

2) CEO Concerns: Attract & retain talent, accelerate digital transformation, supply chain

The Conference Board survey: CEOs cite inflation, supply chain, digital and process transformation as priorities. https://t.co/MFY8ouhteG Full report here: https://t.co/EV9RG1eUXt pic.twitter.com/QntITztxq8— Larry Dignan (@ldignan) January 13, 2022

3) Thoughts on customer economics

Are companies with high LTV-to-CAC less sensitive to interest rates than those with lower ratios?

In other words, would $CRWD, $DDOG, $TEAM, $PLTR e.t.c be better positioned to show operating leverage than $PANW, $ZS, $TWLO in a rising interest rates environment? pic.twitter.com/DbtYoHgsOc— Masterly Inactive (@masterly_in) January 14, 2022

With blessings of strong NRR,ThomasTwitter | LinkedIn

🤓 P.S. You look like someone who likes SaaS Metrics. Make sure you never miss an update