☁ God Bless Klaviyo

$650M+ ARR // $15M cumulative Burn // Founder owns 38.1%

Glad to see the S-1 teardown gurus haven’t retired.

Klaviyo is the first pure-play SaaS IPO in ~2 years, and, at first take, looks like it will take its seat as one with top-tier metrics.

🤑 Fun fact: Kaviyo co-founder, Andrew Bialecki, still owns 38.1% of the company. To put this in perspective, Jason Lemkin at SaaStr put out a great analysis of founder share at the time of IPO. He found the largest founder on average owned <15%.

The Klaviyo Recipe of Success:

“Efficiency is part of our DNA”. CAC Payback of 29 months with a Rule of 40 of 65 (benchmarking included below).

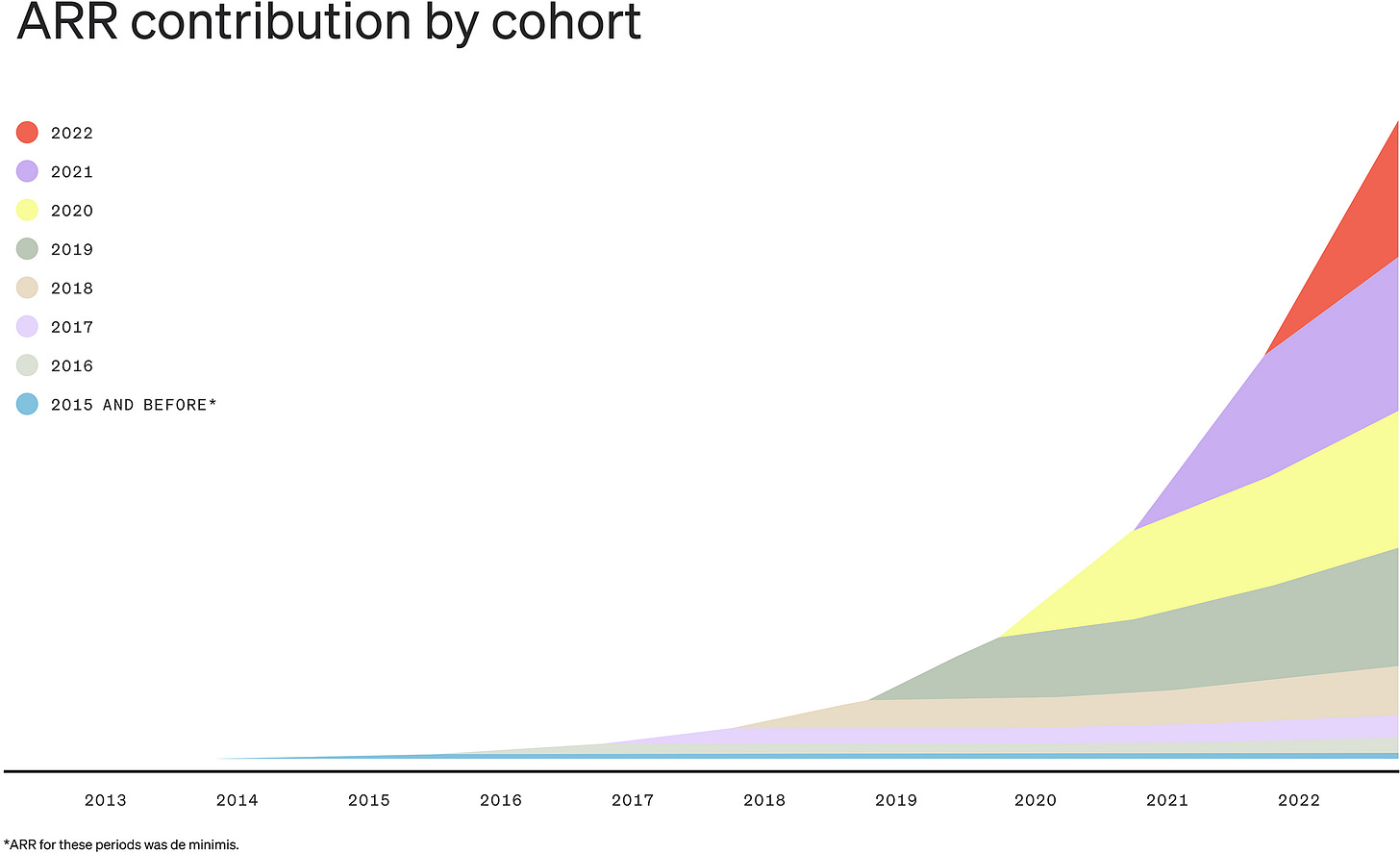

+ Strong NRR. Klaviyo sports 119% NRR vs. ~120% Top Quartile. Boosted by price increases, customer contact growth, and new product launches. (Klaviyo gave a great cohort chart included below)

= $650M ARR with minimal burn. Despite aggressive growth and scale, the company has only burned $15M of the $454.8M total they raised 🤯

As usual, I would highly recommend the deep dives from the which I pulled from extensively: Alex Clayton & Team at Meritech, Jamin Ball at Clouded Judgement / Altimeter, and Janelle Teng at Next Big Teng / Bessemer. If you’re feeling wild, check out the full Klaviyo S-1.

☁ Love SaaS Metrics? You’ll love my SaaS Modeling Bootcamp

Dive into SaaS ARR & revenue metrics

Learn to model SaaS expenses

Understand long-term FCF margins

Bookings, billings, and collections

Join students from Goldman Sachs, Microsoft, Bank of America, Palo Alto Networks, Cowen, SVB, Scotiabank, VCs, and ETF Managers

🚨 Workshop starts in 10 days! (reply to this email with any questions)

Bootstrapped in 2012, Now They Here… with $650M of ARR

Klaviyo was founded in 2012, but didn’t start to raise significant capital until 2019. Since that time, the company has launched new products to build out the platform and partnerships to diversify away from Shopify (~78% of ARR). The company now serves 130k customers and recently launched CDP and reviews. The company is now runrating above $650M (quarterly revenue * 4, Meritech has some great comps below).

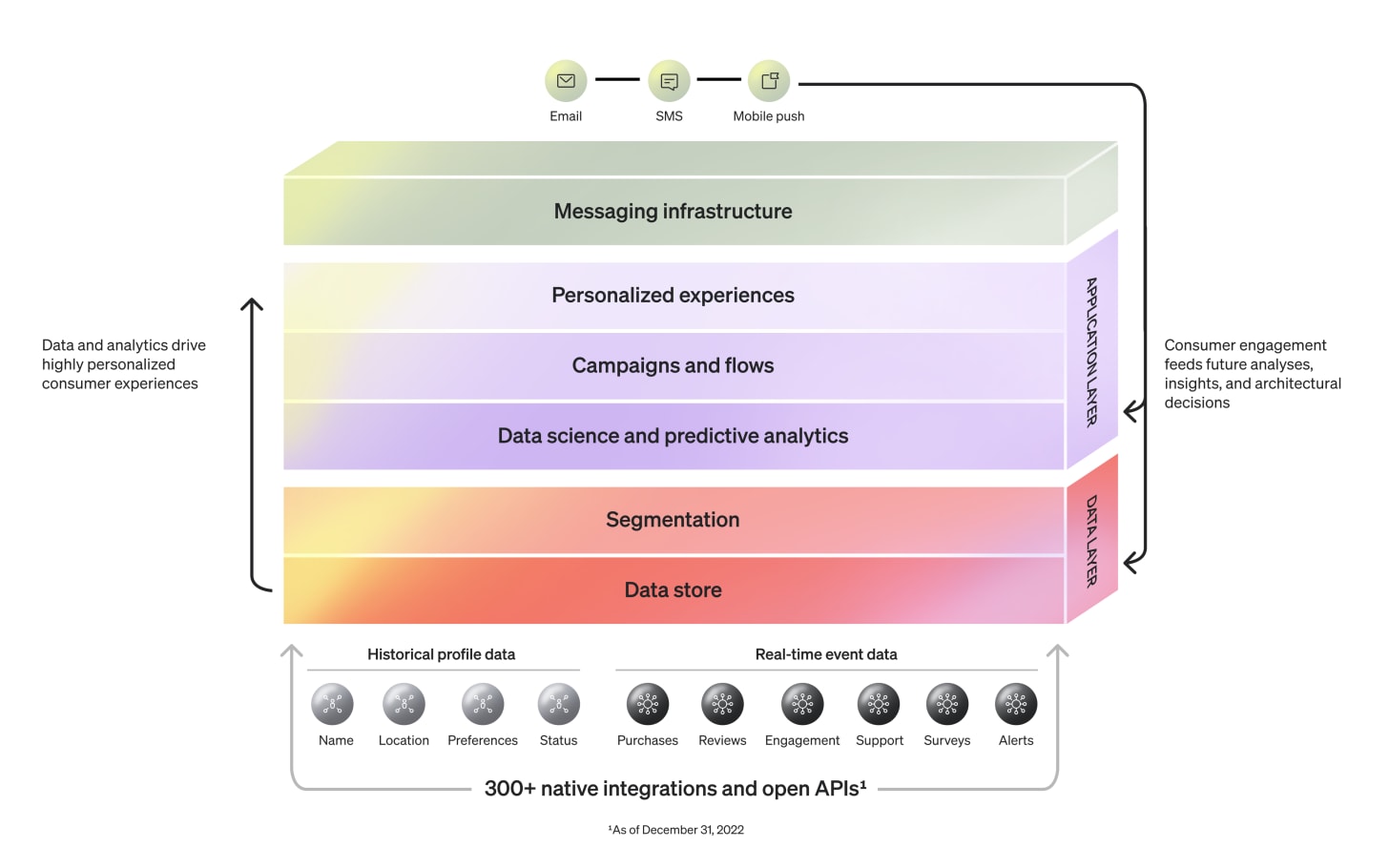

Data Layer + Application

Klaviyo is a SaaS platform combining a data layer with a platform layer to enable online stores to effectively use first-party data to market to their customers via Email, SMS, and push notifications.

Data Layer

Creates a single source of truth for real-time customer event data to allow granular segmentation and real-time interaction

300 native integrations (Shopify, Salesforce Commerce Cloud, WooCommerce, loyalty, social media, customer service, and shipping solutions)

Launching new verticals new verticals, including Mindbody, Zenoti, and Olo

Application Layer

Provides data analytics without the need for in-house engineers

Allows customers to create and manage targeted marketing campaigns

AI allows businesses to estimate consumer lifetime value, predict a consumer’s next order date, and calculate potential churn risk.

“We believe our software is highly extensible across a broad range of functions for B2C and B2B businesses alike”

The company wins by being a purpose-built, full-stack data, analytics, and marketing platform:

Other software solutions were not purpose-built to harness customers’ first-party data to deliver impactful consumer experiences. Data-focused offerings, such as cloud data warehouses or operational databases, provide the ability to store and analyze significant volumes of data for general-purpose use cases but are not purpose-built for consumer data and lack the front-end application layer. Marketing solutions are insufficient because they lack the underlying data intelligence. Simple marketing solutions use a flattened and narrowed view of a consumer’s historical data. This basic profile data alone significantly limits the granularity of segmentation businesses can use. Profile data is also difficult to combine with event data, which includes all digital touch points of a consumer’s engagement with a brand and provides necessary real-time information. Point marketing solutions tend to focus on single engagement channels, driving inconsistent and disjointed consumer experiences across digital channels. In an attempt to bridge this gap, other marketing solutions use a patchwork of third-party technologies, such as separate consumer data, learning, and messaging applications. These solutions often require significant technical expertise to implement, operate, and maintain, which limits flexibility, reduces speed, and increases costs. Furthermore, these solutions are not able to provide clear revenue attribution, minimizing ROI.

Pricing and Pricing Increases

At its core, Klaviyo charges based on the products you want (Email or Email + SMS), the number of contacts you have, and how often you message them. At its heart, the product is a SMB offering starting at $45-60/month, but scales quickly with the size of the business and usage of the product (i.e. PLG).

Klaviyo also announced a price increase for its largest customers (first time in 10 years) in July 2022, with pricing impact taking into effect on September 2022 (hat tip to Rob Litterst for posting). Some marketing blogs estimated this would come out to a 15-50% increase based on the number of emails you sent.

And for reverence, here’s their prior pricing (vs. it’s competitors Omnisend) before the pricing increase.

From their blog post on July 18th:

Today we’ve announced changes to our pricing, with increases for our largest customers, updates to our SMS pricing model, and the introduction of a new enterprise-grade tier. - Klaviyo Blog

And quantifying the revenue impact in their S-1:

We estimate our price increase in September 2022 represented a mid-teens percentage increase of incremental revenue dollars in the first six months of 2023. We anticipate a relatively smaller impact from this price increase in the third quarter of 2023, given that the price increase took effect in the third month of the third quarter of 2022. We estimated this by taking the pricing-related monthly subscription changes for impacted accounts and applying those changes to the remaining months of the year. - Klaviyo S-1

119% NRR

This efficient upsell and pricing at the higher end fuels the company’s strong NRR (119% vs. top quartile 120%). And even though COVID boosted the company’s NRR, it pointed out that its cohorts continued to grow well even after the one-time bump.

Our Q1 2022 Cohort expanded by 128% in the first 12 months;

Our Q1 2021 Cohort expanded by 123% in the first 12 months and 150% after 24 months; and

Our Q1 2020 Cohort expanded by 133% in the first 12 months and 162% after 24 months and 192% after 36 months.

Amazing Efficiency

The efficient upsell (like any PLG) also supports a very healthy CAC payback. As a reminder, most SaaS companies require an account executive to actually increase contract value (typically via increased seats or products) which takes time ($$) and usually commissions (also $$). PLG allows customers to expand organically within the product, which allows much more efficient growth but typically more R&D upfront (need to design UI/UX well enough so minimal services/support is required).

This dynamic is shining through Klaviyo’s impressive CAC Payback of 29 months (consistent with top quarterly and much better than the Median of 41 months).

And also shows in the company’s rule of 40 of 65 (vs. 45 top quartile and 34 median). This is primarily a function of the company’s operating leverage as it scales.

What’s next for the IPO Market?

Janelle Teng at Next Big Teng / Bessemer wrote a great piece on whats driving the IPO market and which companies typically lead out of a downturn/into an IPO Re-Opening.

Themes for Reopening Tech IPOs (Via Bank of America):

Category Leaders

Attractive growth profiles

Strong scale and profitability

My spidey sense tells me Klaviyo will do a great shop shaking open the stagnant IPO market through the rest of the year.

With Blessings of Strong NRR,

Thomas

Any questions? Respond to this email or drop them in the comments 👇

☁ Looking to learn more about SaaS Revenue forecasting?

Learn to analyze and model SaaS companies

Live Q&A + interactive models/worksheets

Slack networking group

Amazing guest speakers (including the CISO of Datadog)

🚨 Workshop starts September 12th (reply to this email with any questions)

Great article. Thanks for sharing!