☁ $DDOG: Derisking the Growth Story

Simple Products + Unified Platform = Juggernaut

The art and science of story telling

Datadog hosted their investor Day February 15th

I LOVED the simplicity and cohesiveness of the growth story

Not only is the company’s strategy and growth to-date impressive, the story telling during the event was succinct and actionable for investors and analysts

Overall, it’s a great case study on explaining how industry tailwinds and the company’s strategy translate to growth and shareholder returns… all in very simple terms.

The event also received great feedback from the sell-side community

A Few high-level thoughts/notes:

Dead Simple. In the first ~35 minutes, the CEO, CTO and VP Product were able to lay out the entire vision of the company, how they’re expanding, the importance of the platform, and how they’re benefitting from AI

LOTS of focus on the Platform. Team made a conscious decision to do the hard work early to build a platform. While this was questioned at the start, it is now paying off in faster innovation and market share (50% of R&D is spent on the platform)

Clear financial ROI. David Obstler (OneTrust Board Member) finished with how the company’s strategy will manifest as 5 growth pillars in the future.

Everyone SAYS they will drive growth the same way

And honestly it isn’t rocket science… land new customers + expand usage + expand products

The difference being the executive team told a compelling story how and why they would be able to execute

AND that they already are

Current Business + New business

Growth companies drive their value from 2 parts: 1) the current book of business (RPO + renewals) and 2) their future growth from new ACV

A company’s RPO and GRR provide it with a (hopefully) solid base so its CAC is primarily focused on net new ARR not replacing churned customers

Growth is the lifeblood of high-multiple companies. For investors to continue paying such a high multiple, investors must have a high degree of confidence that massive amounts of incremental ARR will continue over many years

DDOG is currency trading >15x NTM Sales so there’s a lot riding on them to tell a compelling growth story

And to reiterate - this has to be long-term growth. Investors don’t pay 15x for only one year of growth to have it fizzle out after.

I wrote a piece on how growth impacts SaaS multiples you can check out:

So how can an investor get confidence in future growth?

How strong is your current product/what is your current TAM?

Do you have the opportunity to expand into new products/can you expand your TAM?

Do you have the right to win/do you have the PMF + strategy to win the market?

Will you be able to capture the TAM efficiently/profitability?

Yes, a lot of this is more art than science

But Datadog did a great job telling the story in a way analysts could see (model) the growth for the next few years in the future:

Their core product can 5-10x from here (we’re in a massive market)

They have multiple products which are already driving meaningful ACV growth (not a one trick pony)

They have many bets in place to expand their TAM in the future (we’re making smart growth investments)

Their Platform gives them a unique competitive advantage to capture this TAM (right to win / we won’t be displaced by other competitors)

All making it easier for investors to underwrite continued growth into the future = Higher multiple now

More analysis below 👇

☁ Bootcamp for SaaS Investors

If you’re passionate about the SaaS industry and modeling key metrics we have an amazing bootcamp that will jumpstart your investing trajectory:

Dive into SaaS ARR & revenue metrics (long-term FCF margins, Bookings, billings, and collections)

Co-hosted with Francis (Software Analyst) a guru in Cybersecurity who will help you with frameworks and diving into top public cybersecurity companies

Join students from Goldman Sachs, Microsoft, Bank of America, Palo Alto Networks, Cowen, SVB, Scotiabank, and VCs

Building a Juggernaut

Oliver Pomel, Co-Founder & CEO, sets the stage describing the 2 ingredients Datadog uses to build a wildly successful product (and business): 1) an open-ended unified platform, and 2) building simple, easily-adopted product (as easy as a spreadsheet).

Everything else flows and elaborates from here.

So how do we build products? Well, obviously, there are many ingredients to building a successful product such as Datadog.

But if I were to reduce it to the most -- the 2 most important ideas, it would be, first, that we built Datadog from day 1 as an open-ended unified platform. All of our products are tightly and deeply integrated at the architectural, at the data and at the user interface layer. And the same platform serves end-to-end use cases from one data set to another, from one product to another and across team boundaries.

The second key ingredient would be our relentless focus on delivering a product that can be easily adopted. We call it simple but not simplistic, simple because our product should be deployable in minutes by meer mortals without extensive training and service engagements, and this should show value extremely quickly.

One way to put it is that Datadog should be as approachable and as easy to adopt as a spreadsheet - Olivier Pomel

Step 1: Building a Unified Platform

All of this was started by a singular decision to build a horizontal, infrastructure platform early in the company’s life.

But the defense at Datadog is that we actually decided to build the platform first, as you heard from Olivier. And actually, at the beginning, that was actually seen at the wrong choice. It's even made it pretty hard to get the company funded in the first days. - Yrieix Garnier

The crazy part is they admit that the solution is not that differentiated - just no one else built it:

The platform is basically a data store where you store your data, layers when you actually collect that data and then visualization layer like dashboard or just being able to expose that data, all of that be able to serve a specific use case or a product. Out of this, there's really nothing specific. It's actually, I would even say every solution in the market will provide the same kind of capabilities. - Yrieix Garnier

Taking that risk 14 years ago has allowed the company to build a broad moat around their business:

Step 2: Maximize Usage and Reach

Once you have a platform, you want to make sure its used as broadly and frequently as possible in the organization:

Every month, about 600,000 active users log into Datadog to analyze, coordinate and take action on their company's issues across development, operations and security. - Olivier Pomel

Having more users, use the product more frequently creates a growth flywheel:

The product becomes more sticky

There’s more people to sell adjacent products to

As the company focuses on larger customers this flywheel becomes even stronger:

Remember that the majority of our customers are quite small, and the bottom half of our customers is about 1% to 2% of our revenue.

What it looks like for large customers is that hundreds of users on average use our platform every month. And this number is growing.

Despite the last couple of years, being years of contraction for headcount at larger companies, we keep expanding as we spread across more use cases and more teams. - Olivier Pomel

Step 3: Build (Multiple) Products that Create (Massive) Value

When investors think about modeling future growth it helps to have a sure thing and a number of side bets.

Think of this as “multiple ways to win”

This shows:

I don’t NEED other products (representing execution risk) to win

But the company has also shown an ability to diversify (stability and upside)

Oliver expects their core observability platform to 5-10x from here:

So we think that observability alone on its own holds the next 5x or 10x scale-up for us. - Olivier Pomel

But also noted APM and Log management are independently generating $500M of ARR already:

We've also made progress in delivering a unified platform. As I discussed in the recent earnings call, we now have over $1 billion of AR in infrastructure monitoring and over $0.5 billion of AR in both APM Suite and log management - Olivier Pomel

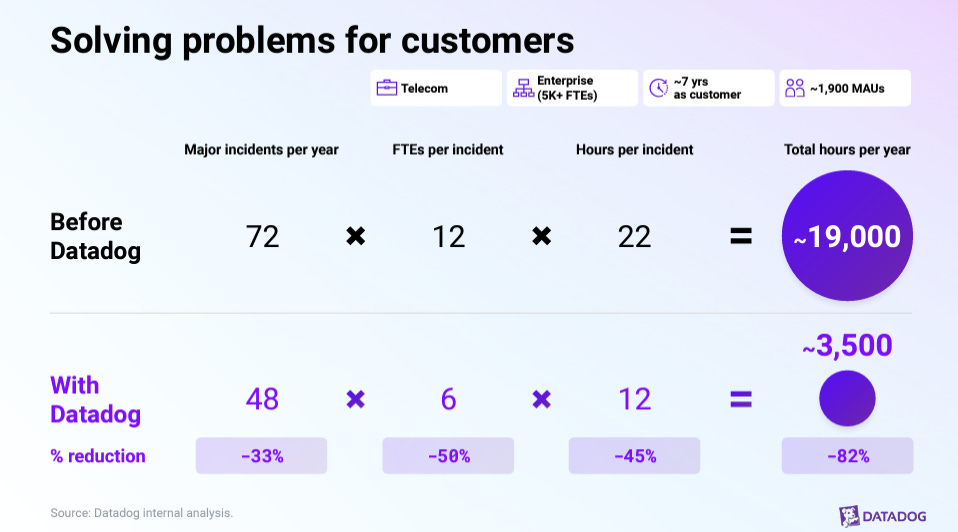

Part of their strategy is simply building products that solve problems for customers.

This seems obvious, but customers need a massive ROI to justify the expense/execution risk of implementing new software.

This is a powerful graphic to help contextualize the value Datadog is bringing to customers

Step 4: Build your Moat

Advantage #1: AI Positioning

The Datadog infrastructure positioning gives the company a unique and highly-valuable dataset to better use AI.

This advantage comes down to contextual data tagging and would would obviously not be available publicly:

We also know how our customers name things, and this is surprisingly important.

So when a customer says Hogwarts, for instance, in a chat with Bits AI, Bits AI knows that it's not about Harry Potter, but it's about a web service that fronts their billing system, for instance. And the key insight here is that you cannot derive this kind of insight from public data. It just doesn't exist. It's not in a publicly available training data set.

That's very important during the incident response. And we also get a lot of context from our customers' stacks from their documentation, from their SureScore, group chat and so on and so forth. - Alexis Le-Quoc

Advantage #2: A unified platfrom creates R&D efficiency

A consistent theme the Datadog team talks about is the rapid pace of innovation at the company.

The company spent considerable time discussing the value of the platform in this pursuit and noted half of engineers are focused on the platform:

I said half of our engineers work on the platform, the other half work on all those various products. And thanks to the platform, those products actually -- those product teams are actually very lean. - Yrieix Garnier

Turns to find out, “very lean” is a wild understatement

Their $500M ARR Log management business has only 30 engineers and their cloud cost management product was built with 10 engineers (while it would take other companies 100).

If I'm taking the example of the log management team, this is $0.5 billion business and it actually only has about 30 engineers working on it.

Another example, cloud cost management, CCM, it's solution for the FinOps personas and if I look at other companies out there, they have, I would say, hundreds of engineers to build that kind of solutions just to build a cloud cost management solutions. At Datadog we were able to do it really quickly with only 10 engineers, again, because we are leveraging all the power of the platform underneath. - Yrieix Garnier

The outcome is a rapidly expanding product map at very high cost efficiency:

Step 5: Close Loop + Collect Value

Bringing this all together the company is building a broad platform with multiple scaled products, multiple ways to win, and a value proposition few will be able to displace.

As Oliver put it, the unique advantages they are creating is helping them build an “Unstoppable Juggernaut”

Our ultimate goal is to collect the data from numerous sources and to provide a single source of truth to break down silos across all users, deployed everywhere, used by everyone. - Yrieix Garnier

We do think that the combined platform, though, ends up being an unstoppable juggernaut when everything comes together, and that's what we're building out. - Olivier Pomel

A side note on the power of a great one-liner

The response from analysts was broadly positive with nearly all of them quoting the company’s “Juggernaut” comment and the importance of building a broad, unified platform.

From JPMorgan:

In our view the most critical and consistent message both from the company and customers is the word “Unified”: Datadog is the leading modern, unified Observability platform consolidating point solutions and gaining share, with Datadog commenting that over the long-term its platform can become “an unstoppable juggernaut when everything comes together.”

Numerous comments sprinkled throughout the event hint at Datadog’s confidence in the growth runway ahead of it, including: “we think Observability alone… holds the next 5x or 10x scale up for us”

From Morgan Stanley

In essence, access to rich, highly contextualized, real-time data gives Datadog the license to enter these categories. At the same time, management acknowledged that its capabilities in these areas will have to get better over time. Ultimately, Datadog is confident that taking a platform approach to delivering this highly integrated set of capabilities will serve the company well over the long term and management is not willing to take shortcuts just to better monetize in the near term.

Our assessment is that despite what seems to be an all-encompassing vision, we were highly encouraged to hear management state that the business has the potential to scale 5-10x from current levels on just the observability opportunity alone.

With Blessings of Strong NRR,

Thomas

☁ Bootcamp for SaaS Investors

If you love Datadog, you’ll love the interactive workshop!

Dive into SaaS ARR & revenue metrics (long-term FCF margins, Bookings, billings, and collections)

Co-hosted with Francis (Software Analyst) a guru in Cybersecurity who will help you with frameworks and diving into top public companies

Join students from Goldman Sachs, Microsoft, Bank of America, Palo Alto Networks, Cowen, SVB, Scotiabank, and VCs