☁ AI Pricing vs. Efficiency Gains

LAST DAY: 30% off SaaS + Cyber Bootcamp

☁

30% off SaaS 101 Bootcamp ends Today (prices increase $165 tomorrow)! More below 👇

Interest in AI is Accelerating

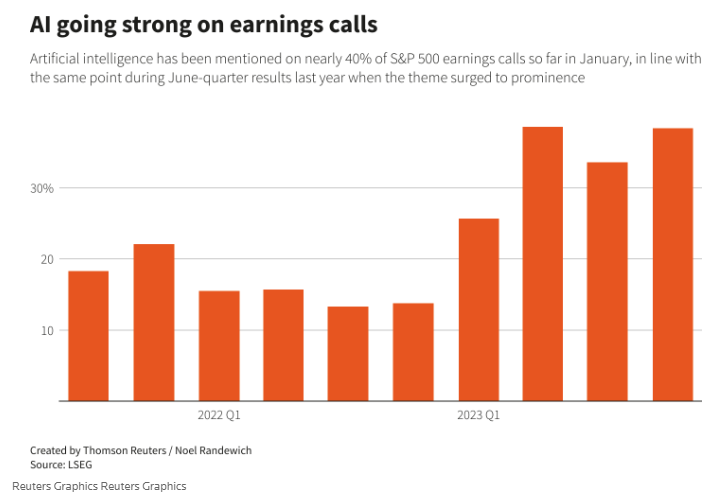

Reuters did an analysis of companies reporting Q4 to-date and noted 38% of companies in the S&P 500 have discussed AI on their conference calls. This continues the spike in interest starting in Q2 of this year as companies rush to take advantage of the benefits of AI (savings and insights).

What is most-interesting is the broad impact and relevance this technology has across the US economy (and globally). This is NOT just a tech product.

The terms "AI" or "artificial intelligence" have been uttered on 38% of conference calls held by S&P 500 companies in January, a Reuters analysis of LSEG transcripts shows. That is up from 34% at the same point during the third-quarter reporting season, and it is in line with the second quarter, when discussion of AI spiked.

"AI" has been mentioned an average of 3.5 times per S&P 500 call so far in January, up from 3.3 times per call at the same point during the October quarter. - Reuters

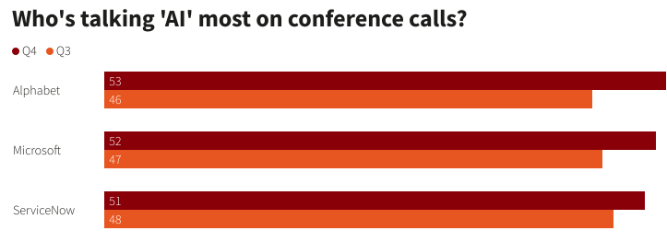

Large tech companies, led by the hyperscalers, are discussing the most-frequently AND increased the most since last quarter.

Alphabet increased 15%

Microsoft increased 11%

ServiceNow increased 6%

3 main trends being discussed:

CEOs are driving the purchasing decisions and shrinking sales cycles

Pricing is outperforming expectations AND have significant room to expand

Tech companies are going to have to spend a lot of money to take a piece of this pie

We discuss all more below 👇

☁ SaaS 101 Live Bootcamp

Dive into SaaS ARR & revenue metrics (long-term FCF margins, Bookings, billings, and collections)

Co-hosted with Francis (Software Analyst) a guru in Cybersecurity who will help you with frameworks and diving into top public companies

Join students from Goldman Sachs, Microsoft, Bank of America, Palo Alto Networks, Cowen, SVB, Scotiabank, and VCs

📢 Last day to receive 30% off! Use Code: EARLY30

The $3 Trillion Opportunity

Why are companies talking about the AI opportunity so much?

Garner expects $3 Trillion to be spent on AI through 2027. And this massive budget increase is coming at the expense of slower growth outside of software and IT services.

Gartner estimates $5 trillion in tech spending in 2024, growing to $6.5 trillion by 2027. That means that spending will grow another $1 trillion in only 2 years, accelerating from the decade plus it took for us to get to $5 trillion. For the first time in a decade, IT services will become bigger than communication services in 2024. Gartner estimates that by 2027, nearly all of the growth in worldwide IT spending will come from software and IT services. And when you drill deeper into the Gartner forecast between 2023 and 2027, $3 trillion will be spent on AI. What we have here is a strong, durable market being supercharged by a once-in-a-generation secular trend.

- Bill McDermott (NOW Q4 Conference Call)

Amazon alone expects to drive tens of billions of dollars over the next several years.

Gen AI is and will continue to be an area of pervasive focus and investment across Amazon primarily because there are a few initiatives, if any, that give us the chance to reinvent so many of our customer experiences and processes, and we believe it will ultimately drive tens of billions of dollars of revenue for Amazon over the next several years.

- Andy Jassy (AMZN Q4 Converene Call)

Companies are shifting resources to win AI market share

Building out the infrastructure to capture this value is going to be wildly expensive and executives are willing to cut unnecessary projects and divert funding to make sure they remain competitive WHILE balancing margins.

“2023 was our ‘year of efficiency’ which focused on making Meta a stronger technology company and improving our business to give us the stability to deliver our ambitious long-term vision for AI and the metaverse,” Zuckerberg said on the earnings call.

Nadella told investors that Microsoft is committed to scaling AI investment and cloud efforts, even if it means looking closely at expenses in other departments, with “disciplined cost management across every team.”

Microsoft CFO Amy Hood underlined the “consistency of repivoting our workforce toward the AI-first work we’re doing without adding material number of people to the workforce,” and said the company will continue to prioritize investing in AI as “the thing that’s going to shape the next decade.”

The theme was similar at Alphabet, where Sundar Pichai spoke of his company’s “focus and discipline” as it prioritizes scaling up AI for Search, YouTube, Google Cloud and beyond. He said investing in infrastructure such as data centers is “key to realizing our big AI ambitions,” adding that the company had cut nonpriority projects and invested in automating certain processes. - CNBC

CEOs are driving purchasing decisions and shortening sales cycles

Bill noted all the conversations he’s having with CEOs and the intense interest in utilizing the efficiency gains.

He also noted that since the CEO is typically involved in the purchases, it significantly decreases sales cycles.

Things are going very well out there, and the momentum is terrific. What's really happening, and I can say this after 186 CEO meetings in the last 6 months, the CEOs are now getting very involved with the gen AI revolution.

- Bill McDermott (NOW Q4 Conference Call)

Demand is underpinned by massive efficiency gains

ServiceNow noted productivity is increasing 40-50% efficiency gains which is helping the product grow rapidly.

As I said, that SKU has outsold any other new introduction we put into the marketplace. So there's a real appetite to invest in Gen AI, and there's no price sensitivity around it because the business cases are so unbelievable. I mean if you're improving productivity, 40%, 50%, it just sells itself.

- Bill McDermott (NOW Q4 Conference Call)

And Microsoft characterized Copilot as not necessarily an operating expense but a development activity to invest in the productivity of your dev team.

And so yes, I think all up, I do see this as a new vector for us in what I'll call the next phase of knowledge work and frontline work even and their productivity and how we participate. And I think GitHub Copilot, I never thought of the tools business as fundamentally participating in the operating expenses of a company's spend on, let's say, development activity. And now you're seeing that transition. It's just not tools. It's about productivity of your dev team.

- Satya Nadella (MSFT Q2 Conference Call)

Companies expect to capture a greater share of the value

When many of the large tech companies originally released pricing, it was higher than expected, which I wrote about here:

ServiceNow mentioned their pricing uplift from their AI SKUs are even outperforming their expectations:

So Mike, first of all, the Pro SKUs, as you know, that we launched it in 2018 Q3, so we have 5 years of consistent trajectory and measures on how we did on Pro across ITSM, CSM and so on. And that we shared at Financial Analyst Day in May. Gina shared that number that we got 25% uplift. When I look at Pro Plus, first, just to underscore what Gina said that it definitely exceeded our expectation, did really, really well and the fastest growth. We have launched so many products over so many years. This definitely exceeded our expectations.

- Chirantan Jitendra Desai, President & COO (NOW Q4 Conference Call)

Satya specifically calls out that their average ARPU remains low and expects Copilot to allow the companies to take some share of the 2-3ppts of OpEx leverage as pricing power.

So you are going to start seeing people think of these tools as productivity enhancers, right? I mean, if I look at it, our ARPUs have been great but they're pretty low. But frankly, even though we've had a lot of success, it's not like we are a high-priced ARPU company.

I think what you're going to start finding is, whether it's Sales Copilot or Service Copilot or GitHub Copilot or Security Copilot, they are going to fundamentally capture some of the value they drive in terms of the productivity of the OpEx, right? So it's like 2 points, 3 points of OpEx leverage would go to some software spend. I think that's a pretty straightforward value equation.

- Satya Nadella (MSFT Q2 Conference Call)

With Blessings of Strong NRR,

Thomas

Any questions? Respond to this email or drop them in the comments 👇

☁ SaaS 101 Live Bootcamp

Dive into SaaS ARR & revenue metrics (long-term FCF margins, Bookings, billings, and collections