☁ Adobe didn't buy ARR

Figma is the "Operating System of Design"

Welcome to Hard Mode! Top founders, VCs, and investors subscribe for insights and analysis to successfully compete and invest in the Enterprise SaaS market. We love to make new friends 👇

50x is back, but…

Let’s dive into the super interesting dynamics around Adobe’s acquisition of Figma announced 9/15. (I’m only ✌weeks late)

Key Stats:

$20B price tag - half cash, half stock

6th largest Software acquisition ever (and maybe top 20 in tech more broadly)

$400M CY22 Target ARR = 50x ARR 🤯

Before we start partying like it’s 2021 again, what did the market think? The stock fell ~17% representing OVER $20B of value. Hmm….

Adobe didn’t buy ARR

To the casual observer, the 50x sticker multiple shook investors and led them to conclude: Adobe “overpaid”.

Did they overpay? No clue.

But Adobe isn’t here for the ARR.

In reality, the Figma acquisition was the latest domino in a string of events shaking investors’ confidence in Adobe. Before the cloud bust beginning in November 2021, Adobe was up 20x from 2012 as the company parlayed dominance in creative and M&A bets within marketing to pricing power/revenue growth and margin expansion.

Even as Canva raised at a $40B valuation (Sept 2021) and Figma at $10B (June 2021), Adobe was assuring investors that its suite was protected from competition.

But investors were beginning to see through the story. When Adobe released Q4 results (December 2021), Adobe’s FY22 revenue Guidance underwhelmed the street.

There are now questions around Adobe for the first time in a really long time - Michael Turrin, Wells Fargo via Bloomberg

Largely forced by these new entrants, Adobe released a free version of its Express product and its lowest tier is priced below Canva.

On the marketing side, the company is fighting to dominate the CDP (customer data platform) market. Adobe has assembled a vast product portfolio after spending billions to acquire Magento, Workfront, Marketo, and Omniture over the previous years, but is still facing stiff competition from Salesforce and Twilio.

Few platforms take most. The stakes are high as customers continue to look for value and ease of use within bundled platforms. But once a company chooses its platform of choice, it becomes harder and harder to take share away:

Everybody’s looking at the Microsofts, Googles, Oracles, and SAPs of the world. If I have an enterprise agreement with one of these vendors, I can leverage a lot more technology and a lot more solutions without necessarily going to other sources for fine point solutions. - ETR via Breaking SaaS

When Adobe announced the acquisition, this signaled they did not in fact have the market dominance they had claimed. And investors are now worried about which other competitors might have a leg up on the legacy player.

The question now: Will the Figma acquisition stop the bleeding within Creative? And even more importantly, can it become a key cog in the company’s flywheel to maintain its platform’s dominance?

And even as Adobe took one competitor off the market, an open-source competitor to Figma, Penpot, raised $8M after sign-ups jumped 5,600% after Adobe’s acquisition.

How does Microsoft fit in?

As usual with anything tech/software, Microsoft plays into the story.

Yes, the 50x multiple was high and if anything, it likely meant there were multiple bidders for such a valuable asset (offensive and defensive).

Microsoft came up as a likely suspect given the company’s platform dominance and distribution reach.

It certainly would have set up an interesting dynamic between the two behemoths which have not only peacefully coexisted, but partnered for over 20 years. CNBC had a great write-up just 2 weeks before the acquisition: Microsoft employees love Figma, and it’s testing the company’s cozy relationship with Adobe.

Adobe gained ubiquity via distribution across most Windows machines and the companies have over 50 listed integrations. In 2015, Adobe made “Azure its preferred cloud for Creative Cloud, as well as the Marketing Cloud and Document Cloud.”

So did Adobe have to pay up to make sure Figma didn’t fall into the hands of one of its largest frenemies? Very possible.

Given the tight strategic backdrop, Microsoft has historically been exclusively an Adobe shop. But Figma started creeping into the Microsoft design and creative functions with the acquisitions of Sunrise (2015) and Xamarin (2016). Both teams were allowed to continue using their legacy design/collaboration stack even though many other staffers were not allowed to make the shift from Adobe:

Sunrise co-founder Jeremy Le Van said his employees were among the lucky ones at Microsoft. He said some Microsoft staffers weren’t able to use Figma because of the business relationship with Adobe and were stuck using products such as Photoshop and XD. Despite executive resistance in certain departments, some designers snuck out of the Adobe ecosystem to use Figma anyway, said Le Van, who stayed on as a design director at Microsoft until 2018. - CNBC

Needless to say, Microsoft seems to have done a 180 on embracing Figma (better to lose Adobe than designers?). Jon Friedman, corporate vice president of design and research, noted, “We’re still heavy on Adobe Illustrator, Photoshop and XD”, but also noted Figma is “like air and water for us”.

“Figma’s become, I would say, sort of the No. 1 common tool we use to collaborate across all of the design community in the community and beyond,” said Friedman, who’s worked at Microsoft for over 18 years. It’s “really great at helping us collaborate at scale, and at global scale. I can collaborate with teams we have in India, China, Europe, Israel and Africa.” - CNBC

Why was Microsoft so interested (threatened)?

For now, Figma is taking share in design, but where could it expand to next? With its cloud-first approach, any document could be shared with a link and edited live instead of having to pass multiple file versions back and forth (think Google Suite). Microsoft Teams allows you to do this now but still seems to be a bit clunky with larger files.

Friedman may have given us a hint: “It [Figma] works great as a presentation tool”

Multiplayer is Hard

An obvious question with any acquisition is: buy vs. build.

Amal Dorai has an amazing thread on the difficulties of building multi-user collaborative software. Amal was the founder of LiveLoop which Microsoft bought to make Office more real-time collaborative (he is now a Venture Partner at Anorak Ventures). These roadblocks become exponentially more difficult when the product has a large network of installed users via backward compatibility and file complexity.

Read the whole thread:

Figma was also technically impressive from an engineering perspective, spending significant time designing the product on the newest technologies:

Figma, though, was something completely new: the company, which was founded in 2012, made a bet on the browser and spent a full four years building v1 of the product. This included writing the editor in C++, cross-compiling it to JavaScript using the asm.js subset that let it achieve desktop like control of memory and performance, and building its own rendering engine from scratch using WebGL — which had only been released in 2011. It was the epitome of leveraging new technologies to compete on a new vector, which in this case was collaboration. - Stratechery

At the end of the day, tech is hard, but the only thing harder is rapid innovation at a large organization (especially if it impacts a key profit center):

Elevating Figma to the Big Leagues

With any large acquisition of an indie platform loved by its community that is acquired by a larger, legacy company, there were instant concerns that this would cause prospective users to look elsewhere.

Jason Warner, CTO GitHub, noted that not only was the fear unfounded, but daily sign-ups actually went up after it was acquired by Microsoft:

And while there may be some grumbling from the platform’s free users, the reality is that large companies (the ones writing the big, important checks) prefer to purchase from other large established companies.

Why? Large companies are hesitant to base too much of their IP and processes on an unproven start-up, especially one which isn’t charging and by extension more likely to go bankrupt.

In fact, Figma struggled to attract large customers at first and Microsoft actually worked with the company to iron out a few kinks in the platform and develop its enterprise plan.

In 2017, a year after the Xamarin acquisition, Field hosted Friedman at his company’s San Francisco headquarters. Field says he remembers asking Friedman why Microsoft didn’t want to keep using the free version of Figma.

″’Look, we’re all worried you’re going to die as a company,” Field recalled Friedman telling him. “We can’t spread it inside Microsoft as a company even though we like it, because you’re not charging.” - CNBC

The time and investment obviously paid off. Large customers now include Google, Oracle, Salesforce, Airbnb, Dropbox, Herman Miller, Stripe, and Twitter. Many of these started with small teams within the organization and grew organically (classic PLG).

And when CEO Dylan Field tweeted about the company’s 10-year anniversary, Salesforce co-CEO Bret Tayler showed his support:

Distribution is King

The success of the Figma acquisition will come down to Adobe’s distribution strategy.

Figma took ~4 years to develop the product and didn’t start offering a paid tier until 2017. From that point, adoption has been a rocketship with ARR targeted to surpass $400M in CY22 and VCs are expecting another ~2x this year.

It’s important to remember here that Adobe did not buy ARR. Adobe is protecting its market share and acquiring an emerging platform. In this framework, today’s ARR is nearly irrelevant and it’s uncertain if the company will be able to accurately capture Figma-specific ARR in the future.

While some speculated the company would acquire the business, just to shut down the product, the healthy dose of RSUs to retain the team makes that unlikely.

Wall Street analysts think Figma could become a “system of record” and Adobe needs to execute as such:

What Figma is trying to create is more of a broader platform that could become more of a system of record within this market, and that’s why I think this could become more important - Michael Turrin, Wells Fargo via CNBC

In my last piece on Unbundling, Rebundling, and Distribution I dove into how Microsoft used its distribution power to dominate the communications space:

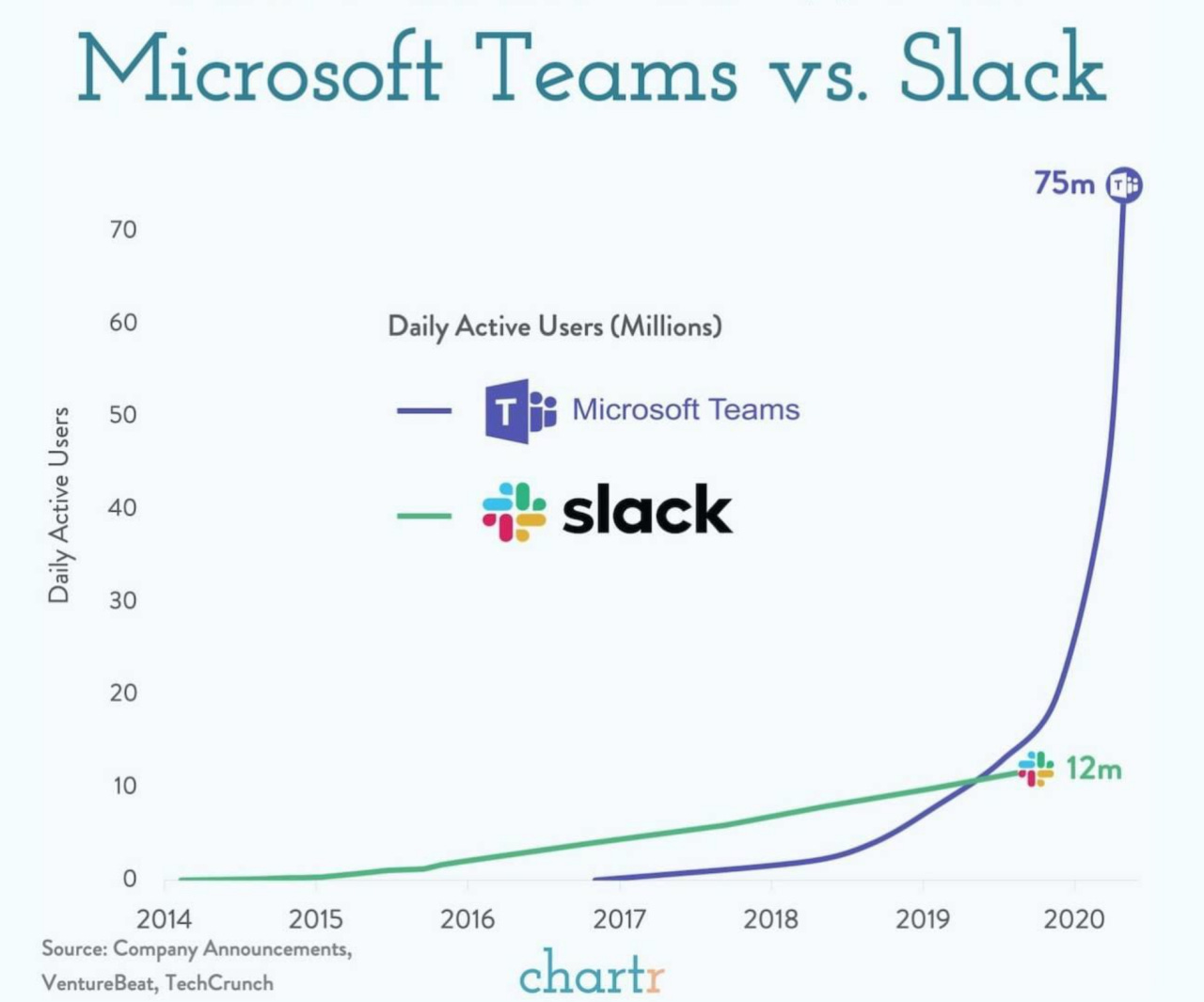

The most popular example of distribution winning over product is the race of Teams vs. Slack. Teams overtook Slack only 3 years after launch using Microsoft’s superior distribution even though Teams was an inferior product. - Breaking SaaS

Adobe has the opportunity to follow a similar strategy within design and is buying a key asset to continue powering its platform flywheel. In reality, Adobe could give the product away for free (although it will probably just be bundled into larger contracts) and still see incremental value as organizations find it easier and cheaper to use Adobe’s full suite.

Customers are coming around to the power of consolidating on Microsoft and Google as it gives the buyer access to more product features for the same price. - Breaking SaaS

Buying the “Operating System of Design”

Per usual, Ben Thompson breaks it down best:

This is a world where Figma is the operating system for design, and applications like Photoshop and Illustrator are reduced to plugins, and increasingly commoditized. That, by extension, is exactly what Adobe is buying: control of the key integration point in the design pipeline, and, one would assume, a favored position for Adobe’s own apps in that pipeline. - Stratechery

Adobe didn’t buy ARR.

Adobe didn’t even really buy Tech (although it’s super impressive).

Adobe bought a killer brand, with deep network effects, poised to be the next key gateway in the design world.

Adobe bought something they couldn’t afford to lose.

And since they had to buy it, it means they clearly didn’t have it before.

💰 The Winners

The Information compiled the biggest winners from Figma’s acquisition:

Index Ventures. 13% stake, worth ~$2.6 billion

Jeff Weiner. 2.2% stake, worth ~$440 million

Greylock Partners. 13% Stake, worth ~$2.6 billion.

Kleiner Perkins. ~10.5% stake, worth ~$2.1 billion

Sequoia Capital. 6% stake, worth ~$1.2 billion

Andreessen Horowitz (led Series D). 1-2% stake, generating “several hundred million dollars in gains”

Durable Capital Partners (led Series E). 1%-2% stake, implying it would “have doubled its investment in a little over a year”