☁️ Is it 2023 yet?

5-Minutes Daily. Built for VCs, founders, and SaaS executives.

Cloud stocks (-10.8%) underperformed the broader market (-1.9%) for the first trading week of 2022 as Fed minutes suggested the Federal Reserve may increase rates sooner and at a faster rate than previously expected. The result? Tech/Cloud/High-growth all took a hit, while industries levered to higher rates (energy/financials) outperformed on the week.

The fed quote heard around the... financial markets:

Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated. - Federal Reserve

With cloud stocks now down ~30% from November highs and industry multiples back to pre-covid levels, investors are starting to dig into when institutional selling will abate and how quickly multiples can recover.

🐂 or 🐻: Where do we stand now?

Many growth stocks now underperforming boring peers

Michael Batnick noted $ARKK (the granddaddy of post-Covid outperformance and heavy on $TSLA/innovation names) is now underperforming regional banks since the start of Covid.

We present to you: the "flippening"

Regional banks versus ARKK from the beginning of the pandemic to today.

What a flippening. pic.twitter.com/6oulbea0dF— Michael Batnick (@michaelbatnick) January 7, 2022

Digging into Cloud specifically, the group continues to outperform the S&P post-Covid, but is now below its tech-heavy counterpart.

$WCLD is up ~53% from February 20, 2020, above the S&P (+38%), but at much higher volatility.

While Cloud outperformed the NASDAQ for the vast majority of post-Covid trading, it's now fallen behind $QQQ (+60%) as the latter benefits from strong FAANMG performance.

Many indicators now point to TMT being oversold

Gavin Baker with a couple of great takeaways on positioning and valuation:

HF net exposure to growth/TMT at 5-year lows (GS Prime)

"Crowded Longs (CRWD) and Expensive Tech (EVSA) baskets are 85% of the way through their typical downside move during a "rate shock" vs. indices only 40-50% of the way through" (MS QDS)

Software now approaching 2019 trough valuation

Per GS Prime data, HF net exposure to growth and TMT are at 5 year lows. Nothing to see here, move along.

Also I took the trouble of resetting my Marquee password, which I've never once successfully remembered, to get these charts. pic.twitter.com/cYQQhtowJA— Gavin Baker (@GavinSBaker) January 5, 2022

1) The superb QDS team at MS showing that their Crowded Longs (CRWD) and Expensive Tech (EVSA) baskets are 85% of the way through their typical downside move during a "rate shock" vs. indices only 40-50% of the way through. Software now approaching 2019 trough valuations. pic.twitter.com/vkHpgGygDS— Gavin Baker (@GavinSBaker) January 6, 2022

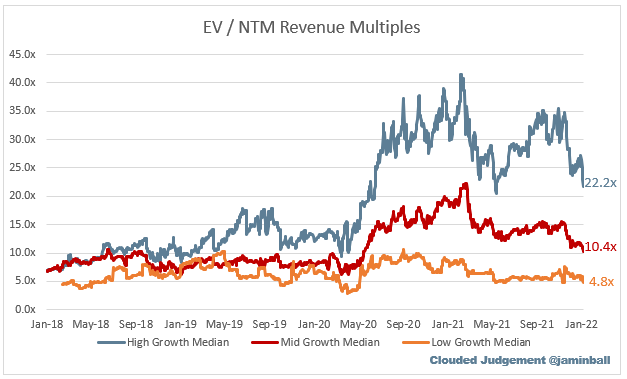

Industry multiples now back to pre-covid levels

The recent decline in cloud stocks seems to mesh with the average decline GS found in historical periods (29% compression on average over the last 21 years).

We're also back to pre-covid valuation levels.

As a friendly reminder, averages mean precisely nothing in public markets.

Cloud software multiples are now exactly where we were pre-covid (looking at overall median). This doesn't mean we can't go lower - nothing magical about pre-covid levels. In fact, they were historically high in Feb '20.

High growth multiples still 54% above pre-covid levels pic.twitter.com/bs3TXdEU98— Jamin Ball (@jaminball) January 5, 2022

Software valuation corrections are frequent (every 1-3 years), and not uncommon (over last 21 years, since 2001). pic.twitter.com/hohnhi3Ofm— Eugene Ng (@EugeneNg_VCap) January 3, 2022

But growth multiples remain elevated

Jamin Ball has High-Growth multiples sitting at ~22x, ~85% above January 2020 levels.

But he also notes that these multiples are heavily influenced by recent high-growth IPOs which push this median up. Removing these, the median is closer to 18x.

It is a little tricky to look at high growth and compare it to pre-covid because many of the companies in that bucket now were not public pre-covid. This list includes Snowflake, Hashicorp, Gitlab, SentinelOne, Confluent, Asana, Monday.com, Zoominfo, Amplitude, Braze, UiPath, DigitalOcean, Qualtrics, Freshworks, JFrog. If I remove the recent IPOs from the high growth median bucket the high growth bucket has a median multiple of closer to 18x (it’s 22x with them). Clouded Judgement 1.7.22 - Jamin Ball

Ram Parameswaran has high-growth Software sitting at ~15x vs. ~12x averages, again biased by high-multiple names.

Food for thought - growth Software multiples still somewhat elevated though arguably biased by $SNOW, $CRWD, $TEAM, $ZS, etc. pic.twitter.com/JuAh4geYfr— Ram Parameswaran (@_ram_) January 6, 2022

The question now: How long do they take to recover?

Jeff Richards posted an analysis of how long it takes SaaS multiples to recover following a crash.

It's a small sample size and SaaS crash 1.0 and 2.0 actually overlap. Excluding SaaS Crash 1.0 here's what the data suggests:

Valuation Peak: 10.5x

Valuation Trough: 6.9x

% Decline: -36%

Days to Recover: 305

A few things to note:

Including SaaS crash 1.0 would have made averages look worse.

Valuations this round peaked at nearly 20x and are now back to 11x, still above where these crashes started

There's no reason valuation should necessarily return to highs this round when they were significantly elevated vs. historicals

Q: How long did it take high growth SaaS stocks to rebound in prior crashes?

A: pic.twitter.com/WMDWkErzgy— Jeff Richards 🇺🇸 (@jrichlive) March 24, 2020

💰 PLG FTW

Miro Raises $400M @ $17.5B Post

Originally founded as a digital whiteboard company, Miro is investing heavily to transition to a border collaboration suite as tech companies continue to embrace remote-first workforces.

Today, the company’s tools integrate with over 100 apps — including new partnerships with the likes of Atlassian, Cisco, Google Workspace, Microsoft Teams and Zoom — and offer nearly 1,000 templates designed to get users and their teams quickly working together no matter where they are. - TechCrunch

Key Stats:

Founded in 2011 by Andrey Khusid and Oleg Shardin

New capital pushes total funding to $476M

Customers include nearly all Fortune 100 companies (20 have ARR > $1M)

Since the last funding in April 2020, user base grew 500% to 30 million users

Full interview with CEO, Andrey Khusid @ Protocol

The power of PLG was a top trend I discussed in my ☁ 2021 Cloud Review

🤔 Some more food for thought on tech margins

How the game has changed and why long-term valuation comparisons let us down. https://t.co/WA9LnkrAxo pic.twitter.com/J6P9vjzvsw— Michael Batnick (@michaelbatnick) January 8, 2022

🚀 A16z Raises $9B across three new funds

It is our role and mission to help these entrepreneurs build the best companies they can and achieve their important goals. With these new funds, including a $1.5B Bio fund, $5B Growth fund, and $2.5B Venture fund, coupled with the $2.2B Crypto Fund and $400M Seed Fund we raised in 2021, we will continue to invest across the entire spectrum of stages, writing checks as small as $25,000 and up to hundreds of millions of dollars. - Future

VC liquidity was a top trend I discussed in my ☁ 2021 Cloud Review

I am looking forward to helping our great entrepreneur partners build a better future. https://t.co/i2YPD3hxY4— benahorowitz.eth (@bhorowitz) January 7, 2022

🐐 Philippe Laffont on making a few big calls

Founder, Coatue Management & Tiger Cub:

To be a good public investor, you don’t need to be a genius or own a crystal ball but you do have to make a few big calls.— Philippe Laffont (@plaffont) January 18, 2021

🧵 2021 Cloud Review

Top 5 ☁ Trends I'm thinking about:

1️⃣ First annual decline on record2️⃣ Multiples driving relative performance3️⃣ From Growth to Economics4️⃣ PLG and Usage-Based Price FTW5️⃣ Liquidity fueling a tech talent war

Read the full review: ☁ 2021 Cloud Review

And NBD, but we kinda went viral (+ a retweet by SaaS 🐐 Dave Kellogg) 👇

☁️ 2021 Cloud Review Mega Thread

In case we just met, my name is Thomas and I work in Corp Finance @Celonis

I ❤ SaaS metrics, strategy and public markets

Grab a ☕, stretch your 👍, this is a long one

5 trends I'm thinking about 🧵👇— Thomas Robb ☁️ (@BreakingSaaS) January 6, 2022

With blessings of strong NRR,ThomasTwitter | LinkedIn

P.S. You look like someone who likes SaaS Metrics 🤓 Subscribe to make sure you never miss an update